FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

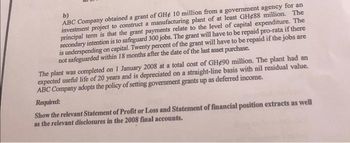

Transcribed Image Text:b)

ABC Company obtained a grant of GHe 10 million from a government agency for an

investment project to construct a manufacturing plant of at least GH488 million. The

principal term is that the grant payments relate to the level of capital expenditure. The

secondary intention is to safeguard 300 jobs. The grant will have to be repaid pro-rata if there

is underspending on capital. Twenty percent of the grant will have to be repaid if the jobs are

not safeguarded within 18 months after the date of the last asset purchase.

The plant was completed on 1 January 2008 at a total cost of GH490 million. The plant had an

expected useful life of 20 years and is depreciated on a straight-line basis with nil residual value.

ABC Company adopts the policy of setting government grants up as deferred income.

Required:

Show the relevant Statement of Profit or Loss and Statement of financial position extracts as well

as the relevant disclosures in the 2008 final accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SAP Inc. received a $1.5 million grant under its Small Business Innovation program. SAP invested the grant money and developed a system to remove metal contaminants from storm water in shipyards. The firm estimates that each shipyard spends $500,000 a year on storm water clean-up efforts. If SAP is able to sign up and retain four shipyards in the first year onwards, what is the present value (PV) of the project (net of investment) if the cost of capital for SAP is 14% per year? Assume a cost of operations and other costs for SAP equal 50% of revenue. $5.64 million $4.80 million $4.51 million $5.93 millionarrow_forwardK88.arrow_forwardThe company DstriBut.inc decides to take a technological shift by replacing its old distribution center with a new one that is more oriented towards technology and less dependent on manpower. The entire installation is estimated at $6,000,000 amortized at the rate of 30% decreasing. An immediate expense of $30,000 (taxable and non-depreciable) is planned to ensure the training of the personnel who will operate on the new installations. This investment creates a working capital requirement of $400,000, fully recoverable. The company estimates to increase its operating cash flow by $1,500,000 before tax. On the other hand, the company must assume an expense for the maintenance and replacement of consumable components of new installations in the amount of $50,000 every 2 years. This investment will have a residual value of $2,500,000 at the end of the investment horizon, which is set at 5 years by senior management. The tax rate is 40% and the rate of return required by senior management…arrow_forward

- A firm is planning to purchase a new machine costing ₱2,600,000 with freight and installation costs amounting to 125,000. The old unit to be traded-in will be given a trade-in allowance of ₱240,000. Other assets that are to be retired as a result of the acquisition of the new machine can be salvaged and sold for ₱52,000. The loss on the retirement of these assets is ₱50,000 will reduce taxes by ₱20,000 which is based on a tax rate of 40%. If the new machine is not purchased, extensive repairs on the old machine will have to be made at an estimated cost of ₱350,000. This cost can be avoided by purchasing the new machine. Additional gross working capital of ₱250,000 will be needed to support operations planned with the new machine. The net cost of investment would be? ₱2,725,000 ₱2,313,000 ₱2,063,000 ₱2,485,000 ₱2,973,000 ₱2,413,000arrow_forwardSaharrow_forwardRaycroft operates a nuclear power station. The power station is due to be decommissioned on 31 December 20X8 but will be fully operational up to that date. It has been estimated that the cost of decommissioning the power station and cleaning up any environmental damage, as required by legislation, will be $60 million. Raycroft recognised a provision for the present value of this expenditure at 31 December 20X0. A suitable discount rate for evaluating costs of this nature is 12%, equivalent to a present value factor after eight years of 0.404. The decommissioning cost will be depreciated over eight years. What is the total charge to profit or loss in respect of this provision for the year ended 31 December 20X1 and 20X2?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education