FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

At the beginning of his current tax year, David invests $12,840 in original issue U.S. Treasury bonds with a $10,000 face value that mature in exactly 20 years. David receives $580 in interest ($290 every six months) from the Treasury bonds during the current year, and the yield to maturity on the bonds is 3.8 percent.

Note: Round your intermediate calculations to the nearest whole dollar amount.

a. How much interest income will he report this year if he elects to amortize the bond premium?

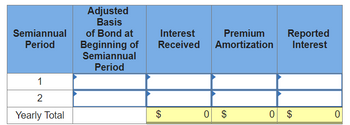

Transcribed Image Text:### Bond Amortization Schedule

This table represents a bond amortization schedule over the course of two semiannual periods.

#### Table Columns:

1. **Semiannual Period**: This column identifies each semiannual period. There are two periods listed:

- Period 1

- Period 2

2. **Adjusted Basis of Bond at Beginning of Semiannual Period**: This column is intended to show the adjusted basis of the bond at the start of each semiannual period. Currently, it is empty, indicating no data has been entered for either period.

3. **Interest Received**: This column is for tracking the interest received during each semiannual period. The cells for both periods are empty, with a total of $0 indicating no interest has been recorded.

4. **Premium Amortization**: This column accounts for any amortization of the bond premium over each period. The cells are empty, with a total of $0 for both periods, showing no premium amortization has been noted.

5. **Reported Interest**: This final column is for the reported interest. Again, both cells are empty, and the total amount is $0, suggesting no reported interest for the year.

#### Yearly Total:

At the bottom of the table is a "Yearly Total" row. It shows the cumulative totals for "Interest Received," "Premium Amortization," and "Reported Interest," all of which are currently $0.

This table is often used in financial education to illustrate how bond amortization schedules are laid out and calculated, though actual values need to be filled in for meaningful analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On January 1, 2021, Norwood borrows $470,000 cash from a bank by signing a five-year installment note bearing 6% interest. The note requires equal payments of $111,575 each year on December 31. Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Norwood borrows $470,000 cash by signing a five-year, 6% installment note. (b) Record the first installment payment on December 31, 2021. (c) Record the second installment payment on December 31, 2022. Complete this question by entering your answers in the tabs below. Req 1 Complete an amortization table for this installment note. Note: Round your intermediate calculations to the nearest dollar amount. Period Ending Date Req 2 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 Total Beginning Balance Debit Interest Expense + Debit Notes Payable 6 of 6 Ending Balance Next > mntarrow_forwardOn January 1, Year 1, Philip Holding invests $40,000 in an annuity to provide 8 equal semi-annual payments. Interest is 10%, compounded semiannually. Compute the equal semiannual amounts that Philip will receive assuming that the first withdrawal is to be received on:July 1, Year 4arrow_forwardMonica invests $1600 into an account the beginning of each quarter for 9 years, starting from today. Interest is to be paid at an interest rate of 1.4% per month, compounded quarterly. Peter, would like to invest two lump sums at the beginning of the 2nd year and 4th year, with the lump sum payment 2 times greater at the 4th year than the 2nd year. Peter's account receives the same interest rate as Monica. Determine the effective interest rate per quarter under this investment. Round your answer to the nearest 0.01% Determine the future value of Monica's investment at the end of the 9 years. Round your answer to the nearest $100 Determine what lump sum Peter must invest at the beginning of the 2nd year that would yield the same yield value as Monica by the end of the 7 years. Round your answer to the nearest $100.arrow_forward

- Let's assume you borrowed $2000 from Wells Fargo Bank on July 1. The annual Percentage Rate is 5%. The term is 2 years. After you paid the first month's payment (i.e., August 1), you received the tax return of $300 from the IRS on the same day. You used the tax return for the loan payment on the same day. The outstanding balance after the 13th, 14th, and 15th term payments is presented in the table below. What would be the outstanding balance after the 16th term payment? 13th 625.50 14th 540.36 15th 454.87 Group of answer choices 369.03 324.54 389.05 295.63arrow_forwardMunabhaiarrow_forwardKavish loans $15,000 to his business partner on June 1st, 2020. The terms of the loan state that interest of 5% compounded annually will be paid when the loan matures on May 31st, 2022. What is the amount of interest income that Kavish must report in each year from 2020 2022? Show your calculations.arrow_forward

- At the beginning of his current tax year, David invests $12,400 in original issue U.S. Treasury bonds with a $10,000 face value that mature in exactly 15 years. David receives $520 in interest ($260 every six months) from the Treasury bonds during the current year, and the yield to maturity on the bonds is 3.2 percent. Note: Round your intermediate calculations to the nearest whole dollar amount. Problem 7-35 Part-a (Algo) a. How much interest income will he report this year if he elects to amortize the bond premium? Semiannual Period 1 2 Yearly Total Adjusted Basis of Bond at Interest Premium Beginning of Received Amortization Semiannual Period Reported Interest b. How much interest will he report this year if he does not elect to amortize the bond premium? Interest Reportedarrow_forward1 ) Suppose that Smith is currently age 16. Smith’s parents pay $25,000 for the right to provide Smith with payments of $K every two months, beginning two months after his 18th birthday and continuing indefinitely. Assume that the nominal annual interest rate is i (6) = 9% until Smith turns age 21, at which point the rate changes to i (6) = 24% thereafter. Find $K.arrow_forwardGreg owes two debt payments – a payment of $5763 that was due in 10 months ago and a payment of $1916 due in 7 months. If Greg makes a payment now, what would this payment be if money is worth 7.12% compounded semi-annually? Assume a focal date of today.arrow_forward

- Darnell receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rate of 4% per year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate. The government taxes nominal interest income at a rate of 20%. The following table shows two scenarios: a low-inflation scenario and a high-inflation scenario. Given the real interest rate of 4% per year, find the nominal interest rate on Darnell's bonds, the after-tax nominal interest rate, and the after-tax real interest rate under each inflation scenario. Inflation Rate Real Interest Rate Nominal Interest Rate After-Tax Nominal Interest Rate After-Tax Real Interest Rate (Percent) (Percent) (Percent) (Percent) (Percent) 2.5 4.0 8.5 4.0 Compared with higher inflation rates, a lower inflation rate will the after-tax real interest rate when the government taxes…arrow_forwardJames has a mortgage of $96,500 at 4% for 15 years. The property taxes are $3,900 per year, and the hazard insurance premium is $764.50 per year. Find the monthly PITI payment (in $). (Round your answer to the nearest cent. Use this table as needed.)arrow_forwardElizabeth makes the following interest-free loans during the year. Assume that tax avoidance is not a principal purpose of any of the loans. The relevant Federal rate is 5% and that the loans were outstanding for the last six months of the year. Borrower's Net Borrower Amount Investment Income Purpose of Loan Richard $5,000 $800 Gift Woody $8,000 $600 Stock purchase Irene $105,000 $0 Purchase principal residence By how much do each of these loans increase Elizabeth's gross income? If an amount is zero, enter "0". a. Richard is not subject to the imputed interest rules because the $10,000 gift loan exception does apply. Elizabeth's gross income from the loan is $ 0 b. The $10,000 exception does not income producing apply to the loan to Woody because the proceeds were used to purchase assets. Although the $100,000 exception applies to this loan, the amount of imputed interest is 1,000 X.Incorrect is $ 0 ✓. c. None of the exceptions apply gross income from the loan is $ to the loan to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education