Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

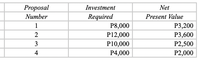

Based on the information of four investment proposals, rank the proposals in terms of NPV index.

A. 3, 2, 1, 4

B. 2, 3, 1, 4

C.2, 1, 3, 4

D. 4, 1, 2, 3

Transcribed Image Text:Proposal

Investment

Net

Required

P8,000

Number

Present Value

1

Р3,200

P12,000

P3,600

3

P10,000

P2,500

4

P4,000

P2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- financial advisor evaluates four stocks for inclusion in an investor's portfolio. A orrelation matrix showing each stock's correlation with the other stocks is shown below Stock ALK CMN BTY DLE ALK 0.40 0.58 1.00 -0.25 BTY 0.40 1.00 0.16 -0.04 CMN -.25 .16 1.00 .37 DLE .58 .04 .37 1.00 f the goal is to reduce the investor's overall portfolio risk, which two stocks should the advisor recommend? a. ALK and DLE b. ALK and CMN c. BTY and DLE BTY and CMarrow_forwardwhich of the following past returns should mutual funds publish in their annual reports? A.Excess return B.Geometric average return C.Arithmetric average return D.Index returnarrow_forwardAssuming that the rates of return associated with a given asset investment are normally distributed; that the expected return, r, is 18.7%; and that the coefficient of variation, CV, is 1.88, answer the following questions: a. Find the standard deviation of returns, sigma Subscript rσr. b. Calculate the range of expected return outcomes associated with the following probabilities of occurrence: (1) 68%, (2) 95%, (3) 99%.arrow_forward

- Given the following information, compute the standard deviation for Investment A: Payoff Probability 30% 0.6 15% 0.3 -12% 0.1 Group of answer choices a. None of these are correct b. 6% c. 9% d. 13%arrow_forwardYou are evaluating five investment projects. You already calculated the rate of return for each alternative investment and incremental rate of return between the two alternatives as well. In calculating the incremental rate of return, a lower cost investment project is subtracted from the higher cost investment project. All rate of return figures are rounded to the nearest integers. Investment Alternative Initial Investment ($) Rate of Return (%) Rate of Return on Incremental Investment (%) A CDE A B C D E b.Select E. c. Select B. 35,000 45,000 d. Do nothing. 50,000 65,000 80,000 12 15 13 20 18 B 28 20 36 27 12 40 22 If all investment alternatives are mutually exclusive and the MARR is 12%, which alternative should be chosen? a. Select D. 42 25 -5arrow_forwardPossible outcomes for three investment alternatives and their probabilities of occurrence are given next. Failure Acceptable Successful Alternative 1 Alternative 2 Alternative 3 Outcomes Probability Outcomes Probability Outcomes Probability 50 0.40 70 0.20 85 0.40 0.20 130 0.40 325 0.40 0.40 265 0.40 410 0.20 Alternative 1 Alternative 2 Alternative 3 80 135 Using the coefficient of variation, rank the three alternatives in terms of risk from lowest to highest. Note: Do not round intermediate calculations. Round your answers to 3 decimal places. Coefficient of Variation Rankarrow_forward

- 10.3 Refer to Exhibit 10.2. a. Construct an equal-weighted (50/50) portfolio of investments B and C. What are the expected rate of return and standard deviation of the portfolio? Explain your results. b. Construct an equal-weighted (50/50) portfolio of investments B and D. What are the expected rate of return and standard deviation of the portfolio? Explain your results.arrow_forwardThe table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3), and the returns of sector indexes in column (4). (1) (2) (3) (4) Actual Actual Benchmark Index Return Weight Weight Return Equity 16% 80% 60% 10% Bonds 9% 15% 35% 7% Cash 3% 5% 5% 1% What was the manager's return in the month? What was the benchmark's return in the month? Did the manager over or under perform the benchmark? a. Over perform b. Under perform c. Equal performance d. Cannot tell from the information given e. None of the above By how much did the manager over or under perform the benchmark? What is the contribution of security selection to relative performance? What is the contribution of asset allocation to relative performance?arrow_forwardThe market portfolio has a beta of _________ Group of answer choices a. 0 b. 1 c. -1 d. 0.5arrow_forward

- The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations incolumn (3), and the returns of sector indexes in column (4).(1) (2) (3) (4)Actual Actual Benchmark IndexReturn Weight Weight ReturnEquity 15% 80% 60% 10%Bonds 10% 15% 30% 6%Cash 4% 5% 5% 1%What was the manager's return in the month? What was the benchmark's return in the month?arrow_forwardComputing Present and Future Values Under Different Assumptions Determine the unknown variables in each of the four separate investment scenarios. Round the RATE to one percentage point (for example, enter 8.5 for 8.54444%). Round NPER, PV, and PMT to the nearest whole number. Use a negative sign only for an amount related to PMT. Investment 1 Investment 2 Investment 3 Investment 4 RATE Answer 7% 6% 1% NPER 10 Answer 4 24 PV $216,000 $9,000 Answer $21,600 PMT $(35,000) $(2,300) $(16,200) Answer TYPE End of period Beg. of period End of period Beg. of periodarrow_forwardRank the following risky investment projects based on stochastic dominance. Project P Project Q Payoff Probability Payoff Probability 20 0.3 30 0.25 40 0.4 50 0.25 70 0.2 60 0.25 80 0.1 90 0.25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education