Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

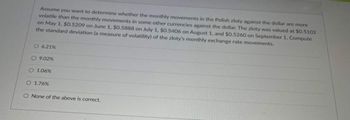

Transcribed Image Text:Assume you want to determine whether the monthly movements in the Polish zloty against the dollar are more

volatile than the monthly movements in some other currencies against the dollar. The zloty was valued at $0.5102

on May 1, $0.5209 on June 1, $0.5888 on July 1, $0.5406 on August 1, and $0.5260 on September 1. Compute

the standard deviation (a measure of volatility) of the zloty's monthly exchange rate movements.

O 6.21%

O9.02%

O 1.06%

O 1.76%

O None of the above is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 4) Suppose the Canadian dollar (CAD) is quoted at 1.3240 - 55 CAD/USD and the Euro is quoted at 0.8220 - 55 EUR/USD. What is the direct quote for the Canadian dollar in France?arrow_forwardCalculate the standard deviation of this scenario Outcome 1: Recession. Probability = 40% . Return = 7.38%. Outcome 1: Recovery. Probability = 60%. Return = 17.27 %. Answer in % terms w/o % sign and to 4 decimal places (1.2345)arrow_forwardDarrow_forward

- A Chinese investor invests in U.S. Treasury bills. If the Chinese renminbi (RMB) appreciates during the holding period against the U.S. dollar (USD), this investment increases in value but default risk remains unchanged. declines in value and decreases in default risk. declines in value but default risk remains unchanged. increases in value and decreases in default risk.arrow_forwardQ1-10 If a PPP estimate of the dollar/pound exchange rate is $1.61/£ and the current spot rate is observed to be $1.68/£, on the basis of these two rates you should, viewing the long-run, a. expect the dollar to appreciate against the pound. b. take a "short" position in dollars. c. expect the pound to appreciate against the dollar. d. have no expectation regarding the likely movement of the dollar/pound exchange rate.arrow_forwardConsider the following information: Rate of Return Probability of State State of if State Economy Recession of Economy .25 Occurs -.09 Normal .45 11 Вoom .30 .30 Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forward

- Suppose that a commercial bank's current quote for transactions involving the United States dollar is A$1.3214 A$1.3298. (a) State the ask and bid prices for the bank. (b) Calculate the bid/ask spread for the bank.arrow_forwardSuppose Dassie Bank quoted the exchange rate of Singapore dollar in US$ at $0.60, the pound rate in US$ at $1.50, and the pound rate in Singapore dollars at S$2.6. As a result of triangular arbitrages among the three currencies and its supply/demand effects, the quoted rate of Singapore dollars in US$ tends to _____. a. depreciate b. remain the same c. appreciatearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education