FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General Accounting

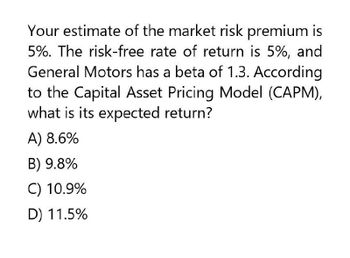

Transcribed Image Text:Your estimate of the market risk premium is

5%. The risk-free rate of return is 5%, and

General Motors has a beta of 1.3. According

to the Capital Asset Pricing Model (CAPM),

what is its expected return?

A) 8.6%

B) 9.8%

C) 10.9%

D) 11.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your estimate of the market risk premium is 5%. The risk-free rate of return is 3%, and General Motors has a beta of 1.7. According to the Capital Asset Pricing Model (CAPM), what is its expected return? A. 11.5% B. 10.4% C. 12.1% D. 10.9%arrow_forwardYou estimate of the market risk premium is 7%. The risk-free rate of return is 3.1% and General Motors has a beta of 1.9. According to the Capital Asset Pricing Model (CAPM), what is its expected return?arrow_forwardYour estimate of the market risk premium is 8%. The risk−free rate of return is 3.1% and General Motors has a beta of 1.5. According to the Capital Asset Pricing Model (CAPM), what is its expected return?arrow_forward

- The current risk-free rate of return (rRf) is 4.67% while the market risk premium is 5.75%. The Burris Company has a beta of 0.92. Using the capital asset pricing model (CAPM) approach, Burris’s cost of equity is? A 9.96 B) 8.964 C) 11.952 D) 10.458arrow_forwardThe expected market return is 5%. The risk-free rate is 3%. According to the CAPM equation, what is the expected return on an asset which has alpha=1.5%, and beta=1.9 ? O a. 11.0% O b. 5.3% O c. 5% O d. 6.8% O e. 8.3%arrow_forwardThe current risk-free rate of return is 4.2%. The market risk premium is 6.6%. Allen Co. has a beta of 0.87. Using the Capital Asset Pricing Model (CAPM) approach, Allen's cost of equity isarrow_forward

- The current appropriate risk-free rate is 6% and the return on the market is 13.5%.Further assume that you calculated the levered beta above as 1.29. Using the CAPM, estimate DUC’s cost of equity. Be sure to state any additional assumptions.arrow_forwardThe risk-free rate of return is 2.5% and the market risk premium is 8%. Rogue Transport has a beta of 2.2. Using the capital asset pricing model, what is Rogue Transport's cost of retained earnings? a.20.1% b.19.6% c.17.7% d.16.4%arrow_forwardSee Attachedarrow_forward

- (Capital Asset Pricing Model) CSB, Inc. has a beta of 0.758. If the expected market return is 10.5 percent and the risk-free rate is 6.5 percent, what is the appropriate expected return of CSB (using the CAPM)? The appropriate expected return of CSB is%. (Round to two decimal places.)arrow_forwardThe risk-free rate is currently 3.3%, and the market return is 14.8%. Assume you are considering the following investments: Investment Beta A 1.54 B 1.16 C 0.51 D 0.11 E 2.14 . a. Which investment is most risky? Least risky? b. Use the capital asset pricing model (CAPM) to find the required return on each of the investments. c. Find the security market line (SML), using your findings in part b. d. On the basis of your findings in part c, what relationship exists between risk and return? Explain.arrow_forwardCAPM: The Treasury bill rate is 5%, and the expected return on the market portfolio is 12%. On the basis of Capital Asset Pricing Model: What is the risk premium of the market? What is the risk premium of an investment with a beta of 1.5? What is the required return of an investment with a beta of 1.5? If an investment has a beta of .8 and offers an expected return of 11% (think of it as its IRR), does it have a positive NPV?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education