FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

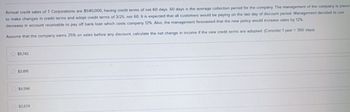

Transcribed Image Text:Annual credit sales of T Corporations are $540,000, having credit terms of net 60 days. 60 days is the average collection period for the company. The management of the company is planni

to make changes in credit terms and adopt credit terms of 3/25, net 60. It is expected that all customers would be paying on the last day of discount period. Management decided to use

decrease in account receivable to pay off bank loan which costs company 12%. Also, the management forecasted that the new policy would increase sales by 12%,

Assume that the company earns 25% on sales before any discount, calculate the net change in income if the new credit terms are adopted. (Consider 1 year = 360 days)

$5,742

$3.816

$4,596

$2.674

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, the sales of OSP Inc. Amounted to R5 million and its most recent statement of financial position revealed trade receivables of R822 000. All sales were on 30 days’ credit to customers. In order to encourage customers to pay in time, the management accountant of OSR Inc has proposed introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 60% of customers will take the discount and pay within 30 days. 30% of the customers will pay after 45 days, and the rest of the customers will not change their current paying behaviour, OSP Inc. Is charge interest of 12% per annum on its overdraft facility Required: Determine the net benefit (cost) of the proposed changes in trade receivables policy A. Net cost of approximately R7 000 B. Net benefit of approximately R 13000 C. Net cost of approximately R 13 000 D. Net benefit of approximately R 7 000arrow_forwardAggarwal Inc. buys on terms of 2/10, net 30, and it always pays on the 30th day. The CFO calculates that the average amount of costly trade credit carried is $350,000. What is the firm's average accounts payable balance? Assume a 365-day year. Please explain process and show calculations.arrow_forwardPlease provide answer in text (Without image)arrow_forward

- Axis Wells and Excavation (AWE) currently generates $198,000 in annual credit sales. AWE sells on terms of net 50, and its accounts receivable balance averages $11,000. AWE is considering a new credit policy with terms of net 25. Under the new policy, sales will decrease to $189,000, and accounts receivable will average $12,600. Compute the days sales outstanding (DSO) under the existing policy and the proposed policy. Assume there are 360 days in a year. Round your answers to the nearest whole number. DSOExisting: days DSONew: daysarrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,800. On October 13 the business borrowed $2,500, and on October 19 they borrowed $4,200. If the current prime rate is 8%, what is the new balance (in $)?arrow_forwardnider Industries sells on terms of 2/10, net 25. Total sales for the year are $600,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 30 days after their purchases. Assume a 365-day year. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. 24 days What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would happen to average receivables if Snider toughened its collection policy with the result that all non-discount customers paid on the 25th day? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forward

- Axis Wells and Excavation (AWE) currently generates $110,000 in annual credit sales. AWE sells on terms of net 50, and its accounts receivable balance averages $11,000. AWE is considering a new credit policy with terms of net 25. Under the new policy, sales will decrease to $104,000, and accounts receivable will average $13,000. Compute the days sales outstanding (DSO) under the existing policy and the proposed policy. Assume there are 360 days in a year. Round your answers to the nearest whole number. DSO Existing: days DSO New: daysarrow_forwardHow much is the remittance of MedLab Inc. to the bank by the end of September?arrow_forwardGilmore Electronics had the following data for a recent year: Cash sales $135,000 Credit sales 512,000 Accounts receivable determined to be uncollectible 9,650 The firm's estimated rate for bad debts is 1.15% of credit sales. Conceptual Connection: If Gilmore's estimate of bad debts is correct (1.15% of credit sales) and the gross margin is 20%, by how much did Gilmore's income from operations increase assuming $150,000 of the sales would have been lost if credit sales were not offered?arrow_forward

- A company has $50,000 in accounts receivable. The company estimates that 5% of accounts receivable will not be collected. What is the net realizable value of accounts receivable?arrow_forwardDome Metals has credit sales of $450,000 yeariy with credit terms of net 45 days, which is also the average collection perlod. a. Assume the fnrm offers a 2 percent discount for payment in 18 days and every customer takes advantage of the discount. Also assume the firm uses the cash generated from its reduced receivables to reduce its bank loans which cost 12 percent. What will the net gain or loss be to the firm if this discount is offered? (Use a 360-day year.)arrow_forwardDuring its first year of operations, Fertig Company had credit sales of $3,000,000, of which $400,000 remained uncollected at year- end. The credit manager estimates that $18,000 of these receivables will become uncollectible. The accounts receivable turnover is 10 times and average collection period is 36.5 days. Assume that average net accounts receivable were $300.000. Explain what these measures tell us. BI V T, TI E LE E H I 99 H E à ला 11 A A OWord(s)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education