Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

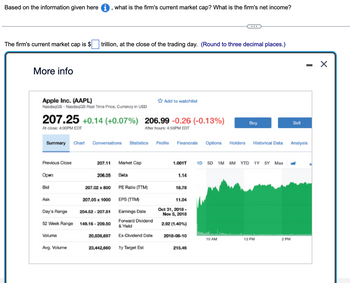

Transcribed Image Text:Based on the information given herei, what is the firm's current market cap? What is the firm's net income?

The firm's current market cap is $ trillion, at the close of the trading day. (Round to three decimal places.)

More info

Apple Inc. (AAPL)

NasdaqGS-NasdaqGS Real Time Price. Currency in USD

207.25 +0.14 (+0.07%) 206.99 -0.26 (-0.13%)

At close: 4:00PM EDT

After hours: 4:56PM EDT

Summary Chart Conversations Statistics

Previous Close

Open

Bid

Ask

Day's Range

52 Week Range

Volume

Avg. Volume

207.11

206.05

207.02 x 800

207.05 x 1000

204.52-207.81

149.16-209.50

Market Cap

Beta

PE Ratio (TTM)

EPS (TTM)

Earnings Date

Forward Dividend

& Yield

Ex-Dividend Date

Add to watchlist

20,036,697

23,442,660 1y Target Est

Profile Financials Options Holders Historical Data

1.001T 1D 5D 1M 6M YTD 1Y 5Y Max

1.14

18.78

11.04

Oct 31, 2018-

Nov 5, 2018

2.92 (1.40%)

2018-08-10

Buy

215.46

10 AM

12 PM

Sell

2 PM

-

Analysis

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The table below shows the closing monthly stock prices for IBM and Amazon. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. (Do not round intermediate calculations. Round your answers to 2 decimal places.) January February Marchi April May June July August September October November December IBM $172.04 174.89 185.17 201.13 194.77 206.33 227.84 210.31 AMZN $606.16 617.72 581.12 545.70 520.70 501.58 604.89 539.16 514.00 596.68 194.09 595.91 174.22 650.30 218.15 213.99arrow_forwardAnalysis of 60 monthly rates of return on United Futon common stock indicates a beta of 1.54 and an alpha of -0.29% per month. A month later, the market is up by 5.9%, and United Futon is up by 6.9%. What is Futon's abnormal rate of return? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Rate of return % Karrow_forwardThe Bloomberg screen below shows the Nasdaq Index price over the last year. Describe the technical indicator used from the chartist and what trade signal it may suggest. CCMP €T On 03 CCMP Index 11/04/2020 Study RSI 1D 3D 1M 6M YTD 1Y 5Y Max Daily Volume 1.000B IRSI (14) on Close (CCMP) 75.3572 Nov C 15811.58 +161.98 Nov 0 15658.52 H 15821.58 L 15616.44 Prev 15811.58 94) Suggested Charts 96) Actions 97) Edit 11/04/2021 Last Px Local CCY Mov Avgs Period 14 Overbought 70 Oversold 30 1 Table + Compare ▾ Add Data Track Annotate News Zoom Key Events 2020 Dec Jan Feb Mar Apr May Jun 06/03/21 Jul Aug Relative Strength Index ไปได้ Sep Edit Chart * Oct 15811.5801 15013.0596 14198.1699 Last Price THigh on 11/03/21 Average 15811.5801 15821.5801 12000 13839.5049 Z-VOU 1 Low on 11/04/20 11394.21 11075.4473 ISMAVG (50) on Close 15013.0596 SMAVG (100) on Close 14805.082 SMAVG (200) on Close 14198.1699 13000 10000 3B 2B 1.000B -0 100 75.3572 -50 -0arrow_forward

- The table below shows the closing monthly stock prices for Penn Company and Teller, Incorporated. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. Note: Input all amounts as positive values. Do not round intermediate calculations. Round your answers to 2 decimal places. Penn Teller January $ 175.04 $ 613.41 February 176.89 623.12 March 191.47 574.07 April 207.78 547.70 May 192.37 510.30 June 208.63 495.58 July 234.49 606.39 August 204.16 536.91 September 220.55 512.70 October 214.59 601.73 November 196.34 591.56 December 175.62 655.80arrow_forwardWant the Correct answer from bellow optionsarrow_forwardWhat was the closing price for McKesson on July 7, 2016?arrow_forward

- Google puts with 1 year to expiration and an exercise price of $680 trade for $27. Google calls with 1 year to expiration and an exercise price of $680 trade for $45. The interest rate over 1 year is 1%. Assume all options are European and Google pays no dividends. Using the put-parity condition, the stock price is equal to $691.27. a) In one month, the stock price remains the same as given above. Is the call option value lower, higher, or the same. Explain briefly.arrow_forwardM4arrow_forwardThe following return series comes from Global Financial Data. US T-bills CPI Year Large Stocks LT Gov Bonds (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average rate of inflation. (Enter percentages as decimals and round to 4 decimals)arrow_forward

- The Bloomberg screen below shows the Nasdaq Index price over the last year. Describe the technical indicator used from the chartist and what trade signal it may suggest. CCMP €T On 03 CCMP Index 11/04/2020 Study RSI 1D 3D 1M 6M YTD 1Y 5Y Max Daily Volume 1.000B IRSI (14) on Close (CCMP) 75.3572 Nov C 15811.58 +161.98 Nov 0 15658.52 H 15821.58 L 15616.44 Prev 15811.58 94) Suggested Charts 96) Actions 97) Edit 11/04/2021 Last Px Local CCY Mov Avgs Period 14 Overbought 70 Oversold 30 1 Table + Compare ▾ Add Data Track Annotate News Zoom Key Events 2020 Dec Jan Feb Mar Apr May Jun 06/03/21 Jul Aug Relative Strength Index ไปได้ Sep Edit Chart * Oct 15811.5801 15013.0596 14198.1699 Last Price THigh on 11/03/21 Average 15811.5801 15821.5801 12000 13839.5049 Z-VOU 1 Low on 11/04/20 11394.21 11075.4473 ISMAVG (50) on Close 15013.0596 SMAVG (100) on Close 14805.082 SMAVG (200) on Close 14198.1699 13000 10000 3B 2B 1.000B -0 100 75.3572 -50 -0arrow_forwardThe market risk premium is 5.41% and the yield on a Treasury bond is 1.02%. What is the fair return on this stock? Etsy, Inc. (ETSY) NasdaqGS - NasdaqGS Real Time Price. Currency in USD * Add to watchlist 140.06 +5.56 (+4.13%) At close: November 20 4:00PM EST Summary Company Outlook Chart Conversations Stati: Previous Close 134.50 Market Cap 17.66B Beta (5Y Monthly) Open 136.52 1.59 Bid 139.90 x 1100 PE Ratio (TTM) 75.22 Ask 140.05 x 900 EPS (TTM) 1.86 Day's Range 136.26 - 143.96 Earnings Date Oct 28, 2020 Forward 52 Week Range 29.95 - 154.88 N/A (N/A) Dividend & Yield Volume 4,258,608 Ex-Dividend Date N/A Avg. Volume 4,284,790 1y Target Est 160.12arrow_forwardpls help me with this question I keep getting it wrong, thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education