Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:✓

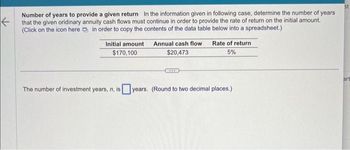

Number of years to provide a given return In the information given in following case, determine the number of years

that the given oridinary annuity cash flows must continue in order to provide the rate of return on the initial amount.

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Initial amount

$170,100

Annual cash flow

$20,473

GCXX

Rate of return

5%

The number of investment years, n, isyears. (Round to two decimal places.)

st

art

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $30,000 in a fund paying 5% per year, with monthly payments for 5 years, if the fund contains $10,000 at the start PMT = $ please round it to the nearest centarrow_forwardFind the periodic payments PMT necessary to accomulate the given account in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $20,000 in a fund paying 2% per year, with quarterly payments for 20 years. PMT = $arrow_forward• model investment and annuity problems;• solve exercises applying concepts of the sum of sets of terms of a sequence, and• solve problems related to annuities using sequences or series. An annuity pays $15,000 per year. Due to inflation, each year a dollar is worth what $0.970 was worth the year before. Payment is made at the beginning of each year. What is the present value of the annuity if it is paid over three years (starting immediately)?arrow_forward

- Find the amount of a perodic payment necessary fur the deposit of a sinking fund. Amount needed a = 60000 Frequency n = semi-annual Rate r = 2% Time t = 10 yearsarrow_forwardGiven the following information, calculate the rate of return. price = $501.88time to maturity = 10 yearsannual payment = $100type = ordinary annuityarrow_forwardAverage Rate of Return, Cash Payback Period, Net Present Value Method for a Service Company Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $288,000. The equipment has an estimated life of 10 years and no residual value. It is expected to provide yearly net cash flows of $36,000. The company's minimum desired rate of return for net present value analysis is 12%. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Compute the following: a. The average rate of return, giving effect to straight-line depreciation on the investment. If required, round your answer to one decimal place. 8 X %arrow_forward

- A real estate investment has the following expected cash flows: Year Cash Flows 1 $14,000 2 19,000 3 19,000 4 25,000 The discount rate is 3 percent. What is the investment’s present value? Round your answer to 2 decimal placesarrow_forwardA fund is built with annual payments increasing by $1 from $1 to $10 and then decreasing by $1 to $0. The first payment of $1 is made today. If the fund is used to purchase a ten-year level annuity with the first payment at twenty years from today, what is the amount of the level payment? (Assume an annual effective rate of interest of 4%.) Possible Answers A B D <$16 c≥ $17 but < $18 E ≥ $16 but < $17 ≥ $18 but < $19 ≥ $19arrow_forwardFind the periodic payments PMT necessary to accumulate the given amount in an annuity account. HINT [See Quick Example 2.] (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $40,000 in a fund paying 3% per year, with monthly payments for 5 years PMT = $arrow_forward

- using computation solution (not excel)arrow_forwarddetermine the size of the payments that must be made to a sinking fund in order to accumulate $233,188 if the interest rate is 5.25% compounded quarterly and payments are made for 7 1/4 years. Use TVM solverarrow_forwardWhat is the future value of $117,000 invested for 5 years at 14% compounded monthly? (a) State the type. present value future value amortization ordinary annuity sinking fund (b) Answer the question. (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education