FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

PLEASE ANSWER 1-3

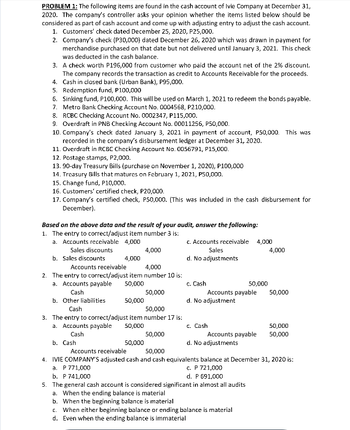

Transcribed Image Text:PROBLEM 1: The following items are found in the cash account of Ivie Company at December 31,

2020. The company's controller asks your opinion whether the items listed below should be

considered as part of cash account and come up with adjusting entry to adjust the cash account.

1. Customers' check dated December 25, 2020, P25,000.

2. Company's check (P30,000) dated December 26, 2020 which was drawn in payment for

merchandise purchased on that date but not delivered until January 3, 2021. This check

was deducted in the cash balance.

3.

A check worth P196,000 from customer who paid the account net of the 2% discount.

The company records the transaction as credit to Accounts Receivable for the proceeds.

Cash in closed bank (Urban Bank), P95,000.

4.

5. Redemption fund, P100,000

6. Sinking fund, P100,000. This will be used on March 1, 2021 to redeem the bonds payable.

7. Metro Bank Checking Account No. 0004568, P210,000.

8.

RCBC Checking Account No. 0002347, P115,000.

9. Overdraft in PNB Checking Account No. 00011256, P50,000.

10. Company's check dated January 3, 2021 in payment of account, P50,000. This was

recorded in the company's disbursement ledger at December 31, 2020.

11. Overdraft in RCBC Checking Account No. 0056791, P15,000.

12. Postage stamps, P2,000.

13. 90-day Treasury Bills (purchase on November 1, 2020), P100,000

14. Treasury Bills that matures on February 1, 2021, P50,000.

15. Change fund, P10,000.

16. Customers' certified check, P20,000.

17. Company's certified check, P50,000. (This was included in the cash disbursement for

December).

Based on the above data and the result of your audit, answer the following:

1. The entry to correct/adjust item number 3 is:

a. Accounts receivable 4,000

Sales discounts

4,000

b. Sales discounts

Accounts receivable

4,000

2. The entry to correct/adjust item number 10 is:

a. Accounts payable 50,000

Cash

b. Other liabilities

50,000

Cash

50,000

3. The entry to correct/adjust item number 17 is:

4,000

a. Accounts payable 50,000

Cash

50,000

b. Cash

50,000

50,000

c. Accounts receivable 4,000

Sales

d. No adjustments

c. Cash

Accounts payable

d. No adjustment

50,000

c. Cash

Accounts payable

d. No adjustments

4,000

50,000

50,000

50,000

Accounts receivable

50,000

4. IVIE COMPANY'S adjusted cash and cash equivalents balance at December 31, 2020 is:

a. P 771,000

c. P 721,000

b. P 741,000

d. P 691,000

5. The general cash account is considered significant in almost all audits

a. When the ending balance is material

b. When the beginning balance is material

c. When either beginning balance or ending balance is material

d. Even when the ending balance is immaterial

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education