FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

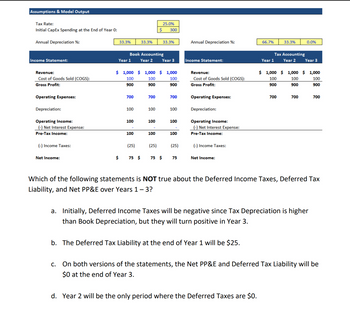

Consider the scenario shown below, in which a company uses straight-line

over 3 years for Book purposes but accelerated depreciation for Tax purposes. The Book

version contains all the calculations, and the Tax version is mostly blank:

Transcribed Image Text:Assumptions & Model Output

Tax Rate:

Initial CapEx Spending at the End of Year 0:

Annual Depreciation %:

Income Statement:

Revenue:

Cost of Goods Sold (COGS):

Gross Profit:

25.0%

$

300

33.3%

33.3%

33.3%

Annual Depreciation %:

66.7%

33.3%

0.0%

Year 1

Book Accounting

Year 2

Year 3

Income Statement:

Year 1

Tax Accounting

Year 2

Year 3

$ 1,000 $1,000 $ 1,000

Revenue:

$ 1,000 $1,000 $ 1,000

100

100

100

900

900

900

Cost of Goods Sold (COGS):

Gross Profit:

100

100

900

900

100

900

700

700

700

Operating Expenses:

700

700

700

100

100

100

Depreciation:

Operating Expenses:

Depreciation:

Operating Income:

100

ỗ

100

100

(-) Net Interest Expense:

Pre-Tax Income:

100

100

100

Operating Income:

(-) Net Interest Expense:

Pre-Tax Income:

(-) Income Taxes:

(25)

(25)

(25)

(-) Income Taxes:

Net Income:

$

75 $

སྒ

75 $

75

Net Income:

Which of the following statements is NOT true about the Deferred Income Taxes, Deferred Tax

Liability, and Net PP&E over Years 1 - 3?

a. Initially, Deferred Income Taxes will be negative since Tax Depreciation is higher

than Book Depreciation, but they will turn positive in Year 3.

b. The Deferred Tax Liability at the end of Year 1 will be $25.

C.

On both versions of the statements, the Net PP&E and Deferred Tax Liability will be

$0 at the end of Year 3.

d. Year 2 will be the only period where the Deferred Taxes are $0.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Assume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or tax rate. Prior to the new provision, BRB's net income after taxes was forecasted to be $4 million. Which of the following best describes the impact of the new provision on BRB's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes. Question 10 options: a) Net fixed assets on the balance sheet will increase. b) The provision will reduce the company's free cash flow. c) The provision will increase the company's net income. d) Net fixed assets on the balance sheet will decrease. e) The provision will increase the company's tax…arrow_forwardDuring the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,535,000, $465,000, and $520,000, respectively. In addition, the company had an interest expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) What is Belyk's net income? (Negative amount should be indicated by a minus sign.) Net income (b) What is Belyk's operating cash flow? Operating cash flow Aarrow_forward2. Which of the following depreciation methods usually results in the paying of the lowest income taxes in the early years of an asset’s life a. Sum-of the year’s digits depreciation method b. Double-declining balance (200%) depreciation method c. Straight-line depreciation method d. Units-of-production depreciation method Please do not plagiarisearrow_forward

- A machine has a carrying amount of 100. For tax purposes, depreciation of 30 has already been deducted from taxable profit in prior periods and an amount of 70 will be deductible in future periods, either as depreciation or through a deduction on disposal. Revenue generated by using the machine is taxable, any gain on disposal of the machine will be taxable and any loss on disposal will be deductible for tax purposes. What is the tax base of the machine? a. 100 b. 70 c. 30 d. 0arrow_forwardWhich of the following is a class of worker that may receive an hourly rate below the federal minimum wage? Multiple Choice Disabled employees in occupations related to their disability. 18-year-old student in a vocational education program. A 23-year-old employee in the first 90 days of work. A student learner working at a local fast-food restaurant.arrow_forwardMallow Incorporated, which has a 21% tax rate, purchased a new business asset. First-year book depreciation was $37,225, and first-year MACRS depreciation was $55,025. As a result of this book/tax difference, Mallow recorded a $3,738 deferred tax asset. True or False True Falsearrow_forward

- Due to an error in computing depreciation expense, Prewitt Corporation overstated accumulated depreciation by $6 million as of December 31, 2018. Prewitt has a tax rate of 30%. Prewitt's retained earnings as of December 31, 2018, would be (Round million answer to 2 decimal places.):arrow_forwardThor, Inc reported depreciation on the income statement by the straight-line method on an asset with a four-year useful life. MACRS is used for the tax return. Income statement: $5 million each year. Tax Return: 2020 $7 million; 2021 $6 million; 2022 $4 million; 2023 $3 million. The income tax rate is 20% for all years. The current year is 2022. Which of the following statements is true regarding the differences between accounting and tax depreciation? The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is originating, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.4M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.6M. The 2022…arrow_forwardFill in the missing numbers for the following income statement. (Do not round intermediate calculations.) Sales Costs Depreciation EBIT Taxes (23%) Net income $ 659,000 420,100 98,900 a. Calculate the OCF. (Do not round intermediate calculations.) b. What is the depreciation tax shield? (Do not round intermediate calculations.) a. OCF $ 206,580 b. Depreciation tax shieldarrow_forward

- During 2021, Raines Umbrella Corporation had sales of $760,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $550,000, $90,000, and $95,000, respectively. In addition, the company had an interest expense of $94,000 and a tax rate of 21 percent. (Ignore any tax loss carryforward provisions and assume that interest is fully deductible.) a. What is the company's net income for 2021? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) b. What is its operating cash flow? (Do not round intermediate calculations.)arrow_forwardPlease show all workarrow_forwardRequired information [The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $903,500 and taxable income of $712,500. The book-tax difference of $191,000 was due to a $242,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $117,000 due to an increase in the reserve for bad debts, and a $66,000 favorable permanent difference from the receipt of life insurance proceeds. b. Compute Hafnaoui Company's deferred income tax expense or (benefit). Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit. X Answer is complete but not entirely correct. Deferred income tax expense $ 712,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education