Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct answer

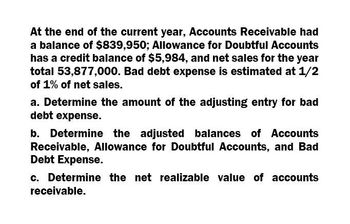

Transcribed Image Text:At the end of the current year, Accounts Receivable had

a balance of $839,950; Allowance for Doubtful Accounts

has a credit balance of $5,984, and net sales for the year

total 53,877,000. Bad debt expense is estimated at 1/2

of 1% of net sales.

a. Determine the amount of the adjusting entry for bad

debt expense.

b. Determine the adjusted balances of Accounts

Receivable, Allowance for Doubtful Accounts, and Bad

Debt Expense.

c. Determine the net realizable value of accounts

receivable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardJars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardInk Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Funnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardThe following accounts receivable information pertains to Marshall Inc. Determine the estimated uncollectible bad debt from Marshall Inc. using the balance sheet aging of receivables method, and record the year-end adjusting journal entry for bad debt.arrow_forwardTines Commerce computes bad debt based on the allowance method. They determine their current years balance estimation to be a credit of $45,000. The previous period had a credit balance in Allowance for Doubtful Accounts of $12,000. What should be the reported figure in the adjusting entry for the current period? A. $12,000 B. $45,000 C. $33,000 D. $57,000arrow_forward

- Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of 4,350 and 9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of 1,530,000, collected receivables in the amount of 1,445,700, and recorded bad debt expense of 83, 750. Required: Next Level Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forwardDetermining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forward

- UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Glenns Nursery Supplies has a debit balance of 390,000. Credit sales are 2,800,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,760. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,330 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 29,890 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Parkers Nursery Supplies has a debit balance of 350,000. Credit sales are 2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,920. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 24,560 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,280. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 22,440 in uncollectible accounts.arrow_forwardUsing data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage