FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

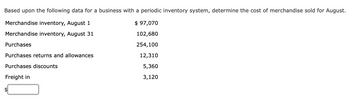

Transcribed Image Text:**Determine the Cost of Merchandise Sold for August Using a Periodic Inventory System**

Given the following data:

- **Merchandise inventory, August 1**: $97,070

- **Merchandise inventory, August 31**: $102,680

- **Purchases**: $254,100

- **Purchases returns and allowances**: $12,310

- **Purchases discounts**: $5,360

- **Freight in**: $3,120

**Task**: Calculate the cost of merchandise sold for August.

Start by computing the net purchases, add the freight in, and apply the periodic inventory method to find the cost of goods sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fast pls solve this question correctly in 5 min pls I will give u like for surearrow_forwardPlease answerarrow_forwardLO 2 Exercise 10-5A Journal entries for a line of credit Dawkins Company has a line of credit with Federal Bank. Dawkins can borrow up to $500,000 at any time over the course of the 2011 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of 2011. Dawkins agreed to pay interest at an annual rate equal to 2 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Dawkins pays 5 percent (3 percent + 2 percent) annual interest on $80,000 for the month of January. Month January February March April Amount Borrowed or (Repaid) $80,000 60,000 (20,000) 30,000 Prime Rate for the Month,% 3.0 3.5 4.0 4.5 Required Provide all journal entries pertaining to Dawkins's line of credit for the first four months of 2011.arrow_forward

- Sh12 Please help me Solution Thankyouarrow_forwardFace value (principal) $ TABLE 7-1 50,400 Day of month 1 2 3 4 Rate of interest 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 31 Jan. 9% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Exact days-in-a-year calendar (excluding leap year)" Length of note 90 days 28 Feb. 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 31 Mar. 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 30 Apr. Maturity value 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 31 May 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 30 31 31 30 June July Aug. Sept. 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 Date of note January 12 189 190 191…arrow_forward3-16A • LO 5 See Example 3-6 on page 3-20, Example 3-8 on page 3-32, Example 3-9 on page 3-32 Vulcan Company is a monthly depositor whose tax liability for March 20-- is $2,505. 1. What is the due date for the deposit of these taxes? 2. Assume that no deposit was made until April 29 (14 days late). Compute the following penalties: a. Penalty for failure to make timely deposit. b. Penalty for failure to fully pay tax. c. Interest on taxes due and unpaid (assume a 6% interest rate). d. Total penalty imposed. $ $ 2$arrow_forward

- CH9 HW 5 points 2 On January 1 of this year, Skamania Company completed the following transactions (assume a 9% annual interest rate): (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use the appropriate factor(s) from the tables provided. Skipped eBook Print References a. Bought a delivery truck and agreed to pay $60,100 at the end of three years. b. Rented an office building and was given the option of paying $10,100 at the end of each of the next three years or paying $28,100 immediately. c. Established a savings account by depositing a single amount that will increase to $90,200 at the end of seven years. d. Decided to deposit a single sum in the bank that will provide 9 equal annual year-end payments of $40,100 to a retired employee (payments starting December 31 of this year). Required: a. What is the cost of the truck that should be recorded at the time of purchase? b. Which option for the office building results in the lowest present value? c. What single amount must be…arrow_forwardDate July 1 July 6 July 11 July 14 July 21 July 27 Units 7 3 4 Unit Cost $70 $75 $80 Sales Units 5 3arrow_forwardQuestion 29arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education