Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

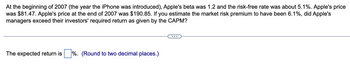

Transcribed Image Text:At the beginning of 2007 (the year the iPhone was introduced), Apple's beta was 1.2 and the risk-free rate was about 5.1%. Apple's price

was $81.47. Apple's price at the end of 2007 was $190.85. If you estimate the market risk premium to have been 6.1%, did Apple's

managers exceed their investors' required return as given by the CAPM?

The expected return is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe following spreadsheet contains monthly returns for Cola Co. and Gas Co. for 2013. Using these data, estimate the average monthly return and the volatility for each stock. (Click on the following icon in order to copy its contents into a spreadsheet.) Month January February March April May June July August September October November The average monthly return for Cola Co. is%. (Round to two decimal places.) Cola Co. -7.10% -2.10% -3.80% -4.10% 1.50% 1.20% -21.10% - 14.50% - 28.80% 22.90% -13.40% Gas Co. -8.10% -2.00% -2.60% -5.00% -4.70% -3.20% 6.70% -8.50% - 12.60% 16.50% -6.10%arrow_forwardThe table below shows the closing monthly stock prices for IBM and Amazon. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. (Do not round intermediate calculations. Round your answers to 2 decimal places.) January February Marchi April May June July August September October November December IBM $172.04 174.89 185.17 201.13 194.77 206.33 227.84 210.31 AMZN $606.16 617.72 581.12 545.70 520.70 501.58 604.89 539.16 514.00 596.68 194.09 595.91 174.22 650.30 218.15 213.99arrow_forward

- On March 9, 2009, the Dow Jones Industrial Average reached a new low. The index closed at 6,547.05, which was down 79.89 that day. What was the return (in percent) of the stock market that day? (Negative answer should be indicated by a minus sign. Round your answer to 2 decimal places.) Return of stock market %arrow_forwardToday, Apple paid a $1.50 dividend (it pays dividends semi- annually). Future dividends are expected to grow at the constant rate of 2% per semi- annual period. If the effective semi-annual rate is 6% what is the current stock price of apple? Please show formulas and procedure used. Thanks!arrow_forwardYou inverted $10,000 in a large U.S. stocks at the beginning of 2016 and earned 6% in 2016, 2.0% in 2017, 4.5% in 2018, and 1.6% in 2019. What average return did you earn during the 2016-2019 period?arrow_forward

- 27) You are pleased to see that you have been given a 4.48% raise this year. However, you read on the Wall Street Journal Web site that inflation over the past year has been 2.38%. How much better off are you in terms of real purchasing power? (Note: Be careful not to round any intermediate steps less than six decimal places.) Your real purchasing power is ____% (Round to two decimal places.)arrow_forwardIn October 2017 a pound of apples cost $1.61, while oranges cost $1.25. Two years earlier the price of apples was only $1.40 a pound and that of oranges was $1.11 a pound. a. What was the annual compound rate of growth in the price of apples? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What was the annual compound rate of growth in the price of oranges? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. If the same rates of growth persist in the future, what will be the price of apples in 2030? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. If the same rates of growth persist in the future, what will be the price of oranges in 2030? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardDigital Technology wishes to determine its coefficient of variation as a company over time. The firm projects the following data (in millions of dollars): Year 1 3 6 9 Profits: Expected Value $ 97 135 243 277 Year 1 3 6 a. Compute the coefficient of variation (V) for each time period. Note: Round your answers to 3 decimal places. 9 Standard Deviation $34 55 Yes 128 176 No b. Does the risk (V) appear to be increasing over a period of time? Coefficient of Variationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education