FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

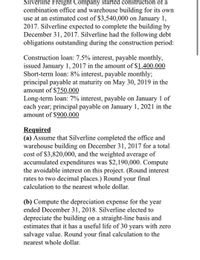

Transcribed Image Text:Silverline Freight Company started construction of a

combination office and warehouse building for its own

use at an estimated cost of $3,540,000 on January 1,

2017. Silverline expected to complete the building by

December 31, 2017. Silverline had the following debt

obligations outstanding during the construction period:

Construction loan: 7.5% interest, payable monthly,

issued January 1, 2017 in the amount of $1,400,000

Short-term loan: 8% interest, payable monthly;

principal payable at maturity on May 30, 2019 in the

amount of $750,000

Long-term loan: 7% interest, payable on January 1 of

each year; principal payable on January 1, 2021 in the

amount of $900,000

Required

(a) Assume that Silverline completed the office and

warehouse building on December 31, 2017 for a total

cost of $3,820,000, and the weighted average of

accumulated expenditures was $2,190,000. Compute

the avoidable interest on this project. (Round interest

rates to two decimal places.) Round your final

calculation to the nearest whole dollar.

(b) Compute the depreciation expense for the year

ended December 31, 2018. Silverline elected to

depreciate the building on a straight-line basis and

estimates that it has a useful life of 30 years with zero

salvage value. Round your final calculation to the

nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Culver Inc. has a fiscal year ending April 30. On May 1, 2023, Culver borrowed $10 million at 11% to finance construction of its own building. Repayments of the loan are to begin the month after the building's completion. During the year ended April 30, 2024, expenditures for the partially completed structure totalled $7 million. These expenditures were incurred evenly throughout the year. Interest that was earned on the part of the loan that was not expended amounted to $482,000 for the year. For situation 3, how much should be shown as capitalized borrowing costs on Culver's financial statements at April 30, 2024? (If an answer is zero, please enter O. Do not leave any fields blank.) Capitalized borrowing $arrow_forwardSMDC Construction is constructing an office building under contract for Onyx Company and uses the percentage-of-completion method. The contract calls for progress billings and payments of P1,550,000 each quarter. The total contract price is P18,600,000 and SMDC Construction estimates total costs of P17,750,000. SMDC Construction estimates that the building will take 3 years to complete, and commences construction on January 2, 2018. SMDC Construction completes the remaining 25% of the building construction on December 31, 2020, as scheduled. At that time the total costs of construction are P18,750,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that SMDC Construction will recognize for the year ended December 31, 2020? Revenue Expenses A. P18,600,000 P18,750,000 B. P4,650,000 P 4,687,500 C. P4,650,000 P 5,250,000 D. P4,687,500 P 4,687,500 Group of answer choices D C B Aarrow_forwardVikramarrow_forward

- IvanhoeFurniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $10,500,000 on January 1, 2020. Ivanhoe expected to complete the building by December 31, 2020. Ivanhoe has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2019 $4,200,000 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2021 3,150,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 2,100,000 Compute the depreciation expense for the year ended December 31, 2021. Ivanhoe elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $630,000. (Round answer to 0 decimal places, e.g. 5,275.) Depreciation Expense $arrow_forwardDuring 2017, Egyptian Mau Company construct building costing P18,500,000. The weighted average accumulated expenditures on the building during 2017 totaled P7,800,000. The entity borrowed P4,000,000 at 7% on January 1, 2017. Funds not needed for construction were temporarily invested in short-term securities, and earned P120,000 interest revenue. In addition to the construction loan, the entity had two other notes outstanding during the year, P3,000,000, 10-year, 10% note payable dated October 1, 2015, and a 5-year P2,000,000, 8% note payable dated November 2, 2015. What amount of interest should be capitalized on December 31, 2017? A. 574,000 B. 620,000 C. 509,600 D. 629,600arrow_forwardIn 2024, KP Building Incorporated began work on a four-year construction project (called Cincy One). The contract price is $460 million. KP recognizes revenue on this contract over time according to percentage of completion. At the end of 2024, the following financial statement information indicates the results to date for Cincy One: INCOME STATEMENT: Gross profit (before-taxes) recognized in 2024 $ 43 million BALANCE SHEET: Accounts receivable from construction billings $ 30 million Construction in progress $ 86 million Less: Billings on construction $ (96 million) Net billings in excess of construction in progress $ 10 million Required: Compute the following, placing your answer in the spaces provided and showing supporting computations below. Note: Round your percentage answer to the nearest whole number. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education