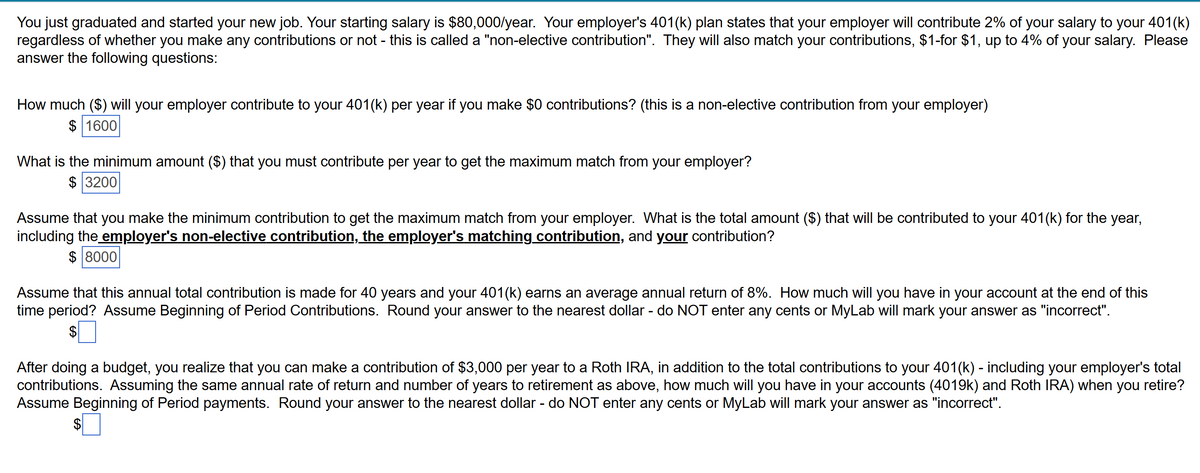

You just graduated and started your new job. Your starting salary is $80,000/year. Your employer's 401(k) plan states that your employer will contribute 2% of your salary to your 401(k) regardless of whether you make any contributions or not - this is called a "non-elective contribution". They will also match your contributions, $1-for $1, up to 4% of your salary. Please answer the following questions: How much ($) will your employer contribute to your 401(k) per year if you make $0 contributions? (this is a non-elective contribution from your employer) $ 1600 What is the minimum amount ($) that you must contribute per year to get the maximum match from your employer? $ 3200 Assume that you make the minimum contribution to get the maximum match from your employer. What is the total amount ($) that will be contributed to your 401(k) for the year, including the employer's non-elective contribution, the employer's matching contribution, and your contribution? $ 8000 Assume that this annual total contribution is made for 40 years and your 401(k) earns an average annual return of 8%. How much will you have in your account at the end of this time period? Assume Beginning of Period Contributions. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect". $ After doing a budget, you realize that you can make a contribution of $3,000 per year to a Roth IRA, in addition to the total contributions to your 401(k) - including your employer's total contributions. Assuming the same annual rate of return and number of years to retirement as above, how much will you have in your accounts (4019k) and Roth IRA) when you retire? Assume Beginning of Period payments. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect". $

You just graduated and started your new job. Your starting salary is $80,000/year. Your employer's 401(k) plan states that your employer will contribute 2% of your salary to your 401(k) regardless of whether you make any contributions or not - this is called a "non-elective contribution". They will also match your contributions, $1-for $1, up to 4% of your salary. Please answer the following questions: How much ($) will your employer contribute to your 401(k) per year if you make $0 contributions? (this is a non-elective contribution from your employer) $ 1600 What is the minimum amount ($) that you must contribute per year to get the maximum match from your employer? $ 3200 Assume that you make the minimum contribution to get the maximum match from your employer. What is the total amount ($) that will be contributed to your 401(k) for the year, including the employer's non-elective contribution, the employer's matching contribution, and your contribution? $ 8000 Assume that this annual total contribution is made for 40 years and your 401(k) earns an average annual return of 8%. How much will you have in your account at the end of this time period? Assume Beginning of Period Contributions. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect". $ After doing a budget, you realize that you can make a contribution of $3,000 per year to a Roth IRA, in addition to the total contributions to your 401(k) - including your employer's total contributions. Assuming the same annual rate of return and number of years to retirement as above, how much will you have in your accounts (4019k) and Roth IRA) when you retire? Assume Beginning of Period payments. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect". $

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:You just graduated and started your new job. Your starting salary is $80,000/year. Your employer's 401(k) plan states that your employer will contribute 2% of your salary to your 401(k)

regardless of whether you make any contributions or not - this is called a "non-elective contribution". They will also match your contributions, $1-for $1, up to 4% of your salary. Please

answer the following questions:

How much ($) will your employer contribute to your 401(k) per year if you make $0 contributions? (this is a non-elective contribution from your employer)

$ 1600

What is the minimum amount ($) that you must contribute per year to get the maximum match from your employer?

$ 3200

Assume that you make the minimum contribution to get the maximum match from your employer. What is the total amount ($) that will be contributed to your 401(k) for the year,

including the employer's non-elective contribution, the employer's matching contribution, and your contribution?

$ 8000

Assume that this annual total contribution is made for 40 years and your 401(k) earns an average annual return of 8%. How much will you have in your account at the end of this

time period? Assume Beginning of Period Contributions. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect".

$

After doing a budget, you realize that you can make a contribution of $3,000 per year to a Roth IRA, in addition to the total contributions to your 401(k) - including your employer's total

contributions. Assuming the same annual rate of return and number of years to retirement as above, how much will you have in your accounts (4019k) and Roth IRA) when you retire?

Assume Beginning of Period payments. Round your answer to the nearest dollar - do NOT enter any cents or MyLab will mark your answer as "incorrect".

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning