FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

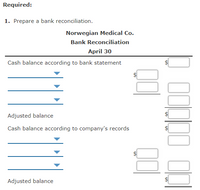

Transcribed Image Text:Required:

1. Prepare a bank reconciliation.

Norwegian Medical Co.

Bank Reconciliation

April 30

Cash balance according to bank statement

Adjusted balance

Cash balance according to company's records

Adjusted balance

%24

%24

Transcribed Image Text:Bank Reconciliation and Entries

The cash account for Norwegian Medical Co. at April 30 indicated a balance of $14,360. The bank statement indicated a balance of $16,680 on April 30. Comparing the bank statement

and the accompanying canceled checks and memos with the records revealed the following reconciling items:

a. Checks outstanding totaled $6,000.

b. A deposit of $6,260, representing receipts of April 30, had been made too late to appear on the bank statement.

c. The bank collected $3,250 on a $3,090 note, including interest of $160.

d. A check for $770 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as $700. The check was for the payment of an obligation to Universal Supply

Co. for a purchase on account.

e. A check drawn for $60 had been erroneously charged by the bank as $600.

f. Bank service charges for April amounted to $60.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information, prepare a bank reconciliation. Bank balance: $6,788 Book balance: $6,525 Deposits in transit: $1,688 Outstanding checks: $569 and $1,523 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $245 but posted in the accounting records as $254. This check was expensed to Utilities Expense. Bank Reconciliation Bank Statement Balance at (date) $fill in the blank 1 Add: Deposits in Transit Outstanding Checks Less: - Select - Adjusted Bank Balance $fill in the blank 8 Book Balance at (date) $fill in the blank 9 Add: - Select - Less: - Select - Adjusted Book Balance $fill in the blank 14arrow_forwardBlanksheet entries for bank reconciliationarrow_forwardThe June 30 bank statement shows a balance of $7,100. The following information as discovered while the bank reconciliation was prepared: A bookkeeper error where a $400 check written to a supplier was incorrectly recorded as $500 Two outstanding checks totaling $840 A bank service charge of $29 A deposit in transit of $330 Bank interest revenue of $20 What is the adjusted bank balance?arrow_forward

- Required:1. Prepare a bank reconciliation as of February 28.2. Prepare adjusting entries for Valentine based on the information developed in the bank reconciliation.3. What is the amount of cash that should be reported on the February 28 balance sheet?arrow_forwardPlease dont give solutions in an imagearrow_forwardDuke Company's unadjusted bank balance at March 31 is $3,850. The bank reconciliation revealed outstanding checks amounting to $580 and deposits in transit of $460. What is the true cash balance? Multiple Choice $3,730 $3,530 $3,930 $4,230arrow_forward

- The cash account for Pala Medical Co. at June 30, 20Y1, indicated a balance of $146,035. The bank statement indicated a balance of $181,965 on June 30, 20Y1. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: A. Checks outstanding totaled $16,445. B. A deposit of $9,900, representing receipts of June 30, had been made too late to appear on the bank statement. C. The bank collected $31,800 on a $30,000 note, including interest of $1,800. D. A check for $2,000 returned with the statement had been incorrectly recorded by Pala Medical Co. as $200. The check was for the payment of an obligation to Skyline Supply Co. for a purchase on account. E. A check drawn for $170 had been erroneously charged by the bank as $710. F. Bank service charges for June amounted to $75. 1. Prepare a bank reconciliation. Refer to the Amount Descriptions list provided for the exact wording of the answer…arrow_forwardMc Graw Hill Nolan Company's cash account shows a $24,659 debit balance and its bank statement shows $23,918 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,619. b. The June 30 bank statement lists $22 in bank service charges; the company has not yet recorded the cost of these services. c. In reviewing the bank statement, a $80 check written by the company was mistakenly recorded in the company's books as $89. d. June 30 cash receipts of $3,373 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. e. The bank statement included a $26 credit for interest earned on the company's cash in the bank. The company has not yet recorded interest earned. Prepare a bank reconciliation using the above information. Bank statement balance. Add: Deduct: Adjusted bank balance NOLAN COMPANY Bank Reconciliation June 30 $ 0 0 Book balance Add: Deduct: 0 0 Adjusted book balance $ 0 0 0 0arrow_forwardThe following bank reconciliation was prepared as of June 30, 20Y7: Line Item Description Amount Amount Cash balance according to bank statement $15,915 Add: Outstanding Check No. 1067 $565 Outstanding Check No. 1106 450 Outstanding Check No. 1110 1,090 Outstanding Check No. 1113 950 Total additions 3,055 Deduct: Deposit of June 30 not recorded by bank (6,900) Adjusted balance $12,070 Cash balance according to company’s records $8,070 Add: Proceeds of note collected by bank: Face value $6,000 Proceeds of note collected by bank: Interest 300 Service charges 10 Total additions 6,310 Deduct: Check returned because of insufficient funds $900 Error in recording June 17 deposit of $8,150 as $1,850 6,300 Total deductions (7,200) Adjusted balance $7,180 b. Prepare a corrected bank reconciliation.…arrow_forward

- Ryan Company deposits all cash receipts on the day they are received and makes all cash payments by check. Ryan's June bank statement shows a $29,361 balance in the bank. Ryan's comparison of the bank statement to its cash account revealed the following: Deposit in transit Outstanding checks Multiple Choice Additionally, a $49 check written and recorded by the company was incorrectly recorded by the bank as a $94 deduction. The adjusted cash balance per the bank records should be: O O $31,580 $31,535 $34,487 $31,625 3,650 1,431 $24.325 H Seved Oarrow_forwardPlease prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon Co. 1) Balance per bank statement $ 9,915 2) Balance per cash general ledger account (books) $ 8,954 3) April 30th deposit of $ 2,600 is not on the bank statement (Deposit in Transit) 4) Check numbers #219 for $ 1000 and # 222 for $ 1,100 written in April do not appear on the April bank statement (Outstanding Checks) 5) Debit memo for a $ 20 service charge appeared on the bank statement 6) The bank incorrectly deducted $ 400 from Bannon's checking account 7) The bank collected a note on behalf of the company in April, a credit memo for net proceeds óf $ 2,000 included the principal of $1,900, interest of $ 150, less a collection fee of $ 50 accompanied the bank statement 8) A check from Apple Co. for $ 150 was returned by the bank marked NSF 9) The bank added $40 of interest earned directly to the checking account balance 10) A Cash Sale in the amount of $ 297 was erroneously journalnized…arrow_forwardQuestion: The following errors were found when the controller at Mountain Motel was doing the June 30 bank reconciliation. On June 25, the bank posted a cheque in the amount of $825 to Mountain’s bank account. The cheque had been written by another company, Mountainside Company. For each of these errors, (a) indicate if and how it would be shown on the bank reconciliation, and (b) prepare the journal entry for Mountain if required. Please explain for the answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education