Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

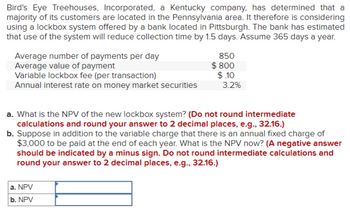

Transcribed Image Text:Bird's Eye Treehouses, Incorporated, a Kentucky company, has determined that a

majority of its customers are located in the Pennsylvania area. It therefore is considering

using a lockbox system offered by a bank located in Pittsburgh. The bank has estimated

that use of the system will reduce collection time by 1.5 days. Assume 365 days a year.

Average number of payments per day

Average value of payment

Variable lockbox fee (per transaction)

Annual interest rate on money market securities

850

$ 800

$.10

a. NPV

b. NPV

3.2%

a. What is the NPV of the new lockbox system? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. Suppose in addition to the variable charge that there is an annual fixed charge of

$3,000 to be paid at the end of each year. What is the NPV now? (A negative answer

should be indicated by a minus sign. Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Eliott Credit Corporation wants to earn an effective annual return on its consumer loans of 13 percent per year. The bank uses daily compounding on its loans. What interest rate is the bank required by law to report to potential borrowers? Multiple Choice 13.00% 11.00% 12.22%arrow_forwardBird's Eye Treehouses, Incorporated, a Kentucky company, has determined that a majority of its customers are located in the Pennsylvania area. It therefore is considering using a lockbox system offered by a bank located in Pittsburgh. The bank has estimated that use of the system will reduce collection time by 1.5 days. Assume 365 days a year. Average number of payments per day Average value of payment Variable lockbox fee (per transaction) Annual interest rate on money market securities 880 $830 $.10 3.2% a. What is the NPV of the new lockbox system? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose in addition to the variable charge that there is an annual fixed charge of $3,000 to be paid at the end of each year. What is the NPV now? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely…arrow_forwardNeveready Flashlights Inc. needs $340,000 to take a cash discount of 3/17, net 72. A banker will lend the money for 55 days at an interest cost of $10,400. What is the effective rate on the bank loan? tion in mind. 20.04% 3.06% 4.25% 10% How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 72 days instead of 17 days? 3.0% 97% 6.55% 15% Should the firm borrow the money to take the discount? No Yes I don't know Sometimes If the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $340,000? $10,000 $1,000 $100,000 ○ $425,000 What would be the effective interest rate in part d if the interest charge for 55 days were $13,000? Should the firm borrow with the 20 percent compensating balance? (The firm has no funds to count against the compensating balance requirement.) 3.0% 6.55% 6.0% 5.0%arrow_forward

- Bird's Eye Treehouses Inc. has determined that a majority of its customers are located in the Winnipeg area. It therefore is considering using a lockbox system offered by a bank in Manitoba. The bank has estimated that use of the system will reduc collection time by 1.5 days. Average number of payments per day 760 Average value of payment $ 770 Variable lockbox fee (per transaction) $ 0.10 Annual interest rate on money market securities 4.0% e-1. What is the NPV of the new lockbox system? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "$" sign in your response.) NPV $170558.7 a-2. Should the lockbox project be accepted? 13 Yes No b-1. If there were a fixed charge of $7,000 per year in addition to the variable charge, what is the NPV of the new lockbox system? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "$" sign in your response.) NPV $ b-2.…arrow_forwardHelpme please.arrow_forwardebbing eflopse bank and trust offers an APR of 41.09 percent compounded quarterlt on its credit cards. Vanishing vortex regional Bank offers an APR OF 39.78 percent compounded daily on jts credit cards. A. what is rhe effective annual rate for ebbing eclipse bank and trust? B what is the effective annual rate for vanishing vortex bank and trust? C. which bank credit card is better?arrow_forward

- Anne Teak, the financial manager of a furniture manufacturer, is considering operating a lock-box system. She forecasts that 400 payments a day will be made to lock boxes with an average payment size of $3,000. The bank's charge for operating the lock boxes is $0.50 a check. The interest rate is 0.012% per day. a. If the lock box makes the cash available 2 days earlier, calculate the net daily advantage of the system. Note: Do not round intermediate calculations. b. Is it worthwhile to adopt the system? c. What minimum reduction in the time to collect and process each check is needed to justify use of the lock-box system? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Net daily advantage b. Is it worthwhile to adopt the system? c. Minimum reduction in time $ Yes (56) 1.39 daysarrow_forwardYour firm has an average receipt size of $90. A bank has approached you concerning a lockbox service that will decrease your total collection time by 2 days. You typically receive 9,100 checks per day. The daily interest rate is 0.019 percent. If the bank charges a fee of $200 per day, what is the NPV of the lockbox project? NPV What would the net annual savings be if the service were adopted? Net annual savingsarrow_forwardSmith Inc. currently fills mail orders from all over the country and receipts were received in its head office. The company's average accounts receivable is P3,125,000 and is financed by a bank loan with 10% interest. Smith is considering a regional lockbox system to speed up collections. This system is projected to reduce the average accounts receivable by 15%. The annual cost of the lockbox system is P25,000. What is the estimated net annual savings in implementing the lockbox system? A. 22,985 B. 28,455 C. 25,750 D. 21,875arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education