Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

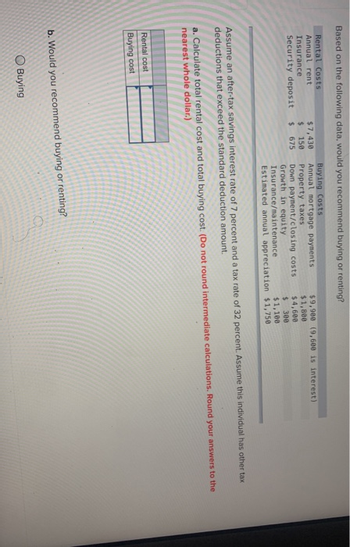

Transcribed Image Text:Based on the following data, would you recommend buying or renting?

Buying Costs

Annual mortgage payments

Rental Costs

Annual rent

Insurance

Security deposit

$7,430

150

675

Rental cost

Buying cost

$

$

Assume an after-tax savings interest rate of 7 percent and a tax rate of 32 percent. Assume this individual has other tax

deductions that exceed the standard deduction amount.

Buying

$9,900 (9,600 is interest)

Property taxes

$1,800

Down payment/closing costs

Growth in equity

$4,600

$ 300

Insurance/maintenance.

$1,100

Estimated annual appreciation $1,750

a. Calculate total rental cost and total buying cost. (Do not round intermediate calculations. Round your answers to the

nearest whole dollar.)

b. Would you recommend buying or renting?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Fill in the missing numbers for the following statement of comprehensive income. (Input all amounts as positive values. Omit $ sign in your response.) Sales Costs Depreciation EBIT Taxes (34%) Net income Calculate the OCF. OCF $ What is the CCA tax shield? CCA tax shield 733,500 503,300 89,400arrow_forwardWorking needarrow_forwardYour mortgage payment, monthly PMI, monthly house insurance, and monthly property tax should total no more than 38% of your gross monthly income. If the total is more, then you are borrowing too much money. With the following payments and income, have you borrowed too much money? Description Mortgage Payment Monthly PMI Monthly Property Tax Monthly Home Insurance Total Gross Monthly Income Percent of GMI Dollars $1613.86 $11.30 $19.37 $6.46 Round your answers to the nearest dollar. Calculate 38% of your gross monthly income. $5284.44 Calculate the total of your payment, PMI, insurance, and property taxes. Are you borrowing too much? O You're borrowing too much. O You're not borrowing too much.arrow_forward

- Required Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forwardFind the following for a $200,000 fixed-rate mortgage and the given information. a) Monthly mortgage payment (principal and interest) b) Monthly house payment (including property taxes and insurance) c) Initial monthly interest d) Income tax deductible portion of initial house payment e) Net initial monthly cost for the home (considering tax savings) Owner's Income Tax Bracket 25% Term of Mortgage 20 years Interest Rate 6% Annual Property Tax $1128 Annual Insurance $540 a) The monthly mortgage payment is $. (Round to the nearest dollar as needed.)arrow_forwardEstimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. (Refer to Exhibit 9-8 and Exhibit 9-9.) Note: Round time value factor to 2 decimal places, intermediate and final answers to the nearest whole number. Monthly gross income Down payment to be made (percent of purchase price) Other debt (monthly payment) Monthly estimate for property taxes and insurance 30-year loan Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase price Affordable Amount Mortgage Costs $ 3,250 20 Percent $ 175 $ 210 7.0 Percentarrow_forward

- If the sales tax is 6% and the purchase price is $193, what is the amount of tax?arrow_forwardf. Insurance: You are still not done allocating your paycheck. Assume that you pay annually 0.5% of your home value in home insurance. You also pay $1,000/year in auto insurance, $2,500/year in medical and dental insurance, and $350 / year in life insurance. What is your monthly payment for these deductions?arrow_forwardAge 60 61 62 63 65 66 67 64 68 69 80 81 82 70 71 83 84 85 86 87 88 89 90 72 73 74 75 76 77 78 79 Table I (Single Life Expectancy) (For Use by Beneficiaries) Life Expectancy 27.1 26.2 25.4 24.5 23.7 22.9 22.0 21.2 20.4 19.6 18.8 18.0 17.2 16.4 15.6 14.8 14.1 13.3 12.6 11.9 11.2 10.5 9.9 9.3 8.7 8.1 7.6 7.1 6.6 6.1 5.7 Age 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120+ Life Expectancy 5.3 4.9 4.6 4.3 4.0 3.7 3.4 3.2 3.0 2.8 2.6 2.5 2.3 2.2 2.1 2.1 2.1 2.0 2.0 2.0 2.0 2.0 1.9 1.9 1.8 1.8 1.6 1.4 1.1 1.0arrow_forward

- Suppose you earn a gross income of $2,920.00 per month and apply for a mortgage with a monthly PITI of $908.12. You have other financial obligations totaling $169.36 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% A. FHA only B. Conventional only C. FHA and Conventional D. None of the abovearrow_forwardEstimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. Note: Round your intermediate and final answers to the nearest whole dollar. Monthly gross income $ 4,850 Other debt (monthly payment) $260 20-year loan at 5 percent Down payment to be made (percent of purchase price ) 10 percent Monthly estimate for property taxes and insurance $ 385arrow_forwardHow is the housing expense ratio calculated? The monthly PITI payment is divided by the borrower's monthly net income. The monthly PITI payment is divided by the borrower's monthly gross income. O The monthly PITI payment plus other monthly obligations are divided by the monthly gross income. The borrower's monthly gross income is divided by the monthly PITI payment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education