ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

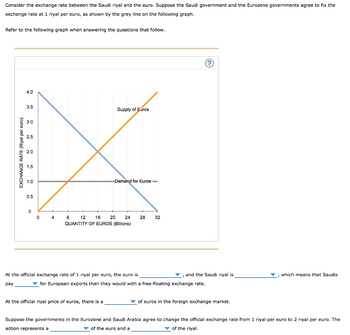

Transcribed Image Text:Consider the exchange rate between the Saudi riyal and the euro. Suppose the Saudi government and the Eurozone governments agree to fix the

exchange rate at 1 riyal per euro, as shown by the grey line on the following graph.

Refer to the following graph when answering the questions that follow.

EXCHANGE RATE (Riyal per euro)

4.0

3.5

3.0

1.5

1.0

0.5

0

0

4

Supply of Euros

Demand for Euros

8

12 16 20

QUANTITY OF EUROS (Billions)

24 28 32

At the official riyal price of euros, there is a

At the official exchange rate of 1 riyal per euro, the euro is

pay

and the Saudi riyal is

▼ for European exports than they would with a free-floating exchange rate.

of euros in the foreign exchange market.

, which means that Saudis

Suppose the governments in the Eurozone and Saudi Arabia agree to change the official exchange rate from 1 riyal per euro to 2 riyal per euro. The

action represents a

of the euro and a

of the riyal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the exchange rate is such that $1 equals 5 euros, then the price of a euro is Answer 1. $5 2. $1 3. $0.40 4. $0.20 5nnintsarrow_forwardThe spot dollar-euro rate is $1.20/€1 and the forward rate is $1.15/€1. You expect the spot dollar- euro rate to be $1.05/€1 in one year's time. You have €1 million to speculate with using the forward exchange market. (i) EE (iv) Is the euro interest rate higher or lower than the dollar? Explain your reasoning. Do you buy or sell €1 million in the forward market? What is your profit in both euros and dollars if you are correct and the spot dollar- euro rate is $1.05/€1 in one year's time? What is your loss in both euros and dollars if you are wrong and the spot dollar-euro rate is $1.40/€1 in one year's time? Text Predictions: On Accessibility: Good to go Focusarrow_forwardSuppose reserve a hotel room in Madrid for $300 per night when you check out, you have charged only $270 per night Assuming that the price of the room in euros had not changed and that the nominal exchange rate had been 0.8 euros/$ when the reservation was made What is the new nominal exchange rate in euros/$? Calculate your answer to 2 decimal placesarrow_forward

- Assume the Bobo (the currency in Boblandia) is the domestic currency. The exchange rate between the Bobo and the Wakandan dollar is currently 2.17. The current price of a Big Mac in Boblandia is 106 Bobos. The current price of a Big Mac in Wakanda is W$217. What is the exchange rate predicted by the theory of Purchasing Power Parity? Round to two decimal places, and do not enter the currency symbols.arrow_forwardSuppose the three-month interest rate in Europe is 2 percent, but the three-month interest rate in the United States is 3 percent. The spot rate of dollar is 0.70 euro = $1, but three-month forward rate is 1 euro= $1.50. Based on this information what can you predict about the foreign exchange market? A. Spot price of dollar may appreciate. B. Spot price of euro may fall. C. European interest rates will certainly fall. D. Forward price of dollar may risearrow_forwardIf a French car costs 10,000 euros, a similar American car costs 15000 dollars, and a euro can buy 1.2 dollars. what is real exchange rates ( you may assume any currency as the “domestic currency”) If a French car costs 10,000 euros, a similar American car costs 15000 dollars, and a euro can buy 1.2 dollars. what is real exchange rates ( you may assume any currency as the “domestic currency”) ???arrow_forward

- Country Z exports $5 million of goods and services and imports $5 million of goods and services. It also has $10 million of foreign currency denominated foreign assets and $5 million of local currency denominated foreign liabilities both of which earn a fixed 5% return in their respective currencies.If the price elasticity of exports is 0.5 and the elasticity of imports is (-)0.4 what will happen to the current account if the exchange rate depreciates by 1%? Question 1Select one: a. it is unchanged b. improves by $0.005 million c. improves by $0.045 million d. improves by $0.055 million e. worsens by $0.005 millionarrow_forwardA box of chocolate candy costs 28.80 Swiss francs in Switzerland and $20 in the United States. Assuming that purchasing power parity (PPP) holds, what is the current exchange rate? Ⓒa 1 U.S. dollar equals 1.44 Swiss francs Ob. 1 U.S. dollar equals 1.21 Swiss francs Oc1 US dollar equals 1.29 Swiss francs d. 1 U.S. dollar equals 0.69 Swiss francs e. 1 U.S. dollar equals 0.85 Swiss francsarrow_forwardData from The Economist BigMac index from January 2021 shows that the localprice of a Big Mac in Denmark is 30 Danish kroner (DKK) and the price of aBig Mac in Costa Rica is 2350 Costa Rican colón (CRC). The exchange rateXCRC/DKK = 100.279. Assume there is no bid-ask spread. Calculate the Purchasing Power Parity Rate PPPRCRC/DKK. What does this ratemeasure?arrow_forward

- Given the interest parity condition, the demand for domestic bonds would decrease if domestic interest rates decreased. In a market where the domestic interest rate is 3.1%, the foreign interest rate is 1.1% and the current exchange rate is 95.00, the future expected exchange rate must be decimal places.) for the interest parity condition to hold. (Round your response to twoarrow_forwardSuppose you & classmates are marketing team assembled by your Brazil based firm To estimate demand in the U.S. market for its newly developed product. The market Research firm you hired requires $150,000 to perform a thorough study. But your Group is informed that total research budget for the year is 3 million Brazilian real & That no more than 20% of the budget can be spent on any one project. 16 points a. If the current exchange rate is 5 real/$, will you have the market study Conducted? Why or why not? (show your calculations) b. If the current exchange rate is 3 real/$, will you have the market study Conducted? Why or why not? (show your calculations) c. At what exchange rate your decision from rejecting the proposed research project to accept the Project?arrow_forwardIn the international market for lumber, suppose Canadian lumber sells for $100 per tonne while Chinese lumber sells for 500 Chinese yuan per tonne. a) What is Purchasing Power Parity? If the current exchange rate is 4 yuan per Canadian dollar, does Purchasing Power Parity hold? b) If the current exchange rate is 4 yuan per dollar, what is the value of the real exchange rate between Canada and China? To earn a profit by exploiting the arbitrage opportunity, in which country should you buy lumber and in which country should you sell it? c) Suppose that money-supply growth is higher in China than it is in Canada. What does purchasing-power parity imply will happen to the real and to the nominal exchange rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education