FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

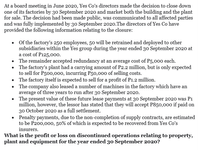

Transcribed Image Text:At a board meeting in June 2020, Yes Co's directors made the decision to close down

one of its factories by 30 September 2020 and market both the building and the plant

for sale. The decision had been made public, was communicated to all affected parties

and was fully implemented by 30 September 2020.The directors of Yes Co have

provided the following information relating to the closure:

Of the factory's 250 employees, 5o will be retrained and deployed to other

subsidiaries within the Yes group during the year ended 30 September 2020 at

a cost of P125,00o.

• The remainder accepted redundancy at an average cost of P5,000 each.

The factory's plant had a carrying amount of P2.2 million, but is only expected

to sell for P500,000, incurring P50,000 of selling costs.

The factory itself is expected to sell for a profit of P1.2 million.

• The company also leased a number of machines in the factory which have an

average of three years to run after 3o September 2020.

The present value of these future lease payments at 30 September 2020 was P1

million, however, the lessor has stated that they will accept P850,000 if paid on

30 October 2020 as a full settlement.

Penalty payments, due to the non-completion of supply contracts, are estimated

to be P200,000, 50% of which is expected to be recovered from Yes Co's

insurers.

What is the profit or loss on discontinued operations relating to property,

plant and equipment for the year ended 30 September 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Super Clubs Hotels, Inc. has signed a service outsourcing contract with Quality Rooms, Inc. for $3 million, which was received in cash at contract inception. Under the agreement, Quality Rooms is obligated to clean and prepare over 5,000 hotels rooms managed by Super Clubs on a daily basis from September 1, 2020 to August 31, 2021. Required: Prepare any journal entry that Quality would record: (1) at inception of the contract and (2) at the end of 2020 to recognize all revenue associated with this contract that should be recognized in 2020.arrow_forwardBlossom Electric Inc. has the following amounts included in its general ledger at December 31, 2023: Organization costs Purchased trademarks Development phase activities (meet all six development phase criteria) Deposits with advertising agency for ads to promote goodwill of company Excess of cost over fair value of identifiable net assets of acquired subsidiary Cost of equipment acquired for research and development projects; the equipment has an alternative future use Costs of researching a secret formula for a product that is expected to be marketed for at least 20 years Payment for a favourable lease; lease term of 10 years $34,700 Total amount of intangible assets to be reported 18,500 31,500 7,700 81,100 125,300 75,900 14,900 (a) Based on the information provided, calculate the total amount for Blossom to report as intangible assets on its statement of financial position at December 31, 2023. Assume Blossom uses IFRS to prepare its financial statements.arrow_forward1. At the Poly Novo 2023 Annual General Meeting (" AGM) heid on 3 November, 2023 they revealed plans to construct a new manufacturing facility adjacent to its existing facility, PolyNovo has already performed a substantial amount of design analysis related to the new facility at a cost of $70, 000. The capital expenditure of $845, 000 associated with the construction of the new facility and the annual operating expenses are substantial. 2. The capital cost of the new facility is expected to be $845, 000 today. PolyNovo must also purchase $300, 000 of plant and equipment ("P&E"). At the end of FY23 PolyNovo had" $46.8m of cash on hand and it plans to use S0.3 million of their cash balance to pay for the building which will reduce the capital cost to just $545,000. If the new facility is built, a piece of obsolete manufacturing equipment must be sold. The equipment had a total capital cost in 2020 of $220,000 and is being depreciated at 511,000 per annum for the years 2021 to 2030…arrow_forward

- 3. Paris paid Cherry $333,333 on 12/31/2020 for the exclusive right to market a particular product using the Cherry Co name and logo in promotional material. The franchise follows the rules of Going Concern. Paris also spent $600,000 on 12/31/2020 in developing a new manufacturing process. Its application for a patent is submitted. Paris believes it will be successful In January of 2021 Paris application for a patent was granted. Legal and registrations costs incurred were $ 210,000. The patent runs for 20 years. But the manufacturing process will only be useful to Paris for 10 years What is the impact on net income related to the $210,000 of costs for the patent?arrow_forwardEucalyptus Ltd has a year end of 31 March 2021. The Directors are planningto close down the company’s London office on 15 June 2021 and haveprovided the following information about the planned restructuring which is valid as at the year end.• The Directors have a detailed plan in place for the closure of the officeon 15 June 2021• Employees who are affected were given full information about theplans via a letter to their home address in January 2021• The Directors can reliably estimate that it will cost them £500,000 tocomplete the restructuringHow would this be treated in the financial statements for the year ended 31 March 2021?a) A restructuring provision would be recognisedb) The London office would be shown as a discontinued operation on theface of the Income Statementc) Nothing would be recognised or disclosed because not all the relevantconditions are satisfiedd) A contingent liability may be disclosed in the notes to the financialstatements, but no provision should be…arrow_forwardConsider the following information from a company's records for 2020: Materials used in research and development projects $4,500 Equipment acquired that will have alternative future uses in future R&D projects for five years 1,500 Personnel costs of employees involved in R&D projects 5,500 Consulting fees paid to outsiders for R&D projects 2,800 Indirect costs reasonably allocable to R&D projects 250 Legal fees associated with registration of a patent resulting from a 2020 R&D project 2,500 Required:Compute the amount of R&D costs that should be classified as expenses in determining 2020 net income. $ _______arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education