FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:b My Questions bartleby

+

References

X

Camden County College

Chapter 3 Quiz

College Ha

http://camdenccinstructure.com/courses/3788/assignments/359677module item_id-88693

-04:00)

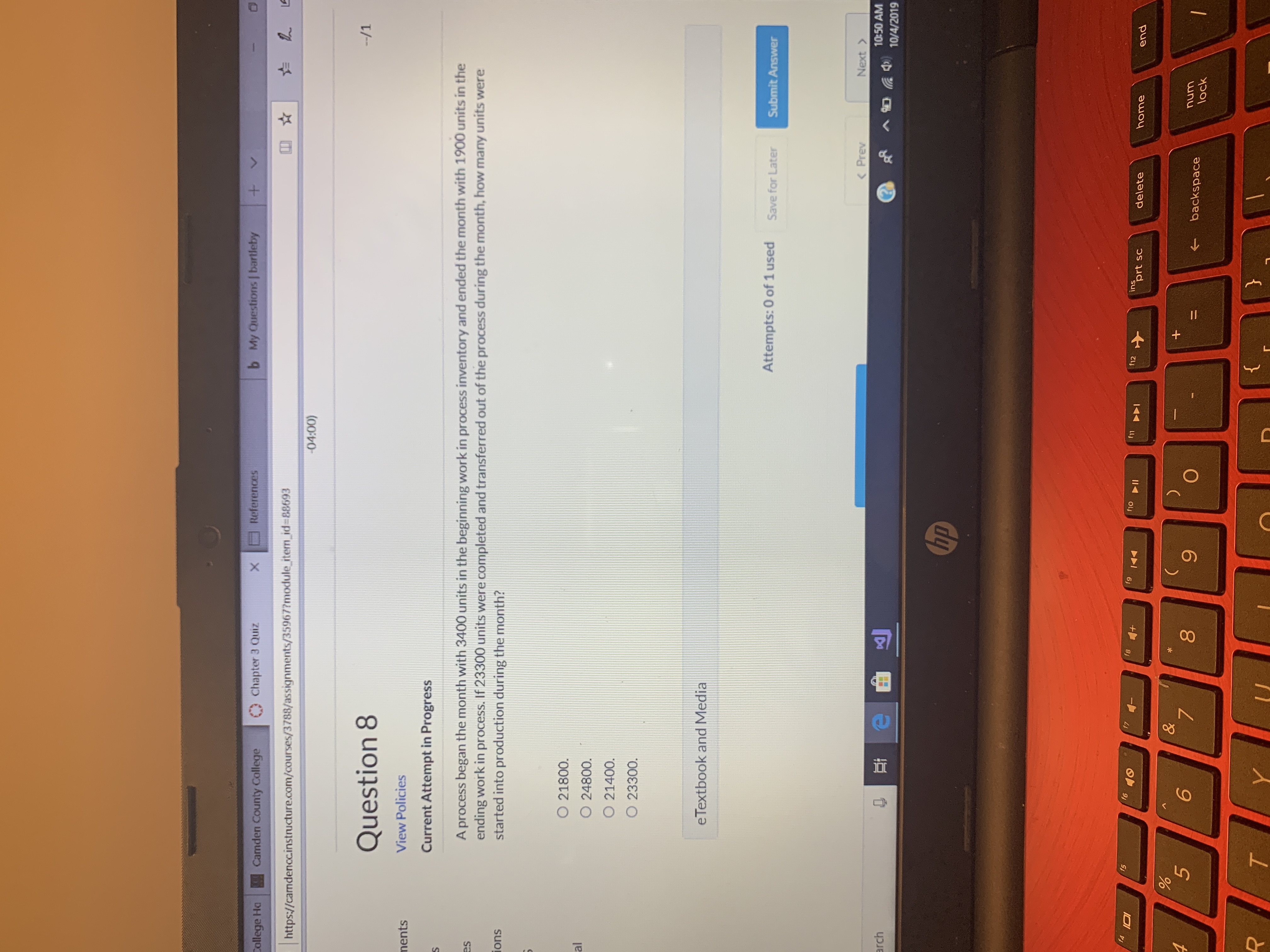

Question 8

--/1

View Policies

nents

Current Attempt in Progress

A process began the month with 3400 units in the beginning work in process inventory and ended the month with 1900 units in the

ending work in process. If 23300 units were completed and transferred out of the process during the month, how many units were

started into production during the month?

es

ions

O 21800.

al

O 24800.

