FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

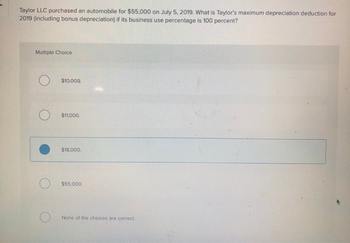

Transcribed Image Text:Taylor LLC purchased an automobile for $55,000 on July 5, 2019. What is Taylor's maximum depreciation deduction for

2019 (including bonus depreciation) if its business use percentage is 100 percent?

Multiple Choice

O

$10,000.

$11,000.

$18,000.

$55,000.

None of the choices are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Magnus Corporation purchased $90,000 of five-year equipment on March 10, 2019 and elected to expense $20,000 of the cost under Section 179. Compact sells the equipment on July 30, 2021, for $95,000. Compact deducted $25,200 under MACRS depreciation. What is the proper classification of the gain? Group of answer choices Section 1245 ordinary income is $50,200; Section 1231 gain is $0 Section 1245 ordinary income is $0; Section 1231 gain is $50,200 Section 1245 ordinary income is $5,000; Section 1231 gain is $45,200 Section 1245 ordinary income is $45,200; Section 1231 gain is $5,000arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardA taxpayer places a $1,050,000 5-year recovery period asset in service in 2020. This is the only asset placed in service in 2020. Assuming half-year convention, an election to expense under Section 179, and no income limitation, what is the amount of total cost recovery deduction (no bonus depreciation)? a.$210,000 b.$1,040,000 c.$1,026,000 d.$1,050,000 e.$1,042,000arrow_forward

- Clay LLC placed in service machinery and equipment (seven-year property) with a basis of $3,480,000 on June 6, 2023. Assume that Clay has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (ignoring any possible bonus depreciation). (Use MACRS Table 1.) Note: Round final answer to the nearest whole number. Multiple Choice O $1,160,000 $497,292 $924,375 $985,839 None of the choices are correct.arrow_forwardIn 2021, Peter Quill had a 5 179 deduction carryover of $40,000. In 2022, Peter elected 5 179 for an asset acquired at a cost of $120,000. Peter's $ 179 business income imitation for 2022 is $130.000. Determine Peter's § 179 deduction for 2022 O a $25,000 Ob $115,000 Oc$130,000 Od $140,000arrow_forwardTax Drill - Section 179 For his business, McKenzie purchased qualifying equipment that cost $212,000 in 2022. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. If an amount is zero, enter "0". a. McKenzie's § 179 expense deduction is $ for 2022. His § 179 carryover to 2023 is $ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment? McKenzie's § 179 expense deduction is $ for 2022. His § 179 carryover to 2023 is $arrow_forward

- On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million. Calculate Christy's cost recovery deductions for 2021 and for 2024.arrow_forwardRequired Information [The following information applies to the questions displayed below.] Stark company has the following adjusted accounts and normal balances at Its December 31 year-end. Notes payable Prepaid insurance Interest expense Accounts payable Wages payable Cash Wages expense Insurance expense Stark, Capital Services revenue $ 12,000 Accumulated depreciation-Buildings 2,600 Accounts receivable 520 Utilities expense 2,000 Interest payable 500 Unearned revenue 12,000 Supplies expense 7,600 Buildings 1,900 Stark, Withdrawals Expenses 30,800 Depreciation expense-Buildings 25,000 Supplies Complete this question by entering your answers in the tabs below. Total expenses Use the adjusted accounts for Stark Company to prepare the (1) Income statement and (2) statement of owner's equity for the year ended December 31 and (3) balance sheet at December 31. The Stark, Capital account balance was $30,800 on December 31 of the prior year, and there were no owner Investments in the…arrow_forwardPlease calculate the rental income for tax purposes. In July 2022, an individual acquires a rental property for $20,000. $110,000 is allocated to the land and $160,000 is allocated to the building. The property is rented for $1,800 per month. Condo fees are $50 per month, property taxes are $1,000 per year and interest expense for 2022 is $6,100. Note: the building was acquired after 1987 for residential use; therefore, a class 1 asset (CCA rate = 4%)arrow_forward

- Celine Dion Corporation purchases a patent from Salmon Company on January 1, 2019, for $55,000. The patent has a remaining legal life of 16 years. Celine Dion feels the patent will be useful for 11 years. Prepare Celine Dion’s journal entries to record the purchase of the patent and 2019 amortization.arrow_forwardOn July 10, 2023, Ariff places in service a new SUV that cost $70,000 and weighed 6,300 pounds. The SUV is used 100% for business. Determine Ariff's maximum deduction for 2023, assuming Ariff's § 179 business income is $110,000. Ariff does not take additional first-year depreciation. A. $14,000 B. $ 28,900 C. $37, 120 D. $70,000 It says that the answer is C but why is that? Please be detailedarrow_forwardOn January 1, 2019, MLW Company purchased a copyright for $1,000,000, having an estimated useful life of 16 years. In January 2023, MLW paid $150,000 for legal fees in a successful defense of the copyright. What should be the amount of copyright amortization expense for the year ended December 31, 2023?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education