FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

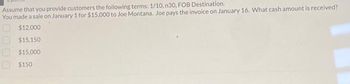

Transcribed Image Text:Assume that you provide customers the following terms: 1/10, n30, FOB Destination.

You made a sale on January 1 for $15,000 to Joe Montana. Joe pays the invoice on January 16. What cash amount is received?

$12,000

$15,150

$15,000

$150

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give true answerarrow_forward25. Jacob Co. sells merchandise on credit to Isaiah Co. for $11,000. The invoice is dated on May 1 with terms of 2/15, net 45. What is the amount of the discount and up to what date must the invoice be paid in order for the buyer to take advantage of the discount? a.$440, May 15 b.$440, May 16 c.$220, May 16 d.$220, May 15arrow_forwardABC had Accounts Receivable of P150,000 at December 1, 2023. The following transactions occurred during December of 2023: December 5-A customer paid P90,000 worth of receivables. December 10-Sold P350,000 worth of goods to XYZ for P500,000 receiving 60% of the bill in cash and the rest to be received at a later time. The terms of the sale is 2/10, n/30. December 15 - XYZ returned P35,000 worth of goods which were billed for P50,000. December 20-XYZ paid the remaining balance. How much was debited/credited to Sales Return and Allowances on December 15? (positive if debited and negative if credited)arrow_forward

- Help Bally Manufacturing sent Intel Corporation an invoice for machinery with a $14,400 list price. Bally dated the invoice August 06 with 5/10 EOM terms. Intel receives a 40% trade discount. Intel pays the invoice on August 19. What does Intel pay Bally? Payable amount Ciparrow_forwardBUS 038 : Business Computations 8. An invoice for $75.20 has terms of 3/10, 1/30, n/60. If you make payment 25 days after the invoicedate, what amount should you pay?arrow_forwardBook the following transactions from the perspective of the buyer and the seller: Apr 19 May 19 Aug 17 Seller Co. sold $80,000 in Merchandise to Buyer Co. on account, n/30 (Cost of Goods Sold was $50,000) Buyer signed a $80,000 90-day, 10% note as an extension of the A/R Buyer paid Seller Co the maturity value Seller Co. Date Description Post Debit Credit ref 1 3 3 4 4 6. 6. 7 8 8. 9 9. 10 10 11 12 12 Buyer Co. Date Description Credit Post ref Debit 2 3. 3 4 4 5 6. 7 8. 9. 10 10 11 11arrow_forward

- A buyer receives merchandise on September 7th that is invoiced for $3,250. The date on the invoice is August 2nd and the terms are 3/15 ROG. How much is due if the buyer pays the bill on September 24th? Answer: A buyer receives the bill for $2,500 of merchandise from a vendor. The date on the invoice is January 15th and the terms are net. How much is due to the vendor and what is the due date? Select one: O a. $2,450 on January 30th b. $2,500 on January 30th c. $2,450 on February 14th d. $2,500 on February 14th Merchandise received on March 2nd with a total quoted cost of $4,000 and transportation costs of $200 was billed on an invoice dated February 6th. The terms on the invoice were 2/10 ROG, FOB Destination, Charges Reversed. How much was due to the vendor if the buyer paid on February 26th? Answer: A buyer receives merchandise on April 2nd that is invoiced for $8,200. The date on the invoice is April 27th and the terms are 2/10 EOM. What is due if the buyer pays by May 15th? Select…arrow_forward**arrow_forward6. A credit sale of $750 is made on 13 June, terms 2/7, n/30, on which a return of $50 is granted on 16 June. The customer paid the amount owing on 17 June. What amount will the customer pay? a) $700 b) $686 c) $685 d) $650 e) None of the abovearrow_forward

- A man gets an inyoice for $460 with terms 3/10, 1/15, n/30. How much would he pay 8 days after the invoice dáte? (Round to the nearest cent as needed) The net amount due is $ CoC-oalalala Help Me Solve This Calculator Get More Help - Clear All Check Answer Pearson 2:43 PM P Type here to search 75°F 9/10/2021 DELL prt se home Insert delete backspace 6. 8 9. R Y U D F\ K V pg up alt ctrlarrow_forwardMaplewood Supply received a $5,430 invoice dated 4/15/20. The $5,430 included $330 freight. Terms were one discount, assume date of last discount.) a. If Maplewood pays the invoice on April 27, 2020 what will it pay? Payable amount b. If Maplewood pays the invoice on May 21, what will it pay? Payable amount 4 3 n 10 " (If more than ' 30 60arrow_forwardI want to correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education