Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

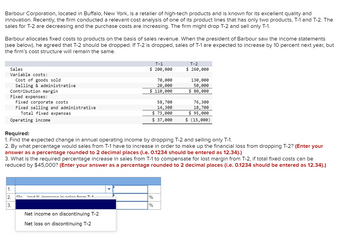

Transcribed Image Text:Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and

innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The

sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1.

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements

(see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but

the firm's cost structure will remain the same.

Sales

Variable costs:

Cost of goods sold

Selling & administrative

Contribution margin

Fixed expenses:

Fixed corporate costs.

Fixed selling and administrative

Total fixed expenses

Operating income

Required:

T-1

$ 200,000

70,000

20,000

$ 110,000

58,700

14,300

$ 73,000

T-2

$ 260,000

130,000

50,000

$ 80,000

76,300

18,700

$ 95,000

$ 37,000

$ (15,000)

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Enter your

answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be

reduced by $45,000? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

1.

2.

Do ired / increase in coles from T 1

%

3.

%

Net income on discontinuing T-2

Net loss on discontinuing T-2

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Munabhaiarrow_forwardBarbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1. Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but the firm's cost structure will remain the same. Sales Variable costs: Cost of goods sold Selling & administrative Contribution margin es Fixed expenses: Fixed corporate costs Fixed selling and administrative Total fixed expenses Operating income Required: T-1 $ 200,000 70,000 20,000 $ 110,000 58,700 14,300 $ 73,000 T-2 $ 260,000 130,000 50,000 $ 80,000…arrow_forwardAlpesharrow_forward

- Barbour Corp, lcoated in Buffalo is a retaier of high end tech products and is known for its excellent quality and innovasion. Recently, firm conduced a relevant cost analsyis of one of its product lines that has 2 producs T-1 and T-2. The sales for T-2 aredecreasing and the purchase cost are increasing. The firm might drop T-2 and sell only T-1. Company allocates fixed costs to products on the basis of the sales revenue. When the president of company saw the income statement (see below) , he agreed that T2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10% next years, but the firm's cost structure will remain the same. T-1 T-2 Sales $220,000 $276,000 Variables Costs: Cost of Goods Sold $74,000 $138,000 Selling & Administrative $25,000 $54,000 Contribution Margin $121,000 $84,000 Fixed Expenses: Fixed Corporate Costs $64,000 $79,000 Fixed Selling & Administrative $16,000 $25,000 Total Fixed Cost…arrow_forwardPeterson Corporation is considering implementing a JIT production system. The new system would reduce current average inventory levels of $2,000,000 by 75%, but it would require a much greater dependency on the company’s core suppliers for on-time deliveries and high-quality inputs. The company’s operations manager, John Leung, is opposed to the idea of a new JIT system. He is concerned that the new system (a) will be too costly to manage; (b) will result in too many stock outs; and (c) will lead to the layoff of his employees, several of whom are currently managing inventory. He believes that these layoffs will affect the morale of his entire production department. The management accountant, Susan Chow, is in favour of the new system, due to the likely result in cost savings. John wants Susan to revise her cost saving estimation because he is concerned that top management will give more weight to financial factors and not give due consideration to nonfinancial factors such as employee…arrow_forwardPlease help answer attached question, thank you!arrow_forward

- Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE belleves that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which Is representative, manufacturing overhead totaled $2,091,000 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $ 1,448,200 1,034,000 Commercial $ 661,000 708,500 Total $ 2,109,200 1,742,500 Management has determined that overhead costs are caused by three cost drivers. These…arrow_forwardJIT production, relevant benets, relevant costs, ethics. Galveston Pump Corporation is considering implementing a JIT production system. The new system would reduce current average inventory levels of $2,000,000 by 75%, but it would require a much greater dependency on the company’s core suppliers for on-time deliveries and high-quality inputs. The company’s operations manager, Frank Griswold, is opposed to the idea of a new JIT system because he is concerned that the new system (a) will be too costly to manage; (b) will result in too many stockouts; and (c) will lead to the layoff of his employees, several of whom are currently managing inventory. He believes that these layoffs will affect the morale of his entire production department. The management accountant, Bonnie Barrett, is in favor of the new system because of its likely cost savings. Frank wants Bonnie to rework the numbers because he is concerned that top management will give more weight to nancial factors and not give due…arrow_forwardBrandon Production is a small firm focused on the assembly and sale of custom computers. The firm is facing stiff competition from low-priced alternatives, and is looking at various solutions to remain competitive and profitable. Current financials for the firm are shown in the table below. In the first option, marketing will increase sales (and costs) by 50%. The next option is Vendor (Supplier) changes, which would result in a decrease of 12% in the cost of inputs. Finally, there is an OM option, which would reduce production costs by 25%. Business Function Current Value Cost of Inputs $50,000 Production Costs $30,000 Revenue $83,000 Which of the options would you recommend to the firm if it can only pursue one option? In addition, briefly comment on the feasibility and contribution of each option.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning