FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

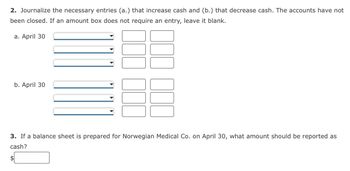

Transcribed Image Text:2. Journalize the necessary entries (a.) that increase cash and (b.) that decrease cash. The accounts have not

been closed. If an amount box does not require an entry, leave it blank.

a. April 30

b. April 30

3. If a balance sheet is prepared for Norwegian Medical Co. on April 30, what amount should be reported as

cash?

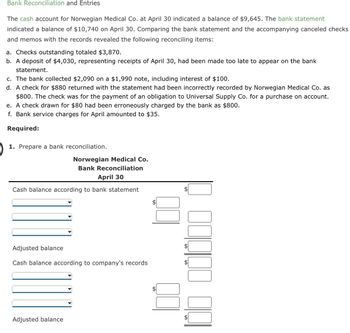

Transcribed Image Text:Bank Reconciliation and Entries

The cash account for Norwegian Medical Co. at April 30 indicated a balance of $9,645. The bank statement

indicated a balance of $10,740 on April 30. Comparing the bank statement and the accompanying canceled checks

and memos with the records revealed the following reconciling items:

a. Checks outstanding totaled $3,870.

b. A deposit of $4,030, representing receipts of April 30, had been made too late to appear on the bank

statement.

c. The bank collected $2,090 on a $1,990 note, including interest of $100.

d. A check for $880 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as

$800. The check was for the payment of an obligation to Universal Supply Co. for a purchase on account.

e. A check drawn for $80 had been erroneously charged by the bank as $800.

f. Bank service charges for April amounted to $35.

Required:

1. Prepare a bank reconciliation.

Norwegian Medical Co.

Bank Reconciliation

April 30

Cash balance according to bank statement

Adjusted balance

Cash balance according to company's records

Adjusted balance

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Transaction Journal Using the chart of accounts provided on the journal page, journalize the following transactions. Omit journal entry memos. Proper journal formatting is required. Not all accounts provided in the chart of accounts will be used Transferred cash from a personal bank account in exchange for stock, $30,00O. Purchased Supplies on account, $2,000. c Paid Cash for utility use, $5,000. Received Cash from clients on account, $1,000. (hint: NOT new revenue) Paid cash for three months rent in advance, $2,000. Paid cash to creditors on account, $3,000. Received cash from clients for services provided, $6,000. (hint: new revenue) Paid cash dividends to stockholders, $1,000. Purchased S10.000 of Office Equipment by paying $5,000 in Cash and the rest on account.arrow_forwardkk. Subject :- Accountingarrow_forwarda. Journalize the entry to record the issuance of the note on January 1. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. b. Journalize the entry to record the payment of the note at maturity, including interest. Assume a 360-day year. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- 1. Record the estimated bad debts expense. 2. Wrote off P. Park's account as uncollectible. 3. Reinstated Park's previously written off account. 4. Record the cash received on account.arrow_forwardHi, for the last part of this question, it says "After you prepare the schedule of accounts payable creditor balances, determine that the total agrees with the ending balance of the Accounts Payable controlling account."Outdoor Artisan LandscapingAccounts Payable(Controlling)Balance, June 1, 20Y1 $Total credits (from purchases journal)Total debits (from cash payments journal)Balance, June 30, 20Y1 $How would I solve this problem? I've attached a picture of the original questionarrow_forwardPrepare a journal entry on August 13 for cash received for services rendered, $10,150. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is enterearrow_forward

- Question 5 of 6 View Policies Date Receipt No. 3/5 7 Current Attempt in Progress Sheridan Company uses an imprest petty cash system. The fund was established on March 1 with a balance of $105. During March, the following petty cash receipts were found in the petty cash box. 9 11 14 1 2 3 4 For Stamps Freight-Out Miscellaneous Expense Travel Expense Miscellaneous Expense Amount $32 13 14 31 -/12 7 : The fund was replenished on March 15 when the fund contained $5 in cash. On March 20, the amount in the fund was increased to $200.arrow_forwardAccounting Qarrow_forward1. When posting all transactions to the ledgers, the cash account will show a total amount in the credit side of A. 118,200 B. 362,000 C. 243,800 D. 100,000 2. What is the final balance of the cash account after posting all related transactions to the ledger and after taking the difference between the total debits and credits? A. 243,800 credit balance B. 243,800 debit balance C. 362,000 debit balance D. 362,000 credit balance 3. After posting all related transactions to the ledger, the service revenue account will show a total balance of A. 82,000 debit B. 58,000 debit C. 82,000 credit D. 58,000 creditarrow_forward

- After posting the July 15 journal entry below to the cash account in the ledger, what would the updated balance in the cash account--the dollar amount on the debit or credit side? (Note: The company had a beginning debit balance of $50,000 on July 1 that should be included.) JOURNAL page 2 DATE DESCRIPTION POST. REF. DEBIT CREDIT 7/15/18 Cash $12,000 Fees Earned $12,000 GENERAL LEDGER ACCOUNT TITLE CASH ACCOUNT NO. 11 DATE ITEM PREF. DEBIT CREDIT DEBIT BALANCE CREDIT BALANCE 7/01/18 Balance $50,000 7/15/18 12,000 ? or ? Group of answer choices $12,000 credit balance $62,000 debit balance $12,000 debit balance $62,000 credit balancearrow_forwardMoving to another ques uestion 12 On March 1, a customer's account balance of $32,300 was deemed to be uncollectible. What entry should be recorded on March 1 to record the write-off assuming the company uses the allowance method? O Debit Bad Debts Expense $32,300; credit Accounts Receivable $32,300 O Debit Allowance for Doubtful Accounts $32,300; credit Accounts Receivable $32,300 O Debit Accounts Receivable $32,300; credit Bad Debts Expense $32,300 O Debit Allowance for Doubtful Accounts $32,300; credit Bad Debts Expense $32,300 Question 12 of 15 >>>>arrow_forwardDetails of Notes Receivable and Related Entries Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the following notes: Interest Date Face Amount Rate Term 1. Аpr. 10 $69,000 4% 60 days 2. June 24 16,800 30 days 3. July 1 72,000 120 days 4. Oct. 31 72,000 60 days 54,000 60 days 5. Nov. 15 6. Dec. 27 108,000 30 days Required: Assume 360 days in a year. 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number. (a) (ь) Note Due Date Interest Due at Maturity (1) (2) (3) (4) (5) (6) O o in o +arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education