Concept explainers

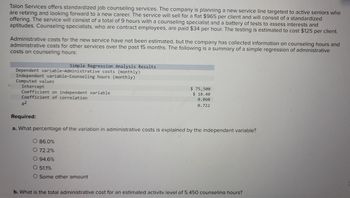

e. what is the estimating equation for total cost based on number of clients implied by these results

1. Total cost= $75,500 + ($436.80 x number of clients)

2.Total cost= $75,500 + ($403.20 x number of clients)

3. Total cost= $75,500 + ($50.40 x number of counseling hours)

a. The estimating equation for total cost based on the number of clients implied by these results is:

Total cost = $75,500 + ($436.80 x number of clients) (Option 1)

or

Total cost = $75,500 + ($403.20 x number of clients) (Option 2)

Since both options provide estimating equations for total cost based on the number of clients, either of them can be used.

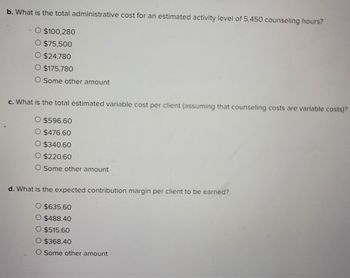

b. To find the total administrative cost for an estimated activity level of 5,450 counseling hours, we need to use the estimating equation for administrative costs based on counseling hours:

Administrative costs = $75,500 + ($18.40 x counseling hours)

Substituting counseling hours with 5,450:

Administrative costs = $75,500 + ($18.40 x 5,450)

Administrative costs = $175,780

Therefore, the total administrative cost for an estimated activity level of 5,450 counseling hours is $175,780. Option D is correct.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Find out BEP in units and value with the following data:Fixed cost - $30000Variable cost - $20 per unitSelling Price - $50 per unit.arrow_forwardVariable Costs, Contribution Margin, Contribution Margin Ratio Super-Tees Company plans to sell 20,000 T-shirts at $19 each in the coming year. Product costs include: Direct materials per T-shirt $6.65 $1.33 Direct labor per T-shirt Variable overhead per T-shirt $0.57 Total fixed factory overhead $43,000 Variable selling expense is the redemption of a coupon, which averages $0.95 per T-shirt; fixed selling and administrative expenses total $13,000.arrow_forwardWhat is the cost behavior type if the total cost is $60,000 at activity level of 6,000 hours, and $80,000 at 9,000 hours? Why?arrow_forward

- Need help with this questionarrow_forwardConvert the accompanying database to an Excel table to find: a.The total cost of all orders. b.Thetotal quantity of airframe fasteners purchased. c. The total cost of all orders placed with Manley Valve. Question content area bottom Part 1 a. The total cost of all orders is $?????? enter your response here.arrow_forwardMake me eary answerarrow_forward

- Garrell Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Time-driven activity rate (cost per unit of activity) Activity cost pool: Receiving Calls Resolving Issues Settling Disputes Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Customer P 31 17 1 $5.46 $8.58 $13.26 Customer Q 21 10 Required: Using time-driven activity-based costing, determine the total Customer Support Department cost assigned to cach customer.arrow_forwardThe controller of Ashton Company prepared the following projected income statement: Sales $97,000 Total variable cost 32,850 Total fixed cost 43,800 Operating income $20,440 Required: Calculate the contribution margin ratio?arrow_forwardCullumber Company makes three models of tasers. Information on the three products is given below. Sales Variable expenses Contribution margin Fixed expenses Net income (a) Net income $ (b) Shocker Net Income Tingler $300,000 $500,000 Tingler Net Income $ Total Net Income (c) Why or why not? Compute current net income for Cullumber Company. ta Net income would 151,400 148,600 $ 119,400 S $29,200 Fixed expenses consist of $298,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $80,800 (Shocker), and $34,300 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Shocker 197,000 303,000 229,800 $73,200 Compute net income by product line and in total for…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education