FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

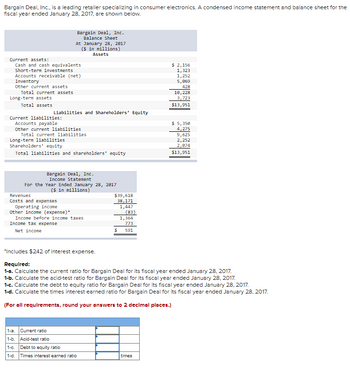

Transcribed Image Text:Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the

fiscal year ended January 28, 2017, are shown below.

Current assets:

Cash and cash equivalents

Short-term investments

Accounts receivable (net)

Inventory

Other current assets

Total current assets.

Long-term assets

Total assets

Bargain Deal, Inc.

Balance Sheet

At January 28, 2017

($ in millions)

Assets

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable

Other current liabilities

Total current liabilities

Long-term liabilities

Shareholders' equity

Total liabilities and shareholders' equity

Bargain Deal, Inc.

Income Statement

For the Year Ended January 28, 2017

($ in millions)

Revenues

Costs and expenses

Operating income

Other income (expense)*

Income before income taxes

Income tax expense

Net income

Current ratio

1-a.

1-b. Acid-test ratio

1-c. Debt to equity ratio

1-d.

$39,618

38,171

1,447

Times interest earned ratio

$

(83)

1,364

773

591

$ 2,156

1,323

1,252

5,069

428

18, 228

3,723

$13,951

*Includes $242 of interest expense.

Required:

1-a. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017.

(For all requirements, round your answers to 2 decimal places.)

times

$ 5,350

4,275

9,625

2,252

2,074

$13,951

Expert Solution

arrow_forward

Step 1

Ratio analysis helps to analyze the financial statements of the company. The management can take decisions on the basis of these ratios. It is also helpful to compare two or more financial statements.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). Target Corporation Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Total liabilities Walmart Inc. Income Statement Data for Year $65,357 $408,214 45,583 304,657 79,607 707 2,065 (94) (411) 1,384 7,139 $ 2,488 $ 14,335 Balance Sheet Data (End of Year) $18,424 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 15,101 26,109 $44,533 $11,327 17,859 15,347 $44,533 Beginning-of-Year Balances $44,106 $163,429 65,682 55,390 97,747 13,712 10,512 30,394 Other Dataarrow_forwardCadux Candy Company's income statement for the year ended December 31, 2021, reported interest expense of $6 million and income tax expense of $32 million. Current assets listed in its balance sheet include cash, accounts receivable, and inventory. Property, plant, and equipment is the company's only noncurrent asset. Financial ratios for 2021 are listed below. Profitability and turnover ratios with balance sheet items in the denominator were calculated using year-end balances rather than averages Debt to equity ratio Current ratio Acid-test ratio. Times interest earned ratio Return on assets Return on equity Profit margin on sales Gross profit margin (gross profit divided by net sales) Inventory turnover Receivables turnover Assets Current assets Cash CADUX CANDY COMPANY Balance Sheet At December 31, 2021 (All values are in millions) Required: Prepare a December 31, 2021, balance sheet for the Cadux Candy Company. (Enter your answers in millions. Round your intermediate calculations…arrow_forwardPrepare the financial statements Entertainment Centre Ltd. reported the following data at March 31, 2017, with amounts adapted and in thousands: Retained Earnings, March 31, 2017: $1,300 Accounts Receivable: $27,700 Net Revenues: $174,500 Total Current Liabilites: $53,600 All other expenses: $45,000 Other current assets: $4,800 Other assets: $24,300 Cost of goods sold: $128,000 Cash: $900 Property equipment, net: $7,200 Share Capital: $26,000 Inventories: $33,000 Long-term Liabilites: $13,500 Dividends: $0. You are the CFO responsible for reporting Entertainment Centre Ltd. results. Use these data to prepare an income statement for the year ended March 31, 2017, the statement of retained earnings for the year ended March 31, 2017 and the classified balance sheet at March 31, 2017. Use the report format for the balance sheet. Draw arrows linking the three statements to explain the information flows between the statements. Prepare the closing entries Use the Entertainment Centre Ltd.…arrow_forward

- Use the following tables to answer the question: LOGIC COMPANY Income Statement For years ended December 31, 2016 and 2017 (values in $) 2016 2017 Gross sales 19,800 15,600 Sales returns and allowances 900 100 Net sales 18,900 15,500 COGS 11,800 8,800 Gross profit 7,100 6,700 Depreciation 780 640 Selling and administrative expenses 2,800 2,400 Research 630 540 Miscellaneous 440 340 Total operating expenses 4,650 3,920 Income before interest and taxes 2,450 2,780 Interest expense 640 540 Income before taxes 1,810 2,240 Provision for taxes 724 896 LOGIC COMPANY Balance Sheet For years ended December 31, 2016 and 2017 (values in $) 2016 2017 Current assets 12,300 9,400 Accounts receivable 16,900 12,900 Merchandise inventory 8,900 14,400 Prepaid expenses 24,400 10,400 Total current assets 62,500 47,100 Building (net) 14,900 11,400 Land 13,900 9,400 Total plant and equipment 28,800 20,800 Total assets 91,300 67,900 Accounts payable 13,400 7,400 Salaries payable 7,500 5,400 Total current…arrow_forwardHere is the income statement for Crane, Inc. Net sales Cost of goods sold Gross profit Expenses (including $14,800 interest and $21,600 income taxes) Net income Additional information: 1. 2. 3. a. b. Crane, Inc. Income Statement For the Year Ended December 31, 2025 C. Compute the following measures for 2025. (Round Earnings per share to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) d. Common stock outstanding January 1, 2025, was 20,900 shares, and 36,200 shares were outstanding at December 31, 2025. (Use a simple average for weighted-average.) The market price of Crane stock was $12 on December 31, 2025. Cash dividends of $23,600 were declared and paid. Earnings per share Price-earnings ratio Payout ratio $449,500 218,400 231,100 77,600 $153,500 Times interest earned $ times % timesarrow_forwardequired information [The following information applies to the questions displayed below.] Simon Company’s year-end balance sheets follow. At December 31 2017 2016 2015 Assets Cash $ 31,800 $ 35,625 $ 37,800 Accounts receivable, net 89,500 62,500 50,200 Merchandise inventory 112,500 82,500 54,000 Prepaid expenses 10,700 9,375 5,000 Plant assets, net 278,500 255,000 230,500 Total assets $ 523,000 $ 445,000 $ 377,500 Liabilities and Equity Accounts payable $ 129,900 $ 75,250 $ 51,250 Long-term notes payable secured bymortgages on plant assets 98,500 101,500 83,500 Common stock, $10 par value 163,500 163,500 163,500 Retained earnings 131,100 104,750 79,250 Total liabilities and equity $ 523,000 $ 445,000 $ 377,500 The company’s income statements for the years ended December 31, 2017 and 2016, follow.…arrow_forward

- Pharoah Corporation recently filed the following financial statements with the SEC. Pharoah CorporationIncome Statement for the FiscalYear Ended July 31, 2017 Net sales $77,630 Cost of products sold 55,218 Gross profit $22,412 Selling, general, and administrative expenses 9,893 Depreciation 1,124 Operating income (loss) $11,395 Interest expense 688 Earnings (loss) before income taxes $10,707 Income taxes 3,748 Net earnings (loss) $6,959 What are the company’s current ratio and quick ratio? (Round answers to 2 decimal places, e.g. 52.75.) Current ratio Quick ratioarrow_forwardPortions of the financial statements for Parnell Company are provided below. PARNELL COMPANYIncome StatementFor the Year Ended December 31, 2018($ in 000s) Revenues and gains: Sales $ 840 Gain on sale of buildings 12 $ 852 Expenses and loss: Cost of goods sold $ 320 Salaries 124 Insurance 44 Depreciation 127 Interest expense 54 Loss on sale of machinery 11 680 Income before tax 172 Income tax expense 86 Net income $ 86 PARNELL COMPANYSelected Accounts from Comparative Balance SheetsDecember 31, 2018 and 2017($ in 000s) Year 2018 2017 Change Cash $ 142 $ 96 $ 46 Accounts receivable 332 212 120 Inventory 317 433 (116 ) Prepaid insurance 62 96 (34 ) Accounts payable 218 113 105 Salaries payable 110 89 21 Deferred income tax…arrow_forwardUse the following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts rec.. Inventory Total Net fixed assets Total assets $11,400 8,150 440 $ 2,810 108 $ 2,702 946 $1,756 Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 320 $ 350 What is the equity multiplier for 2017? Accounts payable 1,190 1,090 Long-term debt 2,120 1,805 Common stock $3,630 $3,245 Retained earnings 3,560 4,180 $7,190 $7,425 Total liab. & equity 2016 2017 $1,950 $2,022 1,110 1,393. 3,440 3,070 690 940 $7,190 $7,425arrow_forward

- Financial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,400 (6,400) 3,000 (2,200) (240) (224) $ 336 Bonds payable Common stock Retained earnings Comparative Balance Sheets. Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $ 640 640 840 2,400 $ 4,520 $ 1,340 1,600 640 940 $ 4,520 2023 $ 540 440 640 2,500 $4,120 $ 1,090 1,600 640 790 $ 4,220 Required: Calculate the following ratios for 2024 Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forwardThe following is the balance sheet data of ABD Ltd. for the year ending Dec 31, 2016 and Dec 31, 2015. Year Total Equity Total Liabilities Dec 31, 2016 $34,670 $14,560 Dec 31, 2015 $33,240 $13,250 Determine the total assets as on Dec 31, 2016 and Dec 31, 2015 respectively. $49,230 and $46,490 $20,110 and $19,990 $34,675 and $46,501 $48,243 and $13,250arrow_forwardOriole Corporation recently filed the following financial statements with the SEC. Look at the image for the balance sheet and more! Oriole CorporationIncome Statement for the FiscalYear Ended July 31, 2017 Net sales $77,630 Cost of products sold 55,218 Gross profit $22,412 Selling, general, and administrative expenses 9,893 Depreciation 1,124 Operating income (loss) $11,395 Interest expense 688 Earnings (loss) before income taxes $10,707 Income taxes 3,748 Net earnings (loss) $6,959 Use the DuPont identity to calculate the return on equity (ROE). In the process, calculate the following ratios: net profit margin, total asset turnover, equity multiplier, EBIT return on assets (EROA), and return on assets. (Do not round intermediate calculations. Round answers to 2 decimal places, e.g. 52.75 or 52.75%.) Net profit margin % Total asset turnover Equity multiplier EBIT return on assets % Return on assets %…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education