FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

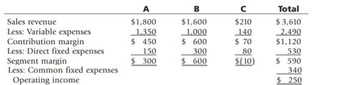

avapei Company produces three products: A, B, and C. A segmented income statement, with amounts given in thousands, follows:

Direct fixed expenses include

Required

- What impact on profit would result from dropping Product C?

- Suppose that 10 percent of the customers for Product B choose to buy from Yavapei because it offers a full range of products, including Product C. If C were no longer available from Yavapei, these customers would go elsewhere to purchase B. Now what is the impact on profit if Product C is dropped?

Transcribed Image Text:Sales revenue

Less: Variable expenses

Contribution margin

Less: Direct fixed expenses

Segment margin

Less: Common fixed expenses

Operating income

A

$1,800

1,350

$ 450

150

$300

B

$1,600

1,000

$ 600

300

$ 600

с

$210

140

$ 70

80

$(10)

Total

$3,610

2,490

$1,120

530

$ 590

340

$ 250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Alligator segment of Wildhorse Specialty Meats is operating at a loss and has the following data: Sales Variable expenses Fixed expenses $7320007 512400 366000 If the Alligator segment is eliminated, what will be the effect on the remaining company? Assume that 50% of the fixed expenses will be eliminated and the rest will be allocated to the segments of the remaining company. O $439200 increase. O $36600 decrease. O $36600 increase. O $183000 increase.arrow_forwardManor Company plans to discontinue a department that has a contribution margin of$24,000and 548,000 in foed costs. of the fixed costs,$21,000cannot be avoided. The effect of this discontinuance on Manor's overall net operating income would be an: a increase of$24,000 b increase of$3,000 c. decrease of$3,000 d. decrease of$24,000arrow_forwardABC Corporation manufactures a product that gives rise to a by-product called Z. The only costs associated with Z are selling costs of P1 for each unit sold. ABC accounts for Z sales first b deducting its separable costs from such sales and then by deducting this net amount from cost of sales of the major product. This year, 1,000 units of Z were sold at P4 each. If ABC changes its method of accounting for Z sales by showing the net amount as additional sales revenue, ABC's gross margin would*a. decrease by P3,000b. increase by P4,000c. increase by P3,000d. be unaffectedarrow_forward

- Choose the product that will have the largest loss if sales greatly decrease. Letter Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Sales and costs for each product follow.arrow_forwardProduct B has revenue of $39,500, variable cost of goods sold of $25,500, variableselling expenses of $16,500, and fixed costs of $15,000, creating a loss from operationsof $17,500. Prepare and show in solution a differential analysis as of May 9 todetermine if Product B should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision.arrow_forwardNeed helparrow_forward

- Please answer in text form , without image)arrow_forwardRowan coffee co. Incurs a loss from operations for the standard coffee line. Sales revenue for the line total $72,000 while incurring variable cost of goods sold of $19,500, variable selling expenses of 17,400 and a fixed cost of $ 49,000. How do I determine if the standard coffee line should be continued or discontinued??arrow_forwardAnswer the following questions using the information below: Company A sells a single product. 1,500 units were sold resulting in $30,000 of sales revenue; $21,000 of variable costs, and $2,400 of fixed costs. If sales increase by $20,000, operating Income will increase BY: ⒸA$11,400 OB. None of them OC. $6,000 OD. $12,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education