FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

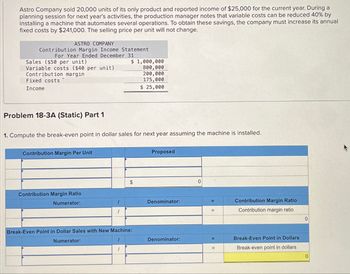

Transcribed Image Text:Astro Company sold 20,000 units of its only product and reported income of $25,000 for the current year. During a

planning session for next year's activities, the production manager notes that variable costs can be reduced 40% by

installing a machine that automates several operations. To obtain these savings, the company must increase its annual

fixed costs by $241,000. The selling price per unit will not change.

ASTRO COMPANY

Contribution Margin Income Statement

For Year Ended December 31

Sales ($50 per unit)

Variable costs ($40 per unit)

Contribution margin

Fixed costs

Income

Problem 18-3A (Static) Part 1

1. Compute the break-even point in dollar sales for next year assuming the machine is installed.

Contribution Margin Per Unit

Contribution Margin Ratio

Numerator:

1

$ 1,000,000

800,000

200,000

175,000

$ 25,000

1

$

Break-Even Point in Dollar Sales with New Machine:

Numerator:

Proposed

Denominator:

Denominator:

0

=

E

Contribution Margin Ratio

Contribution margin ratio

Break-Even Point in Dollars

Break-even point in dollars

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- For the past year, Cline Company had fixed costs of $6,552,000, a unit variable cost of $444, and a unit selling price of $600. For the coming year, no changes are expected in revenues and costs except that a new wage contract will increase variable costs by $6 per unit. a. Determine the break-even sales (in units) for the past year.fill in the blank 1 units b. Determine the break-even sales (in units) for the coming year.fill in the blank 2 unitsarrow_forwardThalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump product line follows: Thalassines Kataskeves, S.A.Income Statement—Bilge PumpFor the Quarter Ended March 31 Sales $ 470,000 Variable expenses: Variable manufacturing expenses $ 124,000 Sales commissions 41,000 Shipping 19,000 Total variable expenses 184,000 Contribution margin 286,000 Fixed expenses: Advertising (for the bilge pump product line) 23,000 Depreciation of equipment (no resale value) 118,000 General factory overhead 40,000* Salary of product-line manager 125,000 Insurance on inventories 10,000 Purchasing department 44,000† Total fixed expenses 360,000 Net operating loss $ (74,000) *Common costs allocated on the basis of machine-hours. †Common costs allocated on the…arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forward

- Astro Company sold 22,000 units of its only product and reported income of $70,200 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 46% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $154,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($54 per unit) Variable costs ($48 per unit) Contribution margin Fixed costs Income Sales level required in dollars Numerator: 3. Compute the sales level required in both dollars and units to earn $240,000 of target income for next year with the machine installed. (Do not round intermediate calculations. Round your answers to 2 decimal places. Round "Contribution margin ratio" to nearest whole percentage) Sales level required in units Numerator: $ 1,188,000 1,056,000 1…arrow_forward4arrow_forwardThe following is Pacific Limited’s contribution format income statement for January 2022: Sales $1,400,000 Variable expenses 700,000 Contribution margin 700,000 Fixed expenses 400,000 Net operating income $ 300,000 The company has no beginning or ending inventories and produced and sold 25,000 units during the month. Required (show your calculation): a. The company’s top management team is currently investigating how many units they need to sell to reach the break-even point. Also, they want to know how much revenue they need to generate to reach the break-even point. What do you think? d.d. Company’s Marketing Manager is confident that she can increase sales by 28% next year with some effort. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answerarrow_forward

- Balcom Enterprises is planning to introduce a new product that will sell for $120 a unit. Manufacturing cost estimates for 28,000 units for the first year of production are: Direct materials $1,372,000. Direct labor $1,008,000 (based on $18 per hour × 56,000 hours). Although overhead has not be estimated for the new product, monthly data for Balcom's total production for the last two years has been analyzed using simple linear regression. The analysis results are as follows: Dependent variable Factory overhead costs Independent variable Direct labor hours Intercept $ 136,000 Coefficient on independent variable $ 5.00 Coefficient of correlation 0.959 R2 0.846 Based on this information, how much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)? Multiple Choice $72 $92 $95 $77arrow_forwardAstro Company sold 23,000 units of its only product and reported income of $264, 600 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 44% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $156,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($56 per unit) $ 1, 288,000 Variable costs ($35 per unit ) 805, 000 Contribution margin 483,000 Fixed costs 218,400 Income $ 264,600 Problem 18 - 3A (Algo) Part 1 1. Compute the break - even point in dollar sales for next year assuming the machine is installed. (Round your answers to 2 decimal places.)arrow_forwardDue to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorporated, has been experiencing financial difficulty for some time. The company's contribution formaet Income statement for the most recent month is given below Sales (12,600 units $30 per unit) Variable expenses Contribution margin Fixed expenses $ 378,000 226,800 151,280 160,200 Net operating loss $ (18,000) Required: 1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales. 2. The president believes that a $6,600 Increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $82,000 per month. If the president is right, what will be the Increase (decrease) in the company's monthly net operating Income? 3. Refer to the original dets. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of $39,000 in the monthly advertising…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education