Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

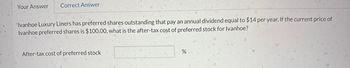

Transcribed Image Text:Your Answer Correct Answer

Ivanhoe Luxury Liners has preferred shares outstanding that pay an annual dividend equal to $14 per year. If the current price of

Ivanhoe preferred shares is $100.00, what is the after-tax cost of preferred stock for Ivanhoe?

After-tax cost of preferred stock

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- chuss Inc. can sell preferred shares for $82 with an estimated flotation cost of $2.00. The preferred stock is anticipated to pay $14 per share in dividends. a. Compute the cost of preferred stock for Schuss Inc. (Round the final answer to 2 decimal places.) Cost of preferred stock % b. Do we need to make a tax adjustment for the issuing firm? multiple choice Yes Noarrow_forwardOweninc has a current stock price of $14.30 and is expected to pay a $0.70 dividend in one year. If Owenlnc's equity cost of capital 11%, what price would Oweninc's stock be expected to sell for immediately after it pays the dividend? OA. $12.14 OB. $15.87 OC. $10.62 OD. $15.17arrow_forwardA company's preferred stock pays an annual dividend of $4.00 per share. The stock is currently priced at $80.00. What is the current dividend yield? O 8.0% O 4.0% O 10.0% O 5.0% 12.0%arrow_forward

- You are considering the purchase of preferred shares issued by Somerset Corp. These pay an annual dividend of $3.15 and are currently selling for $26.90. What is the implied return on this investment? 11.71% 8.54% 10.92% 12.16%arrow_forwardBhaarrow_forwardOweninc has a current stock price of $13.00 and is expected to pay a $0,85 dividend in one year. If Oweninc's equity cost of capital is 11%, what price would Oweninc's stock be expected to sell for immediately after it pays the dividend? OA. $9.51 OB. $13.58 OC. $14.43 OD. $10.86 Maytarrow_forward

- Oweninc has a current stock price of $13.70 and is expected to pay a $1.00 dividend in one year. If Oweninc's equity cost of capital is 11%, what price would Owenlnc's stock be expected to sell for immediately after it pays the dividend? OA. $11.37 OB. $15.21 OC. $9.95 OD. $14.21 wwwarrow_forwardCost of preferred stockarrow_forwardQuestion-based on, "Annual dividend/ Preferred stock". I have tried it but no luck so far. Any help is appreciated.arrow_forward

- The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Req A Req B If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective…arrow_forwardVoltanis Corporation has preferred stock outstanding that will pay an annual dividend of $3.81 every year in perpetuity. If the stock currently sells for $98.31 per share, what is the required return? Multiple Choice O о о O 3.49% 3.63% 2.58% 4.43% 3.88%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education