Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

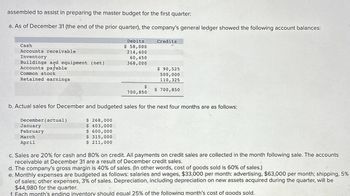

Transcribed Image Text:assembled to assist in preparing the master budget for the first quarter:

a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balances:

Cash

Accounts receivable

Inventory

Buildings and equipment (net)

Accounts payable

Common stock

Retained earnings

Debits.

$ 58,000

Credits

214,400

60,450

368,000

$ 90,525

500,000

110,325

$

700,850

$ 700,850

b. Actual sales for December and budgeted sales for the next four months are as follows:

December (actual)

January

February

March

April

$ 268,000

$ 403,000

$ 600,000

$ 315,000

$ 211,000

c. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts

receivable at December 31 are a result of December credit sales.

d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.)

e. Monthly expenses are budgeted as follows: salaries and wages, $33,000 per month: advertising, $63,000 per month; shipping, 5%

of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be

$44,980 for the quarter.

f. Each month's ending inventory should equal 25% of the following month's cost of goods sold.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Relevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardBudgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 35,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions Prepare a budgeted income statement for 20Y9. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.arrow_forwardBudgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Regina Soap Co.: Factory output and sales for 20Y9 are expected to total 200,000 units of product, which are to be sold at 5.00 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 30,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.15 per share are expected to be declared and paid in March, June, September, and December on 18,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 75,000 cash in May. Instructions Prepare a budgeted income statement for 20Y9. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.arrow_forward

- A company has prepared the operating budget and the cash budget. It is now preparing the budgeted balance sheet. Identify the document that contains each of these balances. A. cash B. accounts receivable C. finished goods inventory D. accounts payable E. equipment purchasesarrow_forwardBudgeted selling and administrative expenses for King Tire Co. In P7-2 for the year ended December 31, 2016, were as follows: Required: 1. Prepare a selling and administrative expense budget, in good form, for the year 2016. 2. Using the information above and the budgets prepared in P7-2, prepare a budgeted income statement for the year 2016, assuming an income tax rate of 40%.arrow_forwardRoman Inc. has the following totals from its operating budgets: Prepare a budgeted income statement for the year ended December 31, 2016, assuming that income from operations is taxed at a rate of 30%.arrow_forward

- Prepare a master budget for the three-month period ending June 30 that includes a budgeted balance sheet as of June 30.arrow_forwardPrepare a master budget for the three-month period ending June 30 that includes a schedule of expected cash collections, by month and in total.arrow_forwardBudgeted Income Statement and Balance SheetAs a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Cash$ 26,000Accounts Receivable23,800Finished Goods16,900Work in Process4,200Materials6,400Prepaid Expenses600Plant and Equipment82,000Accumulated Depreciation—Plant and Equipment$ 32,000Accounts Payable14,800Common Stock, $1.50 par30,000Retained Earnings83,100$159,900$159,900Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at $120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year.Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows:Estimated Costs and ExpensesFixed(Total for…arrow_forward

- Prepare a master budget for the three-month period ending June 30 that includes a cash budget. Show the budget by month and in total. Determine any borrowing that would be needed to maintain the minimum cash balance of $68,000. (Cash deficiency, repayments and interest should be indicated by a minus sign.)arrow_forwardPrepare the cash budget for January and February of Gilmore Company using the following data: February P42,100 January Cash Receipts Cash Disbursements Beginning Cash Balance Ending P46,500 P38,320 P37,220 P5,210 As per computation Required Cash Balance (Minimum) P12,000 P12,000arrow_forwardRequired information [The following information applies to the questions displayed below.] Lamonte Company reports the following budgeted December 31 adjusted trial balance. Debit $ 52,200 122, 200 66, 200 127,200 Cash Accounts receivable Merchandise inventory Equipment Accumulated depreciation-Equipment Accounts payable Loan payable Common stock Retained earnings (beginning year balance) Sales Cost of goods sold Loan interest expense Depreciation expense Salaries expense Totals LAMONTE COMPANY Budgeted Income Statement For Year Ended December 31 Gross profit Selling, general and administrative expenses 362,200 10, 200 12, 200 124, 200 $ 876,600 Prepare the budgeted income statement for the current year ended December 31. Ignore income taxes. $ Credit 0 0 $ 27,200 36,200 24, 200 205,500 61,300 522, 200 $ 876,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning