FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

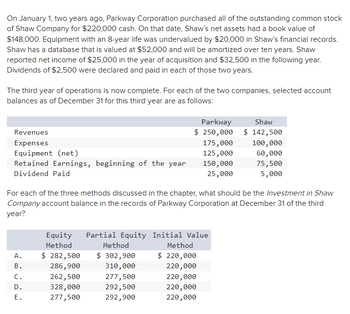

Transcribed Image Text:On January 1, two years ago, Parkway Corporation purchased all of the outstanding common stock

of Shaw Company for $220,000 cash. On that date, Shaw's net assets had a book value of

$148,000. Equipment with an 8-year life was undervalued by $20,000 in Shaw's financial records.

Shaw has a database that is valued at $52,000 and will be amortized over ten years. Shaw

reported net income of $25,000 in the year of acquisition and $32,500 in the following year.

Dividends of $2,500 were declared and paid in each of those two years.

The third year of operations is now complete. For each of the two companies, selected account

balances as of December 31 for this third year are as follows:

Revenues

Expenses

Equipment (net)

Retained Earnings, beginning of the year

Dividend Paid

A.

B.

C.

D.

E.

Parkway

Shaw

$ 250,000 $ 142,500

For each of the three methods discussed in the chapter, what should be the Investment in Shaw

Company account balance in the records of Parkway Corporation at December 31 of the third

year?

$ 282,500

286,900

262,500

328,000

277,500

Equity Partial Equity Initial Value

Method

Method

$ 302,900

310,000

277,500

292,500

292,900

175,000

125,000

150,000

25,000

Method

$ 220,000

220,000

220,000

220,000

220,000

100,000

60,000

75,500

5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Klingon Widgets, Incorporated, purchased new cloaking machinery three years ago for $12 million. The machinery can be sold to the Romulans today for $11 million. Klingon's current balance sheet shows net fixed assets of $9 million, current liabilities of $800,000, and net working capital of $221,000. If the current assets and current liabilities were liquidated today, the company would receive a total of $1.03 million cash. a. What is the book value of Klingon's total assets today? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) b. What is the sum of the market value of NWC and the market value of fixed assets? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) a. Book value of total assets b. Sum of the market value of NWC and market value of fixed assetsarrow_forwardSeveral years ago Walker Security purchased for $120,000 a well-known trademark for padlocks and other secu-rity products. After using the trademark for three years, Walker Security discontinued it altogether when the com-pany withdrew from the lock business and concentrated on the manufacture of aircraft parts. Amortization of the trademark at the rate of $3,000 a year is being contin-ued on the basis of a 20-year life, which the owner says is consistent with accounting standards. Do you agree?Explain.arrow_forwardThis year, Sigma Inc. generated $636,000 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Initial Basis Acc. Depr.* Sale Price Marketable securities $ 157,600 $0 $ 74,000 Production equipment 115,600 92,480 36,000 Business realty: Land 235,500 0 241,750 Building 263,000 78,900 218,000 *Through date of sale. Required: Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. Recompute taxable income assuming that Sigma sold the securities for $174,000 rather than $74,000. Note: I have part B correct with $705,430. It's part A I am having trouble witharrow_forward

- Moshup Ltd sold a building for $145 million. The building cost $205 million several years ago and at the time of sale it had a carrying amount of $128 million. Calculate, to the nearest million dollars, the gain or loss on the sale of the building. Designate any loss calculated by preceding your figure with a negative sign.arrow_forwardMcCloud Drug Company owns a patent that it purchases three years ago for $2 million. The controller recently revalued the patent to its approximate market value of $ 8 million. Identify the accounting concept that was violatedarrow_forwardFranklin Manufacturing Company was started on January 1, year 1, when it acquired $81,000 cash by issuing common stock. Franklin immediately purchased office furniture and manufacturing equipment costing $7,700 and $24,900, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $3,600 salvage value and an expected useful life of three years. The company paid $11,200 for salaries of administrative personnel and $15,500 for wages to production personnel. Finally, the company paid $16,110 for raw materials that were used to make inventory. All inventory was started and completed during the year. Franklin completed production on 4,900 units of product and sold 3,970 units at a price of $15 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in…arrow_forward

- Klingon Widgets, Incorporated, purchased new cloaking machinery three years ago for $5.2 million. The machinery can be sold to the Romulans today for $7.4 million. Klingon's current balance sheet shows net fixed assets of $4 million, current liabilities of $830,000, and net working capital of $142,000. If all the current accounts were liquidated today, the company would receive $945,000 cash. a. What is the book value of Klingon's total assets today? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. b. What is the sum of the market value of NWC and the market value of fixed assets? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. a. Book value of total assets b. Sum of market value of NWC and fixed assetsarrow_forwardOn January 1, 20x2, Gold Company purchased a computer with an expected economic life of five years. On January 1, 20x4, Gold sold the computer to TLK Corporation and recorded the following entry: Cash 39,000 Accumulated Depreciation 16,000 Computer Equipment 40,000 Gain on sale of equipment 15,000 TLK Corporation holds 60 percent of Gold’s voting shares. Gold reported net income of P45,000, and TLK reported income from its own operations of P85,000 for 20x4. There is no change in the estimated life of the equipment as a result of the inter-corporate transfer. In the preparation of the 20x4 consolidated balance sheet, the computer equipment will be: A. Debited for 1,000 C. Credited for 24,000B. Debited for 15,000 D. Debited for 40,000arrow_forwardWillamston Widgets has one fixed asset, which it purchased 5 years ago for $5,000,000. It has taken a total of $2,000,000 in Depreciation charges on that asset, and the company has determined that it could be sold today for $2.500,000. The company's balance sheet shows a total of $2,000,000 in Current Liabilities, and the company has $500,000 in Net Working Capital. If all of the company's Current Assets were liquidated today, the company would receive $1,000,000. What is the Book Value of the company's Total Assets? Multiple Choice O $7,500,000 $5,500,000 $4,000,000 $1,500,000 $4.500.000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education