Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

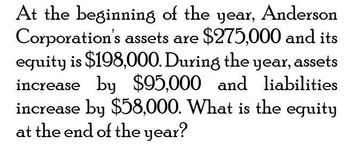

What is the equity at the end of the year

Transcribed Image Text:At the beginning of the year, Anderson

Corporation's assets are $275,000 and its

equity is $198,000. During the year, assets

increase by $95,000 and liabilities

increase by $58,000. What is the equity

at the end of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is optima's net income for the year on these accounting question?arrow_forwardDuring 2021, XYZ Inc. earned revenues of $95,000, had expenses of $73,000, purchased assets with a cost of $12,500, and paid dividends of $5,000. What was the net income for the year?arrow_forwardWhat is Acme's net income for the year on these financial accounting question?arrow_forward

- The Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of 36.5 days (based on a 365-day year), total current assets of $810,000, and cash and marketable securities of $120,000. What were Kretovich’s annual sales?arrow_forwardFor Belzcr Corporation, the working capital at the end of the current year is $24,000 more than the working capital at the end of the preceding year, reported as follows:arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forward

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardCain Corp. reported accrued investment interest receivable of 38,000 and 46,500 at January 1 and December 31, year 1, respectively. During year 1, cash collections from the investments included the following: Capital gains distributions= 145,000; Interest= 152,000. What amount should Cain Corp report as interest revenue from investments for year 1? *arrow_forwardWhat is the amount of working capital and the current ratio at the end of this year? What is the acid - test ratio at the end of this year? What is the accounts receivable turnover and the average collection period? What is the inventory turnover and the average sale period? What is the company's operating cycle? What is the total asset turnover? What is the times interest earned ratio? What is the debt-to-equity ratio at the end of this year? Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Balance Beginning Balance Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Net operating income Interest…arrow_forward

- At the beginning of the year, Keller Company's liabilities equal $60,000. During the year, assets increase by $80,000, and at year-end assets equal $180,000. Liabilities decrease $10,000 during the year. What are the beginning and ending amounts of equity?arrow_forwardIn 2021, Noble Tech Inc. reported that the company's Return on Assets (ROA) was 10%, and its net profit margin was 6%. Calculate the company's total asset turnover (round your answer to two decimal places).arrow_forwardIf a company has average accounts receivable of $60,000 and annual sales of $720,000, what is the DSO, assuming a 360-day year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning