FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

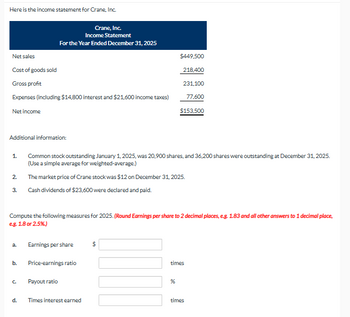

Transcribed Image Text:Here is the income statement for Crane, Inc.

Net sales

Cost of goods sold

Gross profit

Expenses (including $14,800 interest and $21,600 income taxes)

Net income

Additional information:

1.

2.

3.

a.

b.

Crane, Inc.

Income Statement

For the Year Ended December 31, 2025

C.

Compute the following measures for 2025. (Round Earnings per share to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place,

e.g. 1.8 or 2.5%)

d.

Common stock outstanding January 1, 2025, was 20,900 shares, and 36,200 shares were outstanding at December 31, 2025.

(Use a simple average for weighted-average.)

The market price of Crane stock was $12 on December 31, 2025.

Cash dividends of $23,600 were declared and paid.

Earnings per share

Price-earnings ratio

Payout ratio

$449,500

218,400

231,100

77,600

$153,500

Times interest earned

$

times

%

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratios Compared with Industry Averages Because you own the common stock of Phantom Corporation, a paper manufacturer, you decide to analyze the firm's performance for the most recent year. The following data are taken from the firm's latest annual report: P12-8A. LO4 Dec. 31, 2020 Dec. 31, 2019 Quick assets. $ $ 700,000 372,000 4,788,000 552,000 312,000 Inventory and prepaid expenses Other assets. 4,200,00O $5,064,00O Total Assets $5,860,000 Current liabilities. 10% Bonds payable 8% Preferred stock, $1 00 par value Common stock, $10 par value Retained earnings $4 724,000 1,440,00o 480,000 2,700,00O 516,000 $5,860,000 564,000 1,440,000 480,000 2,160,00O 420,000 Total Liabilities and Stockholders' Equity $5,064,00o For 2020, net sales amount to $11,280,000, net income is $575,000, and preferred stock dividends paid are $42,000. Required Calculate the following ratios for 2020: 1. a. Profit margin 2. Return on assets 3. Return on common stockholders’ equity Quick ratio Current ratio 4. 5.…arrow_forwardThe following information pertains to Sunland Company. Assume that all balance sheet amounts represent average balance figures. Total assets Stockholders' equity-common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common dividends Preferred dividends What is Sunland's payout ratio? O 24.6%. O 9.6%. O 17.9%. O 37.9%. $355000 235000 294000 97000 21100 6000 5200 8500arrow_forwarda. Compute net income for 2020. b. Prepare a partial income statement beginning with income from continuing operations before income tax, and including appropriate earnings per share information. Assume 10,000 shares of common stock were outstanding during 2020.arrow_forward

- The following information is available for Jase Company: Line Item Description Amount Market price per share of common stock $25.00 Earnings per share on common stock $1.25 Which of the following statements is true? a.The price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b.The price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year. c.The market price per share and the earnings per share are not statistically related to each other. d.The price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the yeararrow_forwardShow all of your work for numerical problems. 1. Based on the following information for ABC Corporation, answer each question (calculate for year 2023). Assume that price per share is $13.33 and number of shares is 175. Sales Cost of goods sold/Expenses Depreciation b. EBIT Interest Taxable Income Taxes Net Income Dividends Cash Inventory Account Receivable Current assets Net fixed assets Current liabilities Long-term debt Common stock Retained Earning 2022 1,000 1,400 1,600 4,000 9,000 3,500 4,000 3,000 2,500 2023 8,000 4,900 600 ? 450 ? ? ? 1,370 1,200 1,600 1,800 4,600 9,200 3,700 4,300 3,050 2,750 a. What are the ABC's tax liabilities (tax payments)? Use a 21 percent (flat) tax rate. Calculate cash flow from assets (CF Generating), cash flow to creditors, and cash flow to stockholders. Check CF identityarrow_forwardThe comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2. InstructionsDetermine the following measures for 20Y2. Round to one decimal place including percentages, except for per-share amounts, which should be rounded to the nearest cent.1. Working capital2. Current ratio3. Quick ratio4. Accounts receivable turnover5. Number of days' sales in receivables6. Inventor)’ turnover7. Number of days' sales in inventoryarrow_forward

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 62 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,808,800 $1,544,500 Net income 414,400 316,300 Total $2,223,200 $1,860,800 Dividends: On preferred stock $13,300 $13,300 On common stock 38,700 38,700 Total dividends $52,000 $52,000 Retained earnings, December 31 $2,171,200 $1,808,800 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $2,413,380 $2,223,550 Cost of goods sold 825,630 759,580 Gross profit $1,587,750 $1,463,970 Selling expenses $541,940 $662,800 Administrative expenses 461,660 389,260 Total operating expenses $1,003,600 $1,052,060 Income from…arrow_forwardCalculate the following ratios, follow the steps and must interpret your answers , Current ratio Earning per share ratio Current assets=$89000 Current liabilities= 61000 Net income/profit=$18000 Number of shares common stock=76262 Total asset=770000arrow_forwardBelow is select information from DC United Company's income statement. At the end of the current year, the weighted average number of common shares outstanding was 133,000. Select Data from Income Statement, End of Current Year Sales $ 952,000 Cost of goods sold 802, 000 Operating expenses 82,000 Tax expense 16,000 Required: Calculate EPS for DC United.arrow_forward

- Photoarrow_forwardFind for Armstrong Company and Blair Company : Liquidity Ratio (a) Current Ratio Market tests (b) Price/earnings ratio (c) Divident yield ratio (%)arrow_forwardhe financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions except share data) 2021 2020 Sales $ 9,343 $ 10,434 Net income $ 230 $ 748 Stockholders' equity $ 1,760 $ 2,240 Average Shares outstanding (in millions) 640 - Dividends per share $ 0.33 - Stock price $ 8.10 - Required:Calculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education