FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

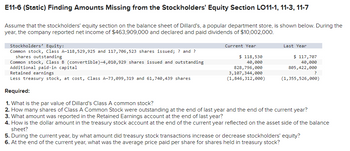

Transcribed Image Text:E11-6 (Static) Finding Amounts Missing from the Stockholders' Equity Section LO11-1, 11-3, 11-7

Assume that the stockholders' equity section on the balance sheet of Dillard's, a popular department store, is shown below. During the

year, the company reported net income of $463,909,000 and declared and paid dividends of $10,002,000.

Stockholders' Equity:

Common stock, Class A-118,529,925 and 117,706,523 shares issued; ? and ?

shares outstanding

Common stock, Class B (convertible)-4,010,929 shares issued and outstanding

Additional paid-in capital

Retained earnings

Less treasury stock, at cost, Class A-73,099,319 and 61,740,439 shares

Current Year

$ 118,530

40,000

828,796,000

3,107,344,000

(1,846,312,000)

Last Year

$ 117,707

40,000

805,422,000

(1,355,526,000)

?

Required:

1. What is the par value of Dillard's Class A common stock?

2. How many shares of Class A Common Stock were outstanding at the end of last year and the end of the current year?

3. What amount was reported in the Retained Earnings account at the end of last year?

4. How is the dollar amount in the treasury stock account at the end of the current year reflected on the asset side of the balance

sheet?

5. During the current year, by what amount did treasury stock transactions increase or decrease stockholders' equity?

6. At the end of the current year, what was the average price paid per share for shares held in treasury stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Summit Apparel has the following accounts at December 31: Common Stock, $1 par value, 1,400,000 shares issued; Additional Paid-in Capital, $17.40 million; Retained Earnings, $10.40 million; and Treasury Stock, 54,000 shares, $1.188 million. Prepare the stockholders' equity section of the balance sheet. (Amounts to be deducted should be indicated by a minus sign. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) SUMMIT APPAREL Balance Sheet (Stockholders' Equity Section) December 31 Stockholders' equity: Total Paid-in Capital Total Stockholders' Equityarrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 59 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $2,490,300 $2,110,600 Net income 532,000 432,300 Dividends: On preferred stock (7,000) (7,000) On common stock (45,600) (45,600) Retained earnings, December 31 $2,969,700 $2,490,300 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,055,050 $2,814,770 Cost of merchandise sold 1,160,700 1,067,840 Gross profit $1,894,350 $1,746,930 Selling expenses $610,240 $744,410 Administrative expenses 519,840 437,200 Total operating expenses $1,130,080 $1,181,610 Income from operations $764,270 $565,320 Other revenue and expense:…arrow_forwardAyayai Corp. has these accounts at December 31: Common Stock, $10 par, 4,500 shares issued, $45,000; Paid-in Capital in Excess of Par $20,250; Retained Earnings $43,000; and Treasury Stock, 400 shares, $8,800. Prepare the stockholders' equity section of the balance sheet. (Enter account name only and do not provide descriptive information.) Ayayai Corp. Balance Sheet (Partial) SAarrow_forward

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forwardBlossom Company has these accounts at December 31: Common Stock, $9 par, 4,800 shares issued, $43,200; Paid-in Capital in Excess of Par $34,900; Retained Earnings $47,000; and Treasury Stock, 500 shares, $11,500. Prepare the stockholders' equity section of the balance sheet. (Enter the account name only and do not provide the descriptive information provided in the question.) Blossom Company Balance Sheet (Partial) December 31 $ $arrow_forward

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forwardLos Altos, Inc., disclosed the following information in a recent annual report: Year 1 Year 2 Net income $73,500 $123,750 Preferred stock dividends 6,300 6,750 Average common stockholders’ equity 2,700,000 3,150,000 Dividend per common share 2.70 2.52 Earnings per share 3.99 4.61 Market price per common share, year-end 41.00 47.30 Calculate the return on common stockholders’ equity for Los Altos, Inc. for both years.Round to two decimals. Year 1 Year 2 Return on Common Stockholders' Equity Answer Answer Did the return improve from Year 1 to Year 2? Answerarrow_forwardGodaarrow_forward

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forwardLooking for the Less: Cash dividends declared to find the Retained earnings.. Attached the journal entries as well.arrow_forwardThe following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year: Common Stock, $15 par $706,500 Paid-In Capital from Sale of Treasury Stock 29,000 Paid-In Capital in Excess of Par-Common Stock 18,840 Retained Earnings 1,109,000 Treasury Stock 14,630 Prepare the Stockholders' Equity section of the balance sheet as of June 30 using Method 1 of Exhibit 8. Eighty thousand shares of common stock are authorized, and 770 shares have been reacquired. Goodale Properties Inc. Stockholders' Equity June 30, 20хх Paid-In Capital: Total Paid-In Capital $4 Total Total Stockholders' Equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education