Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:getproctorio.com/secured #lockdown

Enabled: Homework 3

Saved

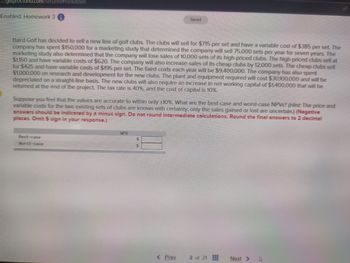

Baird Golf has decided to sell a new line of golf clubs. The clubs will sell for $715 per set and have a variable cost of $385 per set. The

company has spent $150,000 for a marketing study that determined the company will sell 75,000 sets per year for seven years. The

marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at

$1,150 and have variable costs of $620. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell

for $425 and have variable costs of $195 per set. The fixed costs each year will be $9,400,000. The company has also spent

$1,000,000 on research and development for the new clubs. The plant and equipment required will cost $30100,000 and will be

depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1,400,000 that will be

returned at the end of the project. The tax rate is 40%, and the cost of capital is 10%.

Suppose you feel that the values are accurate to within only ±10%. What are the best-case and worst-case NPVs? (Hint: The price and

variable costs for the two existing sets of clubs are known with certainty; only the sales gained or lost are uncertain.) (Negative

answers should be indicated by a minus sign. Do not round intermediate calculations. Round the final answers to 2 decimal

places. Omit $ sign in your response.)

Best-case

Worst-case

NPV

<Prev

2 of 21

Next >

B

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $775 per set and have a variable cost of $335 per set. The company has spent $160,000 for a marketing study that determined the company will sell 61,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,200 sets of its high-priced clubs. The high-priced clubs sell at $1,145 and have variable costs of $605. The company will also increase sales of its cheap clubs by 12,200 sets. The cheap clubs sell for $365 and have variable costs of $155 per set. The fixed costs each year will be $9,850,000. The company has also spent $1,100,000 on research and development for the new clubs. The plant and equipment required will cost $37,400,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1,800,000 that will be returned at the end of the project. The tax rate is 21 percent, and the cost of…arrow_forwardMiller Cereals is a small milling company that makes a single brand of cereal. Recently, a business school intern recommended that the company introduce a second cereal in order to "diversify the product portfolio." Currently, the company shows an operating profit that is 20 percent of sales. With the single product, other costs were twice the cost of rent. The intern estimated that the incremental profit of the new cereal would only be 2.5 percent of the incremental revenue, but it would still add to total profit. On his last day, the intern told Miller's marketing manager that his analysis was on the company laptop in a spreadsheet with a file name, NewProduct.xlsx. The intern then left for a 12-month walkabout in the outback of Australia and cannot be reached. When the marketing manager opened the file, it was corrupted and could not be opened. She then found an early (incomplete) copy on the company's backup server. The marketing manager then called a cost management accountant in…arrow_forwardMcGilla Golf is evaluating a new golf club. The clubs will sell for $1,060 per set and have a variable cost of $480 per set. The company has spent $172,500 for a marketing study that determined the company will sell 53,500 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,100 sets of its high-priced clubs. The high-priced clubs sell at $1,560 and have variable costs of $690. The company also will increase sales of its cheap clubs by 12,700 sets. The cheap clubs sell for $480 and have variable costs of $210 per set. The fixed costs each year will be $9,950,000. The company has also spent $1,325,000 on research and development for the new clubs. The plant and equipment required will cost $33,250,000 and will be depreciated on a straight-line basis to a zero salvage value. The new clubs also will also require an increase in net working capital of $2,710,000 that will be returned at the end of the project. The tax rate is 23 percent…arrow_forward

- Use the following information for all questions. McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $700 per set and have a variable cost of $340 per set. The company has spent $150,000 for a marketing study that determined the company will sell 46,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 12,000 sets of its high-priced clubs. The high-priced clubs sell at $1,100 and have variable costs of $550. The company will also increase sales of its cheap clubs by 20,000 sets. The cheap clubs sell for $300 and have variable costs of $100 per set. The fixed costs each year will be $8,000,000. The company also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $16,100,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $900,000 that will be returned at the end of the project.…arrow_forwardTotally Tanked, Inc. sells tank tops. The firm is considering making some changes in order to achieve its goal of increasing its profit.If it makes no changes, the company anticipates the following for the coming year. Maria, one of the company’s managers suggests the following: “I think if we cut our price to $17 a tank top, we will increase our sales to 3,700,000 tank tops. I think that will help us achieve our goal” Question: Mr. Big, the CEO, upon hearing Maria’s plan says “This is great! We should go forward with your plan since we will increase sales by 700,000 tank tops.” How would you answer Mr. Big? # of tank tops to be sold 3,000,000 Selling price per tank top $20 Variable expense per tank top $8 Fixed expenses for the year $20,000,000arrow_forwardO’Neil Enterprises produces a line of canned soups for sale at supermarkets across the country. Demand has been “soft” recently and the company is operating at 70 percent of capacity. The company is considering dropping one of the soups, beef barley, in hopes of improving profitability. If beef barley is dropped, the revenue associated with it will be lost and the related variable costs saved. The CFO estimates that the fixed costs will also be reduced by 25 percent. The following product line statements are available. Product Broth Beef Barley Minestrone Sales $ 32,600 $ 42,800 $ 51,200 Variable costs 22,000 38,600 40,100 Contribution margin $ 10,600 $ 4,200 $ 11,100 Fixed costs allocated to each product line 4,700 6,000 7,100 Operating profit (loss) $ 5,900 $ (1,800 ) $ 4,000 Required: a-1. Complete the following differential cost schedule. a-2. From an operating profit perspective, should O'Neil…arrow_forward

- McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $815 per set and have a variable cost of $365 per set. The company has spent $150,000 for a marketing study that determined the company will sell 55,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $730. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $445 and have variable costs of $210 per set. The fixed costs each year will be $9.45 million. The company has also spent $1 million on research and development for the new clubs. The plant and equipment required will cost $39.2 million and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1.85 million that will be returned at the end of the project. The tax rate is 25 percent, and the…arrow_forwardNikulbhaiarrow_forwardAlberto Technologies, manufacture and sells an electronic control device for $297. It has costs of $231 to manufacture it. A competitor is bringing a new electronic control device to market that will sell for $253. Marketing manager at Alberto believes it must lower the price to $253 to compete in the market for electronic control device. Marketing manager believes that the new price will cause sales to increase by 12%, even with a new competitor in the market. Alberto's sales are currently 6,000 units per year. What is the target cost per unit if the target operating income is 25% of salesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education