EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you help me with accounting questions

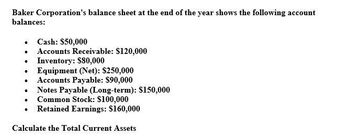

Transcribed Image Text:Baker Corporation's balance sheet at the end of the year shows the following account

balances:

Accounts Receivable: $120,000

•

Cash: $50,000

•

•

Inventory: $80,000

⚫ Equipment (Net): $250,000

•

•

•

Accounts Payable: $90,000

Notes Payable (Long-term): $150,000

Common Stock: $100,000

⚫ Retained Earnings: $160,000

Calculate the Total Current Assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardChasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardSuppose that you are given the following data for Niles Company : Note: The data and calculations are based on a 365-day year. Cash and equivalents Fixed assets Sales Net income Current liabilities Current ratio DSO ROE $225,000 $650,000 $2,500,000 $112,500 $240,000 2.5 18.25 12.00%arrow_forward

- Calculate the total current assets general accounting questionarrow_forwardLydex company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 960,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,700,000 1,800,000 Inventory 3,900,000 2,400,000 Prepaid expenses 240,000 180,000 Total current assets 7,800,000 5,940,000 Plant and equipment, net 9,300,000 8,940,000 Total assets $ 17,100,000 $ 14,880,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 3,900,000 $ 2,760,000 Note payable, 10% 3,600,000 3,000,000 Total liabilities 7,500,000 5,760,000 Stockholders' equity: Common stock, $ 78 par value 7,800,000 7,800,000 Retained earnings 1,800,000 1,320,000 Total stockholders' equity 9,600,000 9,120,000 Total liabilities and stockholders' equity $ 17,100,000 $ 14,880,000 Lydex CompanyComparative Income Statement and Reconciliation This Year Last…arrow_forwardThe following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $513,000 $416,000 Marketable securities 594,000 468,000 Accounts and notes receivable (net) 243,000 156,000 Inventories 1,485,000 1,030,900 Prepaid expenses 765,000 659,100 Total current assets $3,600,000 $2,730,000 Current liabilities: Accounts and notes payable (short-term) $435,000 $455,000 Accrued liabilities 315,000 195,000 Total current liabilities $750,000 $650,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3. Quick ratio fill…arrow_forward

- Sun City Corporation's end-of-year balance sheet consisted of the following amounts: Cash Property, plant, and equipment Capital stock Retained earnings $ 25,000 70,000 100,000 Ob. $200,000 Oc. $165,000 Od. $100,000 7 Accounts receivable Long-term debt Accounts payable Inventory What amount should Sun City report on its balance sheet for total assets? Oa. $95,000 $70,000 40,000 20,000 35,000arrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forward

- Lydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forwardThe Butler-Huron Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Cash and marketable securities Accounts receivable* Inventories** Other current assets Total current assets Plant and equipment (net) Other assets Total assets $82 820 1,507 22 $2,431 3,967 6,460 $6,460 Liabilities and Equity Accounts payable****** Accrued liabilities (salaries and benefits) Other current liabilities Total current liabilities Long-term debt and other liabilities Earnings before taxes Taxes Earnings after taxes (net income) Common stock Retained earnings Net sales Cost of sales Selling, general, and administrative expenses Other expenses Total expenses Total stockholders' equity Total liabilities and equity **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Income Statement (in Millions of Dollars) *Assume that all sales are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning