FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

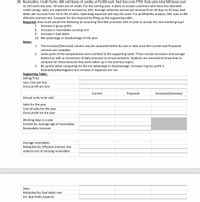

Transcribed Image Text:(B) Receivables: Credit Terms: ABC sold boxes of candles at P1,000 each. Each box costs P750. Daily sales total 500 boxes over

its 250-work day year. All sales are on credit. For the coming year, it plans to accept customers who have less desirable

credit ratings. Sales are expected to increase by 10%. Average collection period will increase from 40 days to 50 days. Bad

debts will increase from 1% to 3% of sales. Operating expenses will stay the same. For profitability analysis, ABC uses an 8%

effective interest rate. Compute for the required by filling up the supporting table.

Required: How much would the following be assuming that ABC proceeds with its plan to accept the new market group?

Increase in gross profit

Increase in receivables carrying cost

7.

8.

9.

Increase in bad debts

10. Net advantage or disadvantage of the plan

Notes:

The Increase/(Decrease) column may be computed either by row or later once the Current and Proposed

columns are complete.

Some parts of the computations were omitted in the supporting table. These include turnovers and average

balance as well as conversion of daily amounts to annual amounts. Students are assumed to know how to

compute for these because they were taken up in the previous topics.

Be careful when computing for the net advantage or disadvantage. Increase in gross profit is

favorable/advantageous but increase in expenses are not.

1.

2.

3.

Supporting Table:

Selling Price

Less: Cost per box

Gross profit per box

Current

Proposed

Increase/(Decrease)

Annual units to be sold

Sales for the year

Cost of sales for the year

Gross profit for the year

Working days in a year

Divided by: Average age of receivables

Receivables turnover

Average receivables

Multiplied by: Effective interest rate

Implicit cost of carrying receivables

Sales

Multiplied by: Bad debts rate

Est. Bad Debts Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Campbell Computing Inc. expects to have sales this year of $30 million under its current credit policy. The company offers a credit term of 2/8, net 20. Currently, 60 percent of paying customers take the discount and rest are paying on time. The bad debt loss is 2 percent. The company has a profit margin of 20%, and uses a 5% short-term bank loan to finance its accounts receivables. With 365-day a year assumption, please calculate the following items: a. The bad debt loss of the company this year b. The annual discount given to customers c. The accounts receivables level d. The financing cost of accounts receivablesarrow_forwardABC Corporation receives checks from its customers. The total check value averages 700,000 each day. It takes an average of 5 days from deposits for these to clear the bank. If the bank offers to accelerate the 5-day clearing process to 3 days for a monthly fee of 600. If ABC can earn 4% investment income from excess cash, how much is the net annual benefits/cost of this bank offer?arrow_forwardABC Company is considering to establish a line of credit with a local bank to make up for the cash deficit for the next three months. The company expects a 60% chance for a $273,446 deficit and a 40% chance for no deficit at all. The line of credit charges 0.52% of interest rate per month on the amount borrowed plus a commitment fee of $2,500 for a quarter. It also requires a 9% compensation balance for outstanding loans. The company can reinvest any excess cash at an annual rate of 8%. What will the expected cost of establishing a line of credit be? Round your answer to the nearest dollar. (Hint: Refer to a numerical example in short-term financing choices.) Group of answer choices $5,313 $5,321 $5,304 $5,309 $5,317arrow_forward

- A company can issue a 45-day $10 million commercial paper at a rate of 4.50%. It can reduce the rate to 4.35% if it is backed by a standby letter of credit (SBLC). A bank is willing to issue the SBLC for a fee of 10 basis points. The following is true: A The fee for issuing the SBLC is $10,000 B The net savings to the issuer is $1,250 C The amount received by the issuer for the commercial paper without an SBLC is $9,945,625. D The difference in the amount received by the issuer with and without the SBLC is $1,875.arrow_forwardDome Metals has credit sales of $162,000 yearly with credit terms of net 30 days, which is also the average collection period. a. Assume the firm offers a 2 percent discount for payment in 15 days and every customer takes advantage of the discount. Also assume the firm uses the cash generated from its reduced receivables to reduce its bank loans which cost 8 percent. What will the net gain or loss be to the firm if this discount is offered? (Use a 360-day year.) Loss of: $_________arrow_forwardIngraham Inc. currently has $500,000 in accounts receivable, and its days sales outstanding (DSO) is 44 days. It wants to reduce its DSO to 20 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 10%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest centarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education