FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

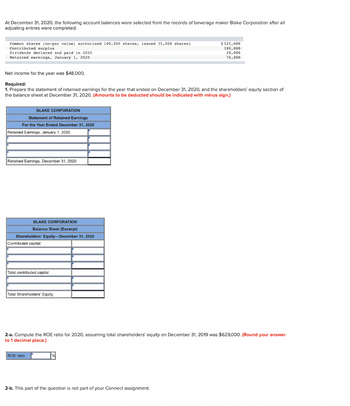

Transcribed Image Text:At December 31, 2020, the following account balances were selected from the records of beverage maker Blake Corporation after all

adjusting entries were completed:

Common shares (no-par value; authorized 100,000 shares; issued 35,000 shares)

Contributed surplus

Dividends declared and paid in 2020

Retained earnings, January 1, 2020

Net income for the year was $48,000.

Required:

1. Prepare the statement of retained earnings for the year that ended on December 31, 2020, and the shareholders' equity section of

the balance sheet at December 31, 2020. (Amounts to be deducted should be indicated with minus sign.)

BLAKE CORPORATION

Statement of Retained Earnings

For the Year Ended December 31, 2020

Retained Earnings, January 1, 2020

Retained Earnings, December 31, 2020

BLAKE CORPORATION

Balance Sheet (Excerpt)

Shareholders' Equity-December 31, 2020

Contributed capital:

Total contributed capital

Total Shareholders' Equity

$525,000

180,000

28,000

76,000

2-a. Compute the ROE ratio for 2020, assuming total shareholders' equity on December 31, 2019 was $629,000. (Round your answer

to 1 decimal place.)

ROE ratio

2-b. This part of the question is not part of your Connect assignment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tamarisk Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $126,000, Common Stock $765,600, Bonds Payable $109,700, Paid-in Capital in Excess of Par-Common Stock $208,700, Goodwill $59,300, Accumulated Other Comprehensive Loss $154,700, and Noncontrolling Interest $34,200. Prepare the stockholders' equity section of the balance sheet.arrow_forwardplease answer without image (Answer in text form)arrow_forwardThe following data were taken from the balance sheet accounts of Monty Corporation on December 31, 2019. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings (a) $515,000 (b) (c) 640,000 475,000 145,000 Prepare the required journal entries for the following unrelated items. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 796,000 A 4% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $41. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2020, and paid January 25, 2020, in bonds held as an investment. The bonds have a book value of $92,000 and a fair value of $131,000.arrow_forward

- Assume that Lululemon Athletica Inc. reported the following summarized data at December 31, 2020. Accounts appear in no particular order. Revenues: $275, Other Liabilities: $38, Other assets: $101, Cash and other Current assets: 53, Accounts Payable: $5, Expenses: $244, Shareholder's equity: $80. Prepare the Trail Balance of Lululemon at December 31,2020. List the accounts in proper order, as shown on "in class" practice. How much was Lululemon's net income or net loss?arrow_forwardThe following accounts appeared on the trail balance of Oriole Company at December 31, 2020. Notes Payable (short-term) $185,000 Accounts Receivable $560,000 Accumulated Depreciation - Bldg. 740,000 Prepaid Insurance 60,000 Supplies 35,000 Common Stock 1,025,000 Salaries and Wages Payable 29,000 Unappropriated Retained Earnings 310,000 Debt Investments (long-term) 280,000 Inventory 1,480,250 Cash 130,000 Land 410,000 Bonds Payable Due 1/1/2028 1,100,000 Trading Securities 79,000 Allowance for Doubtful Accts. 7,700 Interest Payable 5,500 Copyrights 185,000 Buildings 1,200,000 Notes Receivable (due in 6 months) 140,000 Accounts Payable 450,000 Income Taxes Payable 155,000 Additional Paid-in Capital 170,000 Preferred Stock 750,000 Appropriated Retained Earnings 290,000 Compute each of the following: 1. Total current assets $ 2. Total property, plant, and…arrow_forwardSpicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023. Assume that the preferred shares are non-cumulative. Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation, Warehouse Cash Cash Dividends Common Shares Equipment Income Tax Expense Land Notes Payable, due in 2026 Operating Expenses Preferred Shares Retained Earnings Revenue Warehouse Current assets $ 26,760 40,200 11,140 22,280 9,400 20,600 Required: Prepare a classified balance sheet at December 31, 2023. (Enter all amounts as positive values.) Assets 122,000 79,400 41,600 127,600 34,600 110,200 40,200 28,720 282,100 138,800 SPICER INC. Balance Sheet December 31, 2023 Karrow_forward

- The following data were taken from the balance sheet accounts of Sage Corporation on December 31, 2019. Current assets Debt investments (trading) Common stock (par value $10) Paid in capital in excess of par Retained earnings (a) (b) Prepare the required journal entries for the following unrelated items. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) (c) $550.000 685,000 503,000 145,000 861,000 A5% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $35. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. Date A dividend is declared January 5, 2020, and paid January 25, 2020, in bonds held as an investment. The bonds have a book value of $93,000 and a fair value of $139,000. Account Titles and Explanation Debit Creditarrow_forwarda) Prepare all the journal entries for the stated transactions b) Assume that the income for the year is $13,500,000. Prepare a statement of changes in shareholders' equity c) Prepare the shareholders' equity section of the balance sheet at the end of the yeararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education