Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

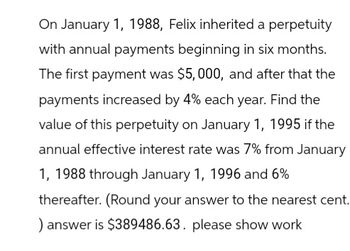

Transcribed Image Text:On January 1, 1988, Felix inherited a perpetuity

with annual payments beginning in six months.

The first payment was $5,000, and after that the

payments increased by 4% each year. Find the

value of this perpetuity on January 1, 1995 if the

annual effective interest rate was 7% from January

1, 1988 through January 1, 1996 and 6%

thereafter. (Round your answer to the nearest cent.

) answer is $389486.63. please show work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Derek deposited $700 at the end of every month into an RRSP for 7 years. The interest rate earned was 3.75% compounded semi-annually for the first 5 years and changed to 4.00% compounded monthly for the next 2 years. What was the accumulated value of the RRSP at the end of 7 years? Round to the nearest centarrow_forwardJim Wright invested $7500 twice a year in an annuity due at Pacific Securities Company for a period of 8 years at an interest rate of 4% compounded semiannually. Using the ordinary annuity table, calculate the total value of the annuity due at the end of the 8-year period.arrow_forwardGreg owes two debt payments – a payment of $5763 that was due in 10 months ago and a payment of $1916 due in 7 months. If Greg makes a payment now, what would this payment be if money is worth 7.12% compounded semi-annually? Assume a focal date of today.arrow_forward

- Franklin owes the following amounts to the same person: $16,000 due today, $11,500 due in 1¼ years, $17,000 due in 2¾ years, and $15,000 due in 4¼ years. He wants to make a single payment of $56,500 instead. Using an interest rate of 8% compounded quarterly, when should this payment be made?arrow_forwardHarleen has deposited $125 at the end of each month for 13 years at 4.68% compounded monthly. After her last deposit she converted the balance into an ordinary annuity paying $890 every three months for nine years. What is the nominal annual rate of interest, compounded quarterly, paid by the annuity?arrow_forwardJulia deposited $900 at the end of every month into an RRSP for 7 years. The interest rate earned was 4.50% compounded semi-annually for the first 3 years and changed to 4.75% compounded monthly for the next 4 years. What was the accumulated value of the RRSP at the end of 7 years? (Round to the nearest cent).arrow_forward

- Bill makes deposits of 2,700 at the end of each year for n years into a fund. At time n, he uses the accumulated value of the fund to purchase an annuity immediate that makes payments of 197,909.20 at the end of each year for 5 years. The annual effective interest rate is 15%. Calculate n. O a. 26 O b. 29 O c. 28 O d. 24 O e. 22arrow_forwardMr. Glen Secundo won a lottery paying P1,400,000 at the beginning of each year for 15 years. Find the amount must set aside today to satisfy this annuity at 13% compounded annually.arrow_forwardJuanita paid a life insurer $60,100 in exchange for an immediate life annuity. Juanita will receive $600 per month from the insurer, and her life expectancy is 14 years. Assume that Juanita receives 12 monthly payments in the first year. How much taxable income must she report? (Round your answer to 2 decimal places)arrow_forward

- James plans to receive a monthly annuity of $779 for the next 25 years as part of his inheritance. The interest rate is 10.78 per annum compounded monthly Calculate the present value (PV) of this annuity. $72.26 O$779.00 $867.16 $289.05 O $1.11arrow_forwardBrodie receives $500 every 12 months forever, starting 20 months from today. If his stated annual interest rate is 14% compounded monthly, what is the present value of this perpetuity? a. $3,600 b. $3,000 c. $3,250 d. $3,350 e. $3,050arrow_forwardAt the beginning of each year, Jerome invests $1,400 semiannually at 8% for nine years. Using the tables found in the textbook, determine the cash value of the annuity due at the end of the ninth year. A. $37,939.86 B. $37,339.68 C. $37,399.68 D. $38,739.68arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education