Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

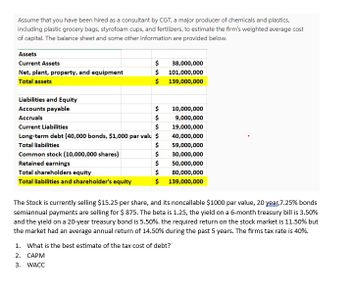

Transcribed Image Text:Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics,

including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost

of capital. The balance sheet and some other information are provided below.

Assets

Current Assets

Net, plant, property, and equipment

Total assets

$

$

$

Liabilities and Equity

Accounts payable

Accruals

Current Liabilities

Long-term debt (40,000 bonds, $1,000 par valu $

Total liabilities

$

Common stock (10,000,000 shares)

$

Retained earnings

Total shareholders equity

Total liabilities and shareholder's equity

$

$

$

$

$

$

38,000,000

101,000,000

139,000,000

10,000,000

9,000,000

19,000,000

40,000,000

59,000,000

30,000,000

50,000,000

80,000,000

139,000,000

The Stock is currently selling $15.25 per share, and its noncallable $1000 par value, 20 year, 7.25% bonds

semiannual payments are selling for $875. The beta is 1.25, the yield on a 6-month treasury bill is 3.50%

and the yield on a 20-year treasury bond is 5.50%. the required return on the stock market is 11.50% but

the market had an average annual return of 14.50% during the past 5 years. The firms tax rate is 40%.

1. What is the best estimate of the tax cost of debt?

2. CAPM

3. WACC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- so.3arrow_forwardGiven the following information for Smashville, Ic., construct a balance sheet: $22,000 $21,000 $102,000 $37,000 $120,000 $12,000 $33,000 $64,000 Current liabilities: Cash: Long-term debt: Other assets: Fixed assets: Other liabilities: Investments: Operating assets: Total assets Total liabilities and equityarrow_forwardA summary of B's capital account for the year ended December 31, 2022 is as follows: Balance, Jan. 1, 2022 Additional investment, May 1 Withdrawal, Sept 2 Balance, Dec. 31, 2022 Compute for the weighted average capital. 1,200,000 230,000 (100,000) 1,330,000arrow_forward

- You are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2018 and 2017 annual financial reports are contained in tables 1 and 2 below, along with important additional information: Table 1: FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total liabilities and shareholders equity 3 909 3 856 Number of shares outstanding (millions) 100 100 Additional information: Depreciation (2018): R483. The firm spent R250m in profitable projects during the…arrow_forwardCalculates the Dupont formula and presents reasons that justify the company's profitability and motivate capital investment. Balance Sheet 2018 2019 Cash $63,000 $201,000 Accounts Receivable 199,000 305,000 Marketable Securities 81,000 42,000 Inventories 441,000 455,000 Prepaids 5,000 9,000 Total Current Assets 789,000 1,012,000 Property, Plant, and Equipment, net 858,000 858,000 Total Assets $1,647,000 $1,870,000 Account Payable $150,000 $100,000 Accruals 101,000 95,000 Total Current Liabilities $251,000 $195,000 Bonds Payable 405,000 575,000 Total Liabilities 656,000 770,000 Common Stocks 700,000 700,000 Retained Earnings 291,000 400,000 Total Stockholders’ Equity 991,000 1,100,000 Total Liabilities & Equity $1,647,000 $1,870,000 Income…arrow_forwardGiven the following information, construct the firm’s balance sheet: Cash and cash equivalents $ 400,000 Accumulated depreciation on plant and equipment 660,000 Plant and equipment 5,400,000 Accrued wages 260,000 Long-term debt 4,210,000 Inventory 7,080,000 Accounts receivable 5,430,000 Preferred stock 550,000 Retained earnings 8,680,000 Land 1,070,000 Accounts payable 2,030,000 Taxes due 170,000 Common stock $ 10 par Common shares outstanding 238,000 Current portion of long-term debt $ 440,000 Round your answers to the nearest dollar. Corporation X Balance Sheet as of XX/XX/XX Assets Liabilities and Owners' Equity Cash and cash equivalents $ Accounts payable $ Accounts receivable Taxes due Inventory Accrued wages Total current assets $ Current portion of long-term debt $ Land Total current liabilities Plant and equipment Long-term debt…arrow_forward

- Need Help please provide Solutionsarrow_forwardQuestion 10 of 25 Based on the following data, what is the amount of working capital? Accounts payable Accounts receivable Cash Intangible assets Inventory Long-term investments Long-term liabilities Short-term investments Notes payable (short-term) Property, plant, and equipment Prepaid insurance $404240 O $411680 > O $458800 $79360 141360 86800 124000 171120 198400 248000 99200 69440 1661600 2480arrow_forwardAssume a company’s balance sheet showed beginning and ending balances in the Long-Term Investments account of $1,100,000 and $900,000, respectively. The company sold a long-term investment that cost $300,000 and recorded a gain on this sale of $35,000. Based solely on the information provided, the company’s net cash provided by (used in) investing activities would be: Multiple Choice $200,000. $300,000. $235,000. $335,000.arrow_forward

- The capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows:arrow_forwardDarden Company has cash of $28,000, accounts receivable of $38,000, inventory of $20,000, and equipment of $58,000. Assuming current liabilities of $28,000, this company's working capital is: Multiple Choice $58,000. $10,000. $88,000. $38,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education