FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A

B

UD

C

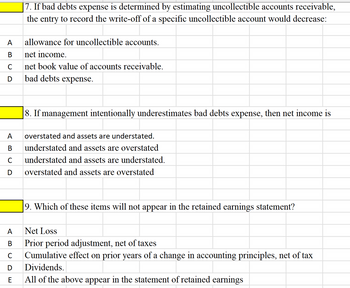

|7. If bad debts expense is determined by estimating uncollectible accounts receivable,

the entry to record the write-off of a specific uncollectible account would decrease:

allowance for uncollectible accounts.

net income.

net book value of accounts receivable.

bad debts expense.

8. If management intentionally underestimates bad debts expense, then net income is

A overstated and assets are understated.

B understated and assets are overstated

C

understated and assets are understated.

D overstated and assets are overstated

9. Which of these items will not appear in the retained earnings statement?

A

Net Loss

B

Prior period adjustment, net of taxes

с Cumulative effect on prior years of a change in accounting principles, net of tax

D

Dividends.

E

All of the above appear in the statement of retained earnings

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The adjusting entry for a bad debt expense has a debit and credit to what account. Bad debt Expense Allowance for doubtful accounts allowance for doubtful account bad debt expense Account payable bad debt expense none of thesearrow_forwardThe Direct Write-off method is the preferred method of accounting for uncollectible accounts according to GAAP. True Falsearrow_forwardUnder the allowance method of recognizing uncollectible accounts, the entry to write off an AR has no effect on net income. increases the allowance for uncollectible accounts. O increases AR. has no effect on the allowance for uncollectible accounts. O decreases net income.arrow_forward

- QUESTION 10 Match the term on the left to the appropriate classification or description on the right. v Allowance for doubtful accounts A. Discounts for early payment of A/R, recorded as contra- revenues v Net accounts receivable B. An account that the firm credits when it records bad debt v Sales discounts expense v Write-offs of A/R C. Entries that reduce gross accounts receivable D. Gross accounts receivable minus Allowance for doubtful accountsarrow_forwardUnder the allowance method, the write-off of an uncollectible account ________. Group of answer choices decreases total assets has no effect on the allowance for uncollectible accounts increases expenses has no effect on net incomearrow_forwardWhen a note is dishonored, the following is true. O Accounts Receivable is debited for the amount of the maturity value (the principal and the interest earned) O Notes Receivable is debited for the amount of the princial Bad debts expense is recorded O Interest revenue is never recorded EBCOarrow_forward

- Which of the following is not an accurate description of the Allowance for Doubtful Accounts? Multiple Choice O O O The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables. The account is a contra account. The account is a liability. The account is increased by an estimate of uncollectible accounts expense.arrow_forwardUnder the allowance method for uncollectible receivables, the entry to record uncollectible-account expense has what effect on the financial statements?a. Decreases assets and has no effect on net incomeb. Increases expenses and increases stockholders’ equityc. Decreases net income and decreases assetsd. Decreases stockholders’ equity and increases liabilitiesarrow_forwardWhich of the following is not an accurate description of the Allowance for Doubtful Accounts? Multiple Choice The account is a contra account. The account is a liability. The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables. The account is increased by an estimate of uncollectible accounts expense.arrow_forward

- When using the percentage of sales method to estimate the amount of bad debt expense for uncollectible accounts, what effect would a debit balance in Allowance for Doubtful Accounts have on the current period's adjusting entry? a.A debit balance would increase the amount of the current period's adjusting entry. b.A debit balance would decrease the amount of the current period's adjusting entry. c.The balance in Allowance for Doubtful Accounts would be ignored when making the current period's adjusting entry. d.A debit balance would be carried over to the next period.arrow_forwardThe debts written off as bad, if recovered subsequently are Oa. Credited to bad debts recovered account O b. Credited to debtors account C.Debited to profit and loss account D.Debited to trading accountarrow_forwardAt the time companies write off accounts receivable, there is no effect on net income. true or falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education