Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

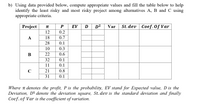

Transcribed Image Text:b) Using data provided below, compute appropriate values and fill the table below to help

identify the least risky and most risky project among alternatives A, B and C using

appropriate criteria.

Project

EV

D

D2

Var

St. dev Coef.0f Var

TT

12

0.2

A

18

0.7

28

0.1

10

0.3

В

22

0.6

32

0.1

11

0.1

C

21

0.8

31

0.1

Where n denotes the profit, P is the probability, EV stand for Expected value, D is the

Deviation, D$ denote the deviation square, St. dev is the standard deviation and finally

Coef.of Var is the coefficient of variation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Define systematic risk. B I וכ B T₂ T² Tx Ix E23 ||| € E E DO PM = 99 @₁ áarrow_forwardExplain the relationship between WACC and EVA! demonstrate by providing a complete analysis and clearly what happens to EVA when the WACC is low and the WACC is high?arrow_forwardWhat is the critical value (based on the T-table) at 95% significance level? a. 2.33 b. 1.646 c. 1.645 d. Not obtainable without additional informationarrow_forward

- You are given the following possible returns for Security J. Given this information, determine the coefficient of variation for Security J State Probability G 1 30% 10% 25% 18% 14% 24% 27% 2 3 4 O 0.3907 O 0.3847 O 0.3721 O 0.4040 00.3597 31%arrow_forwardPlease give all part answer??? Definitely I will give good rating.arrow_forwardI need typing clear urjent no chatgpt use i will give 5 upvotes full explanationarrow_forward

- How do you know when to use the formula FV=PV(1+i)n vs. FV=PV(1+r/m)mtarrow_forwardFind the optimal solution for the following problem. Note: Round your answers to 3 decimal places. Maximize C = 13x + 9y subject to and 6x + 11y ≤ 18 16x + 21y ≤ 41 x ≥ 0, y ≥ 0. a. What is the optimal value of x? X b. What is the optimal value of y? c. What is the maximum value of the objective function?arrow_forwardWill adjusted R2 be a good alternative for evaluating model performance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education