Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

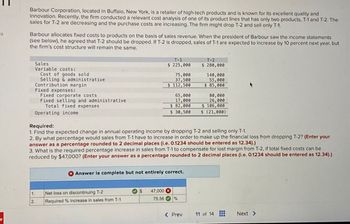

Transcribed Image Text:Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and

innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The

sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1.

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements

(see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but

the firm's cost structure will remain the same.

Sales

Variable costs:

Cost of goods sold

Selling & administrative

Contribution margin

Fixed expenses:

Fixed corporate costs

Fixed selling and administrative

Total fixed expenses

Operating income.

Required:

T-1

$225,000

T-2

$ 280,000

75,000

37,500

$112,500

140,000

55,000

$ 85,000

80,000

26,000

$ 106,000

$ 30,500 $ (21,000)

65,000

17,000

$82,000

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Enter your

answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be

reduced by $47,000? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

Answer is complete but not entirely correct.

1.

Net loss on discontinuing T-2

$ 47,000

2.

Required % increase in sales from T-1

75.56

%

< Prev

11 of 14

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Munabhaiarrow_forwardBarbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1. Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but the firm's cost structure will remain the same. Sales Variable costs: Cost of goods sold Selling & administrative Contribution margin es Fixed expenses: Fixed corporate costs Fixed selling and administrative Total fixed expenses Operating income Required: T-1 $ 200,000 70,000 20,000 $ 110,000 58,700 14,300 $ 73,000 T-2 $ 260,000 130,000 50,000 $ 80,000…arrow_forwardBarbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1. Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but the firm's cost structure will remain the same. Sales Variable costs: Cost of goods sold Selling & administrative Contribution margin Fixed expenses: Fixed corporate costs. Fixed selling and administrative Total fixed expenses Operating income Required: T-1 $ 200,000 70,000 20,000 $ 110,000 58,700 14,300 $ 73,000 T-2 $ 260,000 130,000 50,000 $ 80,000…arrow_forward

- Rahularrow_forwardBarbour Corp, lcoated in Buffalo is a retaier of high end tech products and is known for its excellent quality and innovasion. Recently, firm conduced a relevant cost analsyis of one of its product lines that has 2 producs T-1 and T-2. The sales for T-2 aredecreasing and the purchase cost are increasing. The firm might drop T-2 and sell only T-1. Company allocates fixed costs to products on the basis of the sales revenue. When the president of company saw the income statement (see below) , he agreed that T2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10% next years, but the firm's cost structure will remain the same. T-1 T-2 Sales $220,000 $276,000 Variables Costs: Cost of Goods Sold $74,000 $138,000 Selling & Administrative $25,000 $54,000 Contribution Margin $121,000 $84,000 Fixed Expenses: Fixed Corporate Costs $64,000 $79,000 Fixed Selling & Administrative $16,000 $25,000 Total Fixed Cost…arrow_forwardPeterson Corporation is considering implementing a JIT production system. The new system would reduce current average inventory levels of $2,000,000 by 75%, but it would require a much greater dependency on the company’s core suppliers for on-time deliveries and high-quality inputs. The company’s operations manager, John Leung, is opposed to the idea of a new JIT system. He is concerned that the new system (a) will be too costly to manage; (b) will result in too many stock outs; and (c) will lead to the layoff of his employees, several of whom are currently managing inventory. He believes that these layoffs will affect the morale of his entire production department. The management accountant, Susan Chow, is in favour of the new system, due to the likely result in cost savings. John wants Susan to revise her cost saving estimation because he is concerned that top management will give more weight to financial factors and not give due consideration to nonfinancial factors such as employee…arrow_forward

- Green Auto's Northern Division is currently purchasing a part from an outside supplier. The company's Southern Division, which has no excess capacity, makes and sells this part for external customers at a variable cost of $19 and a selling price of $31. If Southern begins sales to Northern, it (1) will use the general transfer-pricing rule and (2) will be able to reduce variable cost on internal transfers by $3. On the basis of this information, Southern would establish a transfer price of: $16. $19. $28. $31. None of the other answers are correct.arrow_forwardGold&Blue's Northern Division is currently purchasing a part from an outside supplier. The company's Southern Division, which has no excess capacity, makes and sells this part for external customers at a variable cost of P19 and a selling price of P31. If Southern begins sales to Northern, it (1) will use the general transfer-pricing rule and (2) will be able to reduce variable cost on internal transfers by P3. On the basis of this information, Southern would establish a transfer price of: P20. P28. P23. P25.arrow_forwardPlease help answer attached question, thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning