FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Can someone please help me check my work on this?

Aracel Engineering completed the following transactions in the month of June.

- J. Aracel, the owner, invested $240,000 cash, office equipment with a value of $10,000, and $77,000 of drafting equipment to launch the company.

- The company purchased land worth $53,000 for an office by paying $7,400 cash and signing a note payable for $45,600.

- The company purchased a portable building with $56,000 cash and moved it onto the land acquired in b.

- The company paid $2,900 cash for the premium on an 18-month insurance policy.

- The company provided services to a client and collected $8,700 cash.

- The company purchased $26,000 of additional drafting equipment by paying $10,500 cash and signing a note payable for $15,500.

- The company completed $17,500 of services for a client. This amount is to be received in 30 days.

- The company purchased $1,600 of additional office equipment on credit.

- The company completed $25,000 of services for a customer on credit.

- The company purchased $1,338 of TV advertising on credit.

- The company collected $6,000 cash in partial payment from the client described in transaction g.

- The company paid $1,500 cash for employee wages.

- The company paid $1,600 cash to settle the account payable created in transaction h.

- The company paid $1,040 cash for repairs.

- J. Aracel withdrew $10,990 cash from the company for personal use.

- The company paid $1,500 cash for employee wages.

- The company paid $4,100 cash for advertisements on the Web during June.

Required:

- Prepare general

journal entries to record these transactions using the following titles: Cash (101);Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); J. Aracel, Capital (301); J. Aracel, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). Post the journal entries from part 1 to the ledger accounts.- Prepare a

trial balance as of the end of June.

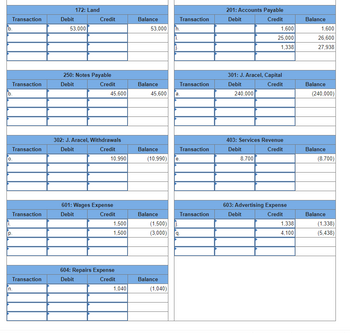

Transcribed Image Text:Transaction

[b.

0.

Transaction

b.

Transaction

Transaction

Transaction

n.

Debit

172: Land

53,000

Credit

250: Notes Payable

Debit

Credit

45,600

302: J. Aracel, Withdrawals

Debit

Credit

10,990

601: Wages Expense

Debit

Credit

1,500

1,500

604: Repairs Expense

Debit

Credit

1,040

Balance

53,000

Balance

45,600

Balance

(10,990)

Balance

Balance

(1,040)

Transaction

h.

(1,500) j

(3,000)

Transaction

a.

Transaction

e.

Transaction

201: Accounts Payable

Debit

Credit

301: J. Aracel, Capital

Debit

Credit

240,000

1,600

25,000

1,338

403: Services Revenue

Debit

Credit

8,700

603: Advertising Expense

Debit

Credit

1,338

4,100

Balance

1,600

26,600

27,938

Balance

(240,000)

Balance

(8,700)

Balance

(1,338)

(5,438)

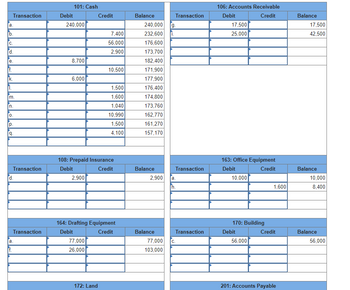

Transcribed Image Text:a.

b.

C.

d.

Transaction

e.

f.

m.

n.

0.

P.

9.

Transaction

d.

f.

Transaction

a.

Debit

101: Cash

240,000

8,700

6,000

2,900

Credit

77,000

26,000

7,400

56,000

2,900

108: Prepaid Insurance

Debit

Credit

172: Land

10,500

1,500

1,600

1,040

10,990

1,500

4,100

164: Drafting Equipment

Debit

Credit

Balance

240,000 9.

232,600 i.

176,600

173,700

182,400

171,900

177,900

176,400

174,800

173,760

162,770

161,270

157,170

Balance

2,900

Balance

Transaction

77,000

103,000

Transaction

a.

Th.

Transaction

C.

106: Accounts Receivable

Debit

Credit

17,500

25,000

163: Office Equipment

Debit

Credit

10,000

170: Building

Debit

56,000

1,600

Credit

201: Accounts Payable

Balance

17,500

42,500

Balance

10,000

8,400

Balance

56,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nash Co, recently installed some new computer equipment. To prepare for the installation, Nash had some electrical work done in what was to become the server room, costing $20,600. The invoice price of the server equipment was $200,000. Three printers were also purchased at a cost of $1,900 each. The software for the system was an additional $46,200. The server equipment was believed to have a useful life of eight years, but due to the heavy anticipated usage, the printers were expected to have only a four-year useful life. The software to run the system was estimated to require a complete upgrade in five years to avoid obsolescence. Additionally, it cost $12.600 for delivery. All of the above costs were subject to a 6% non-refundable provincial sales tax. During the installation, a training course was conducted for the staff that would be using the new equipment, at a cost of $9,550. Assume that Nash follows IFRS, and that any allocation of common costs is done to the nearest 1%…arrow_forwardW bought a new printing machine. The cost of the machine was $80,000. The installation costs were$5,000 and the employees received training on how to use the machine, at a cost of $2,000. Beforeusing the machine to print customers' orders, a test was undertaken and the paper and ink cost $1,000. What should be the cost of the machine in the company's statement of financial position?$85.000$80, 00088, 000$86.000arrow_forwardAt the end of Year 1, how much is the balance of the assets account Production-in-Progress if WW Guy uses the percentage of completion method? see the options in attached screenshot.arrow_forward

- A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000; June 30, $490,000; October 30, $870,000. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 12% and 7%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). Date January 1 Expenditure Weight Average $ 590,000 x 12/12 = $ 590,000 March 31 690,000 x 9/12 = 517,500 June 30 490,000 x 6/12 = 245,000…arrow_forwardIn June, Blackfly Ltd. received a $6,000 cash payment for work performed & billed the previous month. The company replanted a clear-cut area of northern Alberta for which it sent out an invoice for $20,000. At the beginning of the month the company had $1,000 of trees for planting. During the month the company purchased $2,000 more, and at the end of the month it was left with trees that had cost $1,000. The company's expenses were $1,000 in rent for its office and $3,000 in other expenses. Amortization on the truck and office equipment was calculated to be $1,500. The income tax rate is 10%. Net income for June was O$11,250 none of the listed answers are correct $15,500 $9,900 $10,800arrow_forwardDominion construction is awarded a contract to build a commercial building. The contract price is $1,500,000 and during the first month of the job, the following transactions occurred: Cash expenditures to date $300,000 Total expenditures to date $350,000 Estimated expenditure to complete $1,100,000 Total estimated expenditures $1,450,000 Billing to date $280,000 Cash collected to date $250,000 What is "Revenue to Date" in Cash Method? 350000 280000 250000 300000arrow_forward

- A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000, June 30, $490,000; October 30, $870,000. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 12% and 7%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. A company constructs a building for its own use. Construction began on January 1 and ended on December The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000; June 30, $490,000; October 30, $870,0 00. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not…arrow_forwardJayarrow_forwardHP Company purchased equipment on January 1 at a list price of $127,000, with credit terms 2/10, n/30. Payment was made within the discount period and Yocum was given a $21,400 cash discount. Yocum paid $6,000 sales tax on the equipment, and paid installation charges of $11,760. Prior to installation, Yocum paid $4,000 to pour a concrete slab on which to place the equipment. What is the total cost of the new equipment? Select one: a. $123,600 b. $125,360 C. $131,760 d. $129,36 e. The answer does not exist Previous page Next pagearrow_forward

- Franklin Manufacturing Company was started on January 1, year 1, when it acquired $81,000 cash by issuing common stock. Franklin immediately purchased office furniture and manufacturing equipment costing $7,700 and $24,900, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $3,600 salvage value and an expected useful life of three years. The company paid $11,200 for salaries of administrative personnel and $15,500 for wages to production personnel. Finally, the company paid $16,110 for raw materials that were used to make inventory. All inventory was started and completed during the year. Franklin completed production on 4,900 units of product and sold 3,970 units at a price of $15 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in…arrow_forwardO'Connor Company ordered a machine on January 1 at a purchase price of $100,000. On the date of delivery, January 2, the company paid $25,000 on the machine and signed a long-term note payable for the balance. On January 3, it paid $1,000 for freight on the machine. On January 5, O'Connor paid cash for installation costs relating to the machine amounting to $6,000. On December 31 (the end of the accounting period), O'Connor recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $10,700. Required: 1. Indicate the effects (accounts, amounts, and + for increase, - for decrease) of each transaction (on January 1, 2, 3, and 5) on the accounting equation. 2. Compute the acquisition cost of the machine. 3. Compute the depreciation expense to be reported for the first year. 4. What should be the book value of the machine at the end of the second year? Complete this question by entering your answers in the…arrow_forwardThomas Ramsey is the owner of Atlas Magazine. On January 1, Atlas Magazine purchased printing equipment for printing $89,000. The equipment is estimated to have a useful life of 4 years and a salvage value of $17,000. Thomas estimates the equipment will produce 500,000 magazines during its useful life. It produces the following units: 125,000 in year 1, 150,000, in year 2, 75,000 in year 3, and 100,000 in year 4. Required: Record your answers below, use the following page to show your work 1. Calculate depreciation expense and the book value at the end of the third year using the straight-line depreciation method. Depreciation expense: Book Value: 2. Calculate depreciation expense and the book value at the end of the second year usin the double declining balance depreciation method. Depreciation expense:_ X x Book Value: 49,000 × 44, 500 = 39605 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education