Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Hockdown

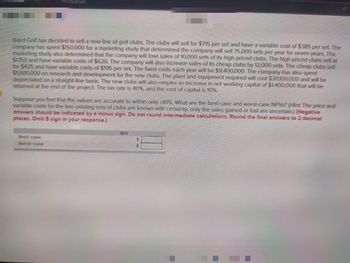

Baird Golf has decided to sell a new line of golf clubs. The clubs will sell for $715 per set and have a variable cost of $385 per set. The

company has spent $150,000 for a marketing study that determined the company will sell 75,000 sets per year for seven years. The

marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at

$1,150 and have variable costs of $620. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell

for $425 and have variable costs of $195 per set. The fixed costs each year will be $9,400,000. The company has also spent

$1,000,000 on research and development for the new clubs. The plant and equipment required will cost $30,100,000 and will be

depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1,400,000 that will be

returned at the end of the project. The tax rate is 40%, and the cost of capital is 10%.

Suppose you feel that the values are accurate to within only +10%. What are the best-case and worst-case NPVs? (Hint: The price and

variable costs for the two existing sets of clubs are known with certainty; only the sales gained or lost are uncertain.) (Negative

answers should be indicated by a minus sign. Do not round intermediate calculations. Round the final answers to 2 decimal

places. Omit $ sign in your response.)

Best-case

Worst-case

NPV

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Haresh valaarrow_forwardMcGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $840 per set and have a variable cost of $400 per set. The company has spent $290,000 for a marketing study that determined the company will sell 69,100 sets per year for seven years. The marketing study also determined that the company will lose sales of 12,800 sets of its high-priced clubs. The high-priced clubs sell at $1,210 and have variable costs of $670. The company will also increase sales of its cheap clubs by 14,800 sets. The cheap clubs sell for $430 and have variable costs of $220 per set. The fixed costs each year will be $10,500,000. The company has also spent $2,400,000 on research and development for the new clubs. The plant and equipment required will cost $38,700,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $3,100,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of…arrow_forwardMcGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $815 per set and have a variable cost of $365 per set. The company has spent $150,000 for a marketing study that determined the company will sell 55,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,000 sets of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $730. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $445 and have variable costs of $210 per set. The fixed costs each year will be $9.45 million. The company has also spent $1 million on research and development for the new clubs. The plant and equipment required will cost $39.2 million and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1.85 million that will be returned at the end of the project. The tax rate is 25 percent, and the…arrow_forward

- Please help! The formulas look mostly right, I dont know why the answer is wrong!arrow_forwardUse the following information for all questions. McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $700 per set and have a variable cost of $340 per set. The company has spent $150,000 for a marketing study that determined the company will sell 46,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 12,000 sets of its high-priced clubs. The high-priced clubs sell at $1,100 and have variable costs of $550. The company will also increase sales of its cheap clubs by 20,000 sets. The cheap clubs sell for $300 and have variable costs of $100 per set. The fixed costs each year will be $8,000,000. The company also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $16,100,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $900,000 that will be returned at the end of the project.…arrow_forwardMiller Books is considering publishing a book about meditation. The fixed costs to publish the book is estimated at $160,000. Variable material costs are estimated at $6 per book. Demand over the life of the textbook is estimated at 4,000 copies. Miller books anticipates that they can sell the books for $46 per unit. a) Write an expression for total revenue b) Write an expression for total cost c) Write an expression for total profit d) Find the break-even point e) Recommend a strategy if Miller will not be able to sell more than 3,500 copies.arrow_forward

- Help please and thank you so much!arrow_forwardMcGilla Golf is evaluating a new line of golf clubs. The clubs will sell for $1,030 per set and have a variable cost of $465 per set. The company has spent $165,000 for a marketing study that determined the company will sell 52,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 9,800 sets of its high-priced clubs. The high-priced clubs sell at $1,530 and have variable costs of $660. The company also will increase sales of its cheap clubs by 12,400 sets. The cheap clubs sell for $465 and have variable costs of $195 per set. The fixed costs each year will be $9,800,000. The company has also spent $1,250,000 on research and development for the new clubs. The plant and equipment required will cost $32,200,000 and will be depreciated on a straight-line basis to a zero salvage value. The new clubs will also require an increase in net working capital of $2,620,000 that will be returned at the end of the project. The tax rate is 25…arrow_forward1arrow_forward

- Orange Computer decides to sell a new line of foldable smartphones. The phones will sell for $965 per unit with variable cost of $487 per device. The company has spent $840,000 for a marketing study that determined the company will sell 94,000 new generation foldable handsets per year for seven years. The marketing study also determined that the company will lose sales of 9,300 units per year of its prior generation, but larger screen sized handsets. The prior generation, larger screen handsets sell for $1,395 and have variable costs that are 51.25% of the selling price. The company will also increase sales of its companion watch by 12,200 per year. The watch sells for $396 and has variable costs of $183 of total selling price. The fixed cost for the company each year is $15,750,000. The company has already spent $1,600,000 on research and development for the new gadgets. The plant and equipment required will cost $59,100,000 and will be depreciated on a straight-line basis to zero.…arrow_forwardLarson, Inc., manufactures backpacks. Last year, it sold 85,000 of its basic model for $25 per unit. The company estimates that this volume represents a 20 percent share of the current market. The market is expected to increase by 15 percent next year. Marketing specialists have determined that as a result of new competition, the company's market share will fall to 16 percent (of this larger market). Due to changes in prices, the new price for the backpacks will be $22 per unit. This new price is expected to be in line with the competition and have no effect on the volume estimates. Required: Estimate Larson's sales revenues from this model of backpack for the coming year. Sales revenuearrow_forwardanswer must be in proper format or i will give down votearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education