FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ng

Heading 1

Heading 2

Title

Styles

Г

Comments

Editing

v

Share

Find

v

E

rM

Replace

Dictate Sensitivity Editor

Add-ins

Read on

reMarkable

Select

Editing

Voice Sensitivity Editor

Add-ins

reMarkable

year. Each set requires 2.5 hours to polish the material.

If polishing labor costs $15.00 per hour, determine the direct labor cost budget for polishing for

3,000,000

the year.

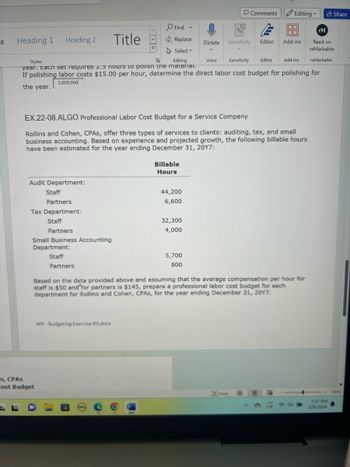

EX.22-08.ALGO Professional Labor Cost Budget for a Service Company

Rollins and Cohen, CPAs, offer three types of services to clients: auditing, tax, and small

business accounting. Based on experience and projected growth, the following billable hours

have been estimated for the year ending December 31, 2017:

Audit Department:

Staff

Partners

Tax Department:

m, CPAS

Cost Budget

Staff

Partners

Small Business Accounting

Department:

Staff

Billable

Hours

44,200

6,600

32,300

4,000

5,700

800

Partners

Based on the data provided above and assuming that the average compensation per hour for

staff is $50 and for partners is $145, prepare a professional labor cost budget for each

department for Rollins and Cohen, CPAs, for the year ending December 31, 2017.

W9-Budgeting Exercise #3.docx

DF

7:37 PM

DOLL с

3/8/2024

100%

Transcribed Image Text:Review

View

Help

Paragraph

2

Normal

No Spacing

Heading 1

Heading 2

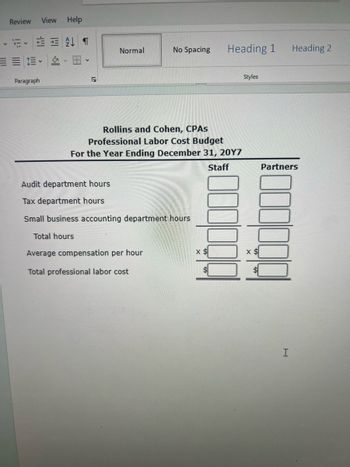

Rollins and Cohen, CPAS

Professional Labor Cost Budget

For the Year Ending December 31, 20Y7

Audit department hours

Tax department hours

Small business accounting department hours

Total hours

Staff

Styles

Average compensation per hour

x $

x $

Total professional labor cost

Partners

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- O MyPath Home Content O Managerial Accounting, Fifteenth x My Questions | bartleby х O File | C:/Users/pse/Documents/managerial-accounting-15th-edition.pdf Managerial Accounting, Fifteenth Edition 204 / 795 Required: 1. Compute the cost per equivalent unit for materials, for labor, and for overhead. 2. Compute the total cost per equivalent whole unit. EXERCISE 4-4 Applying Costs to Units-Weighted-Average Method [LO4–4] Data concerning a recent period's activity in the Prep Department, the first processing department in a company that uses process costing, appear below: Materials Conversion Equivalent units of production in ending work in process Cost per equivalent unit 2,000 $13.86 800 $4.43 A total of 20,100 units were completed and transferred to the next processing department during the period. Required: Compute the cost of the units transferred to the next department during the period and the cost of ending work in process inventory. EXERCISE 4-5 Cost Reconciliation…arrow_forwardY2 Part 1 Clean−It−Up, Inc., is a manufacturer of vacuums and uses standard costing. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of budgeted machine-hours. In 2020, budgeted fixed manufacturing overhead cost was$18,000,000. Budgeted variable manufacturing overhead was $8 per machine-hour. The denominator level was 1,000,000 machine-hours.arrow_forwardNonearrow_forward

- Please help me with correct answer thankuarrow_forwardExercise 4-1B Direct versus indirect costs Tilley Professional Services is composed of two separate divisions: (1) tax services as provided by the tax department and (2) auditing services as provided by the audit department. Each department has numerous clients. Engagement with each individual client is a separate service (i.e., product) and each department has several engagements in each period. Cost items of the firm follow: Salary of the partner in charge of the audit department Salary of the managing partner of the firm Cost of office supplies such as paper, pencils, erasers, etc. Depreciation of computers used in the tax department License fees of the firm Professional labor for a tax engagement Office assistant labor supporting both departments Professional labor for an audit engagement Depreciation of computers used in the audit department Salary of the partner in charge of the tax department Travel expenditures for an audit engagement Page 194 Required a. Identify each cost as…arrow_forward* 00 %24 %24 D. Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple Re Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each. The following data appear in the company records for the current period: Maintenance Personnel Printing Developing Machine-hours 006 3,100 Labor-hours 00E T 006 006 Department direct costs $15,200 009 $ 009'ET$ 009 Required: Use the direct method to allocate these service department costs to the operating departments. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) XAnswer is not complete. Maintenance Personnel Printing Developing 3,600 X $ X 009 13,600 X Service department costs 13,600 Maintenance allocation (3,600) 13,600 X (009) Personnel allocation Total costs allocated $ 17.200 17,200 Mc Graw K…arrow_forward

- Exercise 17-15 (Algo) Computing activity rates, overhead allocation, and cost per unit LO P3 Lucern Company reports the following for its overhead cost for the year. Activity Budgeted Cost Budgeted Activity Usage Engineering support $ 34,300 70 design changes Electricity 35,400 3,540 machine hours Setup 58,800 490 setups 1. Compute the activity rate for each activity using activity-based costing.2. The company’s Pro model used these activities to produce 1,200 units during the year: 2 design changes, 130 machine hours, and 10 setups. Allocate overhead cost to the Pro model and compute its overhead cost per unit using activity-based costing.arrow_forwardi need the answer quicklyarrow_forwardCH 19 Q10 Entry for Factory Labor Costs A summary of the time tickets for the current month follows: Job No. Amount 100 $3,780 101 3,140 104 5,750 108 6,460 Indirect labor 20,150 111 3,940 115 2,580 117 17,510 Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank.arrow_forward

- --/1 Question 22 View Policies Current Attempt in Progress The predetermined overhead rate for Coronado Industries is $5, comprised of a variable overhead rate of $3 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $150000 was divided by normal capacity of 30000 direct labor hours, to arrive at the predetermined overhead rate of $5. Actual overhead for June was $12680 variable and $8040 fixed, and standard hours allowed for the product produced in June was 4000 port hours. The total overhead variance is O $720 F. O $4040 F. O $4040 U. O $720 U. hp ins f12 f11 f10 prt sc f9 144 f8 f7 f6 f5 4+ 8 %3D C 60 To 96arrow_forwardPlease do not give solution in image format thankuarrow_forwardneed answer for all with all work thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education