O 21400.

O 23300.

eTextbook and Media

Attempts: 0 of 1 used

Save for Later

Submit Answer

< Prev

Next

arch

10:50 AM

AR 4 10/4/2019

hp

f4

f5

f6

IOI

f8

f

f12

ins

prt sc

delete

home

end

&

+

6

7

O

num

backspace

lock

}

T

Y

00

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- S18-13 Preparing journal entry Learning Objective 5 The Mixing Department's production cost report for May shows $12,500 in total costs, of which $2,500 will remain in the department assigned to the units still in process at the end of the month. Prepare the journal entry to record the transfer of costs from the Mixing Department to the Packaging Department.arrow_forward* Question Completion Status: QUESTION 25 The following data (in thousands of dollars) have been taken from the accounting records of Rudy Corporation for the just completed year. Sales $800 Raw materials inventory - beginning $ 60 $70 Raw materials inventory, ending Purchases of raw materials $180 Direct labor $100 Manufacturing overhead $190 Administrative expenses $110 $150 $70 $80 $120 $160 Selling expenses Work in process inventory beginning Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending The net income for the year (in thousands of dollars) was O $190 $390 O $70 O $130 O $310arrow_forwardCommunity Co X Home Myly Assignments 16P Summer 2012, x M Question 4-M03 Ch 17 Graded to.mheducation.com/ext/map/index.html?_con-contexternal_browser=0&launchUrl=https%253A%252F%252Flms.mheducatio Graded Practice i Process Assembly Machining Setups Finishing Support Activity Budgeted Cost $ 310,600 24,000 $ 334,600 Inspecting $ 226,000 Purchasing $ 132,000 Saved Activity Activity Cost Driver Machine hours (MH) Usage 7,400 Setups 180 Inspections 760 Purchase orders 480 Additional production information concerning its two models follows. Units and Activities Units produced Machine hours Setups Inspections Purchase orders Model X Model Z 1,600 3,200 2,200 5,200 60 120 480 280 320 160 Per Unit Model X Selling price per unit $ 410 Model Z $ 390 Direct materials cost per unit 145 115 Direct labor cost per unit 130 145 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the…arrow_forward

- 13 - Unit 1 - Chapter 1 Ass X it 1 - Chapter 1 Assignment i 13 t 13 of 15 S Print O n Bartleby vs Chegg - Which Is Bex b Search results for 'Martinez Con X https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%25 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Contribution margin per unit Next Help 3 90% Save & Exit Check marrow_forwardtab es lock esc QUESTION 8 Deja Brew Company reported the following for the most recently completed fiscal year: Raw Materials Purchased Direct Labor Work-in-Process Inventory, Beginning Work-in-Process Inventory, Ending Finished Goods Inventory, Beginning Finished Goods Inventory, Ending Calculate cost of goods sold for the year. ! Click Save and Submit to save and submit. Click Save All Answers to save all answers. 1 Q A @ 2 W S # M $63,500 58,200 31,600 31,500 3 E Manufacturing Overhead Cost of Goods Manufactured $ 4 R % 07 dº 5 MacBook Pro D F $109,600 180,800 95,900 391,200 T 6 G 7 Y * 00 O H 8 Uarrow_forwardbMy Questions | bartleb https//camoenccinstructure.com/courses/3788/assignments/35966?module_iten id-88692 o Busimess and inandat The Kirkland Department of Delta Company began the month of December with beginning work in process of 4,000 units that are 100% complete as to materials and 30% complete as to conversion costs. Units transferred out are 10,000 units. Ending work in process contains 8,000 units that are 100 % complete as to materials and 60% complete as to conversion costs. Compute the equivalent units of production for materials and conversion costs for the month of December. Equivalent Units QUANTITIES Physical Units Materials Conversion Costs Units to be accounted for Work in process, December 1 Started into production Total units Units accounted for Transferred out Work in process, December 31 3 Total units eTextbook and Mediaarrow_forward

- to.mheducatic Baker College | Undergraduate, https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducati... A CT Homework Problems i Direct materials Direct labor Variable overhead Fixed overhead Total Silent Sentry manufactures gas leak detectors that are sold to homeowners throughout the United States at $25 apiece. Each detector is equipped with a sensory cell that is guaranteed to last two full years before needing to be replaced. The company currently has 50,000 gas leak detectors in its inventory that contain sensory cells that had been purchased from a discount vendor. Silent Sentry engineers estimate that these sensory cells will last only 18 months before needing to be replaced. The company has incurred the following unit costs related to the 50,000 detectors. $ 10 2 3 1 $ 16 OT L Saved Silent Sentry is currently evaluating three options regarding the 50,000 detectors. Check myarrow_forwardA v2.cengagenow.com A Chapter 23 Pre CengageNOwv2 | Online teaching and learning resource from Cengage Learning h eBook E Print Item Single Plantwide Factory Overhead Rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation $29,957 Indirect labor 74,241 Factory electricity 8,466 Indirect materials 17,584 Selling expenses 41,679 Administrative expenses 23,445 Total costs $195,372 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Tortilla chips 7,200 0.10 Potato chips 7,200 0.15 Pretzels 5,100 0.12 Total 19,500 If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. X per processing hour b. Use the overhead rate in (a)…arrow_forwardng Heading 1 Heading 2 Title Styles Г Comments Editing v Share Find v E rM Replace Dictate Sensitivity Editor Add-ins Read on reMarkable Select Editing Voice Sensitivity Editor Add-ins reMarkable year. Each set requires 2.5 hours to polish the material. If polishing labor costs $15.00 per hour, determine the direct labor cost budget for polishing for 3,000,000 the year. EX.22-08.ALGO Professional Labor Cost Budget for a Service Company Rollins and Cohen, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 2017: Audit Department: Staff Partners Tax Department: m, CPAS Cost Budget Staff Partners Small Business Accounting Department: Staff Billable Hours 44,200 6,600 32,300 4,000 5,700 800 Partners Based on the data provided above and assuming that the average compensation per hour for staff is $50 and for partners is $145,…arrow_forward

- royalty-free image X A Login Homework i X https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducati... A Question 11 - Ch 17-18 Homew X Cost Data: Bonding Department Direct materials costs in beginning inventory, September 1 Conversion costs in beginning inventory, September 1 Direct materials costs incurred in September Conversion costs incurred in September Physical Units: Bonding Department Units in process, September 1 Units transferred out during September Units in process, September 30 Percentages of Completion: Bonding Department Direct materials, September 1 Conversion, September Direct materials, September 30 Conversion, September 30 Cost per equivalent unit Direct Materials Required information [The following information applies to the questions displayed below.] Lavalear Corporation uses a process costing system and traces costs through several processing departments, starting with the Bonding Department.…arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company. Garcon Pepper Company Company Beginning finished goods inventory $ 13,400 $ 19,300 Beginning work in process inventory 17,800 23,700 Beginning raw materials inventory (direct materials) 11,300 10,950 Rental cost on factory equipment Direct labor 32,000 24,100 23,600 37,400 Ending finished goods inventory 20,000 17,000 Ending work in process inventory 25,000 19,000 7,600 9,800 Ending raw materials inventory Factory utilities 13,950 17,500 Factory supplies used (indirect materials) 8,500 5,100 General and administrative expenses 21,500 45,000 Indirect labor 2,000 9,580 7,580 2,200 Repairs-Factory equipment Raw materials purchases Selling expenses 36,000 58,000 58,000 58,900 Sales 223,530 310,010 Cash 25,000 18,700 Factory equipment, net 222,500 121,825 Accounts receivable, net 14,600 21,950 Required: 1. Complete the table to find…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education