Century 21 Accounting General Journal

11th Edition

ISBN: 9781337680059

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

At the beginning of April, Haron Kadir launched a custom computer solutions company called Softworks. The company had the following transactions during April.

April

- Haron Kadir invested $65,000 cash, office equipment with a value of $5,750, and $30,000 of computer equipment in the company.

- The company purchased land worth $22,000 for an office by paying $5,000 cash and signing a long-term note payable for $17,000.

- The company purchased a portable building with $34,500 cash and moved it onto the land acquired on date 2nd.

- The company paid $5,000 cash for the premium on a two-year insurance policy.

- The company provided services to a client and immediately collected $4,600 cash.

- The company purchased $4,500 of additional computer equipment by paying $800 cash and signing a long-term note payable for $3,700.

- The company completed $4,250 of services for a client. This amount is to be received within 30 days.

- The company purchased $950 of additional office equipment on credit.

- The company completed client services for $10,200 on credit.

- The company received a bill for rent of a computer testing device that was used on a recently completed job. The $320 rent cost must be paid within 30 days.

- The company collected $5,100 cash in partial payment from the client described in transaction dated 9th.

- The company paid $1,800 cash for wages to an assistant.

- The company paid $950 cash to settle the payable created in transaction dated 8th.

- The company paid $608 cash for minor maintenance of the company’s computer equipment.

- Haroon Kadir withdrew $6,230 cash from the company for personal use.

- The company paid $1,800 cash for wages to an assistant.

- The company paid $750 cash for advertisements on the web during April.

Required

- Open the following ledger accounts—their account numbers are in parentheses (use the balance column format): Cash (101);

Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Computer Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); H. Kadir Capital (301); H. Kadir Withdrawals (302); Fees Earned (402); Wages Expense (601); Computer Rental Expense (602); Advertising Expense (603); and Repairs Expense (604).Post the journal entries from part 1 to the accounts and enter the balance after each posting.

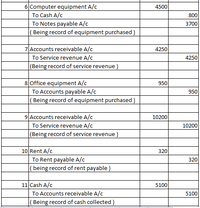

Transcribed Image Text:6 Computer equipment A/c

To Cash A/c

To Notes payable A/c

( Being record of equipment purchased)

4500

800

3700

7 Accounts receivable A/c

To Service revenue A/c

(Being record of service revenue )

4250

4250

8 Office equipment A/c

To Accounts payable A/c

|( Being record of equipment purchased)

950

950

9 Accounts receivable A/c

To Service revenue A/c

10200

10200

(Being record of service revenue )

10 Rent A/c

To Rent payable A/c

|(being record of rent payable )

320

320

11 Cash A/c

To Accounts receivable A/c

5100

5100

( Being record of cash collected )

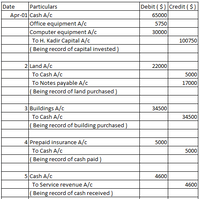

Transcribed Image Text:Date

Particulars

Debit ( $) Credit ($)

Apr-01 Cash A/c

Office equipment A/c

Computer equipment A/c

To H. Kadir Capital A/c

(Being record of capital invested)

65000

5750

30000

100750

2 Land A/c

22000

To Cash A/c

5000

To Notes payable A/c

( Being record of land purchased )

17000

3 Buildings A/c

To Cash A/c

34500

34500

|( Being record of building purchased )

4 Prepaid insurance A/c

5000

To Cash A/c

5000

( Being record of cash paid )

5 Cash A/c

To Service revenue A/c

(Being record of cash received )

4600

4600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: Date Item Debit Credit BalanceDebit BalanceCredit January 1 Balance 319,900 February 10 Purchased for cash 499,000 818,900 November 20 Purchased with long-term mortgage note 663,300 1,482,200 Item Section of Statement of Cash Flows Added or Deducted Amount Purchase of land for cash $fill in the blank 3 Purchase of land by issuinglong-term mortgage note $fill in the blank 6arrow_forwardReporting Land Acquisition for Cash and Mortgage Note on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 272,900 Feb. I 10 Purchased for cash 393,000 665,900 Nov. 20 Purchased with long-term mortgage note 539,400 1,205,300 Item Section of Statement of Cash Flows Added or Deducted Amount Purchase of land for cash Investing activities section Deducted Purchase of land by issuing long-term mortgage note Financing activities section Investing activities section Operating activities section Separate schedulearrow_forwardReporting Land Acquisition for Cash and Mortgage Note on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 256,200 Feb. 10 Purchased for cash 389,400 645,600 Nov. 20 Purchased with long-term mortgage note 522,900 1,168,500 Item Section of Statement of Cash Flows Added or Deducted Amount Purchase of land for cash Purchase of land by issuing long-term mortgage notearrow_forward

- On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: Please see the attachment for details:arrow_forwardOn the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows:arrow_forwardRequired information [The following information applies to the questions displayed below.] Cash Accounts receivable Equipment, net Land Total assets Cash Accounts receivable Equipment, net Current Year Prior Year $ 10,400 60,500 57,000 98,000 $ 225,900 Express the items in common-size percents. (Round your percentage answers to one decimal place.) Land Total assets Current Year % % % $ 13,400 25,800 50,400 72,500 $ 162,100 % Prior Year % % % %arrow_forward

- Requlred Informatlon RivMera Townshlp reported the following data for Its governmental activitles for the year ended June 30, 20X9: 2 of 3 Item Amount Cash and cash equivalents $1,000,000 300,000 8,500,000 1,200,000 400,000 4,800,000 Receivables Capital assets Accumulated depreciation Accounts payable 01:56:09 Long-term liabilities Additlonal Information avalable is as follows: All of the long-term debt was used to acquire capital assets. Cash of $475,000 Is restricted for debt service. Based on the preceding Informatlon, on the statement of net assets prepared at June 30, 20X9, what amount should be reported for net assets Invested In capital assets, net of related debt? Multiple Cholce $3.300,000 $2.900,000 $2,825,000 $4.200,000arrow_forwardCommon-size Balance Sheet. Explain what it is and why it is used inbusiness. Prepare common-size balance sheet for Target with the infoprovided below. Assets CashAccounts receivableInventoryOther current assetsTotal current assetsGross plant and equipmentAccumulated depreciationNet plant and equipmentLong-term investmentsGoodwill, trademarks, andother intangible assetsTotal assets $ Dec 31, 2022$20,2684,8733.2772,886$31,304$25,032-10,065$14,96711,512 32,272 $90,055arrow_forwardageNOWv2/Online teach x CengageNOWv2| Online teachin x M (no subject) - morganmcgrew4@ x keAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator3D&inprogress%3Dfalse eBook Reporting Land Transactions on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1. Balance 1,013,000 Purchased for cash 304,000 1,317,000 Mar. 12 Oct. Sold for $167,000 143,000 1,174,000 4 Section of Statement of Amount Cash Flows Added or Deducted Item Mar. 12: Purchase of fixed asset Oct. 4: Sale of fixed asset Gain on sale of fixed asset (assume the indirect method) %24 %24arrow_forward

- I need help solving this questionarrow_forwardQuestion 7.17 please explained in detail.arrow_forwardReporting Land Transactions on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 868,000 Mar. 12 Purchased for cash 104,300 972,300 Oct. 4 Sold for $95,550 63,840 908,460arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning