Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

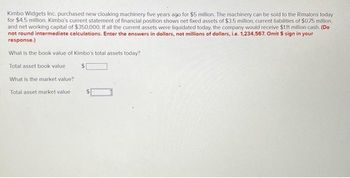

Transcribed Image Text:Kimbo Widgets Inc. purchased new cloaking machinery five years ago for $5 million. The machinery can be sold to the Rimalons today

for $4.5 million. Kimbo's current statement of financial position shows net fixed assets of $3.5 million, current liabilities of $0.75 million,

and networking capital of $350,000. If all the current assets were liquidated today, the company would receive $1.11 million cash. (Do

not round intermediate calculations. Enter the answers in dollars, not millions of dollars, i.e. 1,234,567. Omit $ sign in your

response.)

What is the book value of Kimbo's total assets today?

Total asset book value

$

What is the market value?

Total asset market value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Moshup Ltd sold a building for $145 million. The building cost $205 million several years ago and at the time of sale it had a carrying amount of $128 million. Calculate, to the nearest million dollars, the gain or loss on the sale of the building. Designate any loss calculated by preceding your figure with a negative sign.arrow_forwardKADS, Inc. has spent $400,000 on research to develop a new computer game. The firm is planning to spend $200,000 on a machine to produce the new game. Shipping and installation costs of the machine will be capitalized and depreciated; they total $50,000. The machine has an expected life of three years, a $75,000 estimated resale value, and falls under the MACRS seven-year class life. Revenue from the new game is expected to be $600,000 per year, with costs of $250,000 per year. The firm has a tax rate of 21 percent, an opportunity cost of capital of 15 percent, and it expects net working capital to increase by $100,000 at the beginning of the project. What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Need Cash Flows for 3 yearsarrow_forwardHaystack company purchased a machine on January 1, 2015 for $48,000. The company estimates that the machine will have a $4,000 salvage value at the end of its 10 year useful life. On September 30, 2019 the machine was sold for a gain of $3,500. What must have been the selling price of the machine?arrow_forward

- Ralph’s Bow Works (RBW) is planning to add a new line of bow ties that will require the acquisition of a new knitting and tying machine. The machine will cost $1.3 million. It is classified as a 7-year MACRS asset and will be depreciated as such. Interest costs associated with financing the equipment purchase are estimated to be $50,000 per year. The expected salvage value of the machine at the end of 10 years is $80,000. The decision to add the new line of bow ties will require additional net working capital of $55,000 immediately, $30,000 at the end of year 1, and $10,000 at the end of year 2. RBW expects to sell $370,000 worth of the bow ties during each of the 10 years of product life. RBW expects the sales of its other ties to decline by $23,000 (in year 1) as a result of adding this new line of ties. The lost sales level will remain constant at $23,000 over the 10-year life of the proposed project. The cost of producing and selling the ties is estimated to be $70,000 per year.…arrow_forwardThe Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $80,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $8,000 per year. If the machine is not replaced, it can be sold for $5,000 at the end of its useful life. A new machine can be purchased for $160,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $40,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to the…arrow_forwardOn January 1, 2021, Gringo Company had capitalized cost of P5,000,000 for a new computer software product with an economic life of 5 years. Sales for 2021 amounted to P3,000,000. The total sales of software over its economic life are expected to be P10,000,000. The pattern of future sales cannot be measured reliably. On December 31, 2021, the software had a net realizable value of P4,500,000. What is the carrying amount of the computer software on December 31, 2021?arrow_forward

- Dorothy & George Company is planning to acquire a new machine at a total cost of $37,500. The machine's estimated life is 6 years and its estimated salvage value is $600. The company estimates that annual cash savings from using this machine will be $8,200. The company's after-tax cost of capital is 7% and its income tax rate is 40%. The company uses straight-line depreciation. (Use Appendix C, Table 1 and Appendix C, Table 2.) (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Round answers to the nearest dollar amount.) Required: 1. What is this investment's net after-tax annual cash inflow? 2. Assume that the net after-tax annual cash inflow of this investment is $6,000; what is the net present value (NPV) of this investment? 3. What are the minimum net after-tax annual cost savings that make the proposed investment acceptable (i.e., the dollar cost savings that would yield an NPV of $0)? Hint: Redo the NPV analysis by setting the NPV…arrow_forwardHayden Company is considering the acquisition of a machine that costs $459,000. The machine is expected to have a useful life of 6 years, a negligible residual value, an annual net cash inflow of $83,000, and annual operating income of $70,550. The estimated cash payback period for the machine is (round to one decimal place)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education