Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

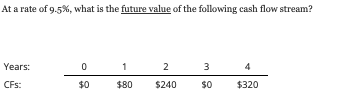

Transcribed Image Text:At a rate of 9.5%, what is the future value of the following cash flow stream?

Years:

CFS:

0

$0

1

$80

2

$240

3

$0

4

$320

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- For the following cash flow series, which of the statements is true? Year Future Value 0 $200.00 1 $200.00 2 $200.00 a) The NPV is $561.60 at a discount rate of 6%. b) The NPV is $556.65 at a discount rate of 8%. c) The IRR is 9.81%. d) The payback is 2 years. e) None of the above.arrow_forwardWhat is the present worth (P) of all the cash flows if F=16000, n=6 years, and i= 8% per year? Select one: O a. $16,480.00 b. $103,824.00 O c. $10,082.71 O d. $34,608.00arrow_forwardConsider the following cash flow diagram. What value of C makes the inflow series equivalent to the outflow series at an interest rate of 10% compounded annually?arrow_forward

- In a geometric sequence of annual cash flows starting at the EOY zero, the value of A0 is $1,304.35 (which is a cash flow). The value of the last term in the series, A10, is $5,276.82. What is the equivalent value of A for years 1 through 10? Let i = 20% per yeararrow_forwardCash Flow Series B Cash Flow Series C -$2,330 $2,870 $2,470 $2,070 $1,670 $1,270 Y Y Y - 2Y 2Y 2Yarrow_forwardGiven the cash flow diagram, what is the uniform annual equivalent value at the end of each year for six years? a.) P214.14 b.) P239.37 c.) P227.88 d.) P301.87arrow_forward

- Draw the cashflow diagram and solve using the formulaarrow_forwardUsing an external rate of 12%, find the internal rate of return (IRR) for the following cash flow. Year 0 1 3 4 Cash Flow $25,000 $20,000 -$20,000 $11,000 $13,000 "Iarrow_forwardIf you invest $8,800, what is your rate of return if you will receive the following cash flows at the end of these years: Yr. 1 $2,000; Yr. 2 $2,100; Yr. 3 $2,200; Yr. 4 $2,300; Yr. 5 $3,700?arrow_forward

- Given the cash flow diagram, what is the uniform annual equivalent value at the end of each year for six years?arrow_forwardWhat is the present value of the following cash flow stream at a rate of 6.25%? $411.57 $433.23 $456.03 $480.03 $505.30arrow_forwardConsider another set of net cash flows: Year Cash flow 0 1,000 1 1,000 2 0 3 1,500 4 2,000 5 3,500 What is the net present value of the stream if the opportunity cost of capital is 10 percent? a. What is the value of the stream at the end of year 5 if the cash flows are invested in an account that pays 10 percent annually? 2. What cash flows today (time 0), in lieu of the 1,000 cash flow, would be needed to accumulate $10,000 at the end of year 5? (Assume that the cash flows for years 1 through 5 remain the same.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